創新項目正重塑加密貨幣市場,推動區塊鏈技術、人工智能融合,以及去中心化金融落地。隨住比特幣愈加成為數碼黃金,以及Render及Sui等新玩家顛覆行業標準,投資者機會不斷增多。

本文會深入分析頂尖加密貨幣、其賣點同2025年預測;無論你係新手,定係資深投資者,呢份指南都會深度剖析未來加密投資方向。

比特幣(BTC)

風險水平: 低

現價: $94,404.27

一年變幅: +117.57% 市值: $1.87兆 流通量: 1,980萬BTC

點解依家要入手?

比特幣隨住主流機構如黑石等引入ETF,地位日益鞏固為數碼黃金。特朗普政府下監管政策改變,以及反加密的美證監領袖被換,都象徵親比特幣時代來臨。配合全球宏觀經濟放寬貨幣政策、通脹預期升溫,吸引大量機構與散戶將比特幣視為抗通脹避險之選。

預測:

分析師預期比特幣將於2025年觸及$120,000至$150,000。此預測基於ETF推動機構採納、政府儲備策略,以及宏觀大趨勢有利分散資產。根據過往走勢,期間或出現20–40%調整。高波動性突顯了風險管理的重要,不過長線升勢依然樂觀。

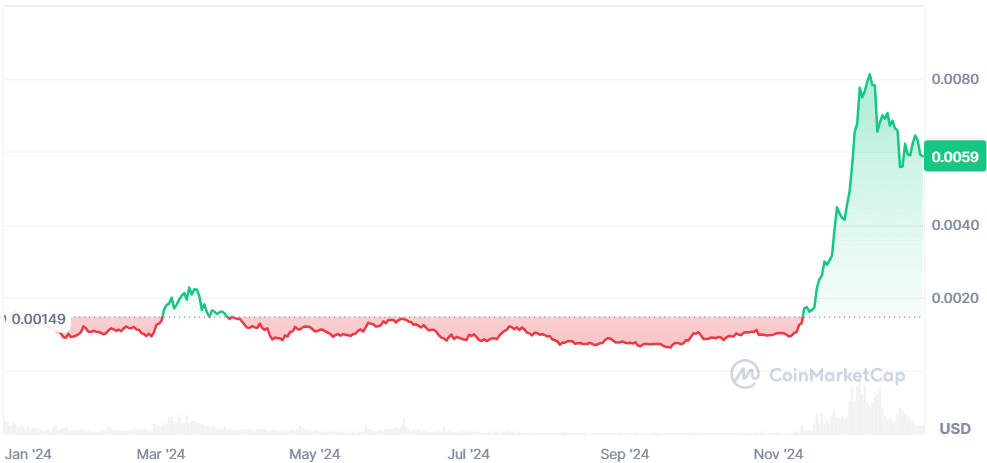

Snek(SNEK)

風險水平: 高

現價: $0.005861

一年變幅: +202.12% 市值: $4.36億 流通量: 743.8億SNEK

點解依家要入手?

Snek係Cardano區塊鏈上領先嘅迷因幣,以社群驅動為主題。受惠於Cardano生態系發展,Snek擁有高用戶互動率,持有人超過39,797名及55項整合。2024牛市期間,Snek較其他迷因幣保持穩定支撐力,展現抗跌實力。尚未獲大交易所上架,意味潛在升值空間大,屆時價格料可急升。

預測:

若Snek能成功登陸Binance或Coinbase等大型交易所,到2025年有望錄得5至10倍回報。增長依賴Cardano生態擴展及吸納新持有人。技術層面,Snek相較其他迷因幣波動較低,反映社群支持強,即使市況調整亦較穩,但依賴炒作及社群熱度,故越早參與回報越高但風險亦大。

以太幣(ETH)

風險水平: 中

現價: $3,344.72

一年變幅: +39.82% 市值: $4,029.2億 流通量: 1.2046億ETH

點解依家要入手?

以太幣係DeFi及NFT的骨幹,不斷推動區塊鏈創新同應用。近日轉向權益證明(PoS)大幅提升能源效益、擴展性及質押回報,使ETH繼續領導業界。2025年Q1「Pectra」升級將加快交易速度並提升Layer-2擴容,增值空間進一步擴大。比特幣ETF效應推動機構資金流入以太坊,顯示投資人信心濃厚。

預測:

以太幣預料2025年交易區間為$8,000至$10,000,牛市極端情況更有機會於2025年Q1衝上$14,000。主要動力包括DeFi壯大、企業應用普及,以及巨鯨囤積表現長線信心。參考比特幣減半帶動歷史走勢,配合技術分析(如黃金分割回撤),以太幣繼續有力衝高。

Tars AI(TARS)

風險水平: 高

現價: $0.3501

一年變幅: +560.54% 市值: $2.42億 流通量: 6.9168億TAI

點解依家要入手?

TARS AI係基於Solana嘅AI生態,包括Sona(AI助手)、去中心化搜尋引擎等。與Google、Bybit等平台合作證明其有潛力成為Web3 AI橋樑。近期里程碑包括超過20,000用戶,及於CoinGecko曝光,反映採用度持續上升。TARS AI勇於創新AI融入區塊鏈,切合市場對去中心化AI需求急升。

預測:

若AI加密趨勢持續、Solana生態應用普及,TARS AI或可於2025年錄得3至5倍升幅。但考慮到行業競爭激烈及波動高屬高風險投資。長遠增長需視乎保持合作及吸納新用戶,如能擴大AI-crypto市場佔有率,潛力無限。

卡爾達諾(ADA)

風險水平: 中

現價: $0.8784

一年變幅: +35.34% 市值: $308.6億 流通量: 351.3億ADA

點解依家要入手?

卡爾達諾係基礎紮實嘅區塊鏈平台,專注去中心化、可擴展性同智能合約。持續升級(如Plutus V3及Hydra)加強其與以太幣競爭力。智能合約增長反映開發者認受度,生態系統擴展及Lace錢包等技術進展亦提升易用性。

預測:

預計2025年ADA上望$3,動力來自智能合約生態發展、加密立法支持及社群自治。如跨鏈互操作和DeFi導入順利,目標有望突破$3,屬中期投資亮點。

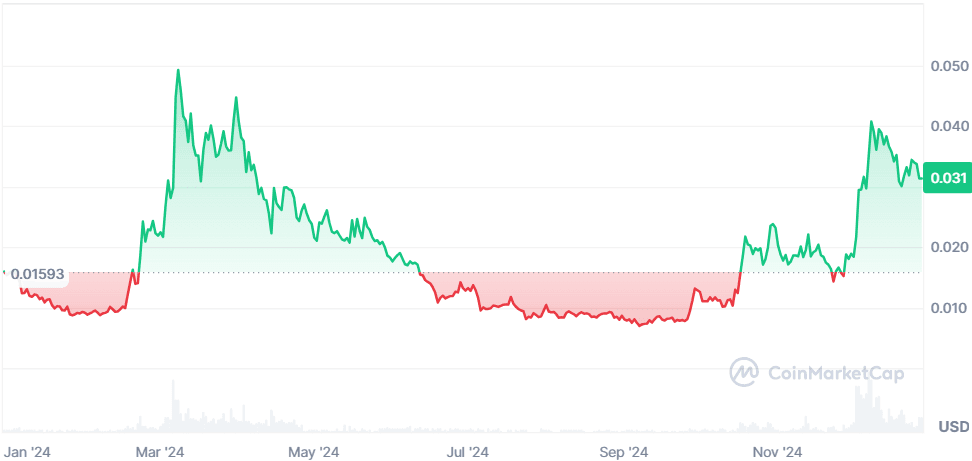

Humans.ai(HEART)

風險水平: 高

現價: $0.03219

一年變幅: +118.46% 市值: $1.8億 流通量: 55.9億HEART

點解依家要入手?

Humans.ai係革命性嘅AI+區塊鏈平台,專注推動AI與去中心化融合。平台為合倫理規範及上鏈治理AI模型提供框架,獨有應用包括AI聲音、虛擬形象及互動NFT。用戶可將AI模型代幣化為NFT實現去中心治理。隨AI應用於加密領域興起,Humans.ai瞄準例如智能交易、DeFi自動化管理、提升區塊鏈便捷度等熱點。AI代理更可持續監測數據、自動執行交易與決策,適合尋求分散AI投資機會者。此外,重視合倫理AI治理亦吸引企業同開發者於合規上嘅需要。

預測:

隨住AI智能代理於交易、DeFi、NFT應用需求上升,Humans.ai有潛力於2025年錄得3至5倍升值,特別是假如其去中心化AI治理架構廣獲行業採用。不過最終能否突出要視乎其在擁擠市場的差異化優勢,合倫理及去中心化正是其最大賣點。

Render(RNDR)

風險水平: 中

現價: $6.91

一年變幅: +42.04% 市值: $35.7億 流通量: 5.1769億RENDER

點解依家要入手?

Render Network係一個顛覆傳統的去中心化平台,連接藝術家、開發者同企業,提供無限GPU渲染算力。與Arnold、OctaneRender等頂尖渲染工具整合,為3D創作者帶來極高彈性。近期RNP-016、RNP-017及RNP-018建議案獲社群通過,令平台發展更進一步。

applicability in high-profile industries like gaming, film, and AI. With support for Blender - a globally trending creative tool - Render positions itself as a leader in enabling cost-effective, high-quality decentralized rendering solutions. The network’s ongoing efforts to enhance GPU cloud rendering make it highly relevant in the AI and blockchain spaces. Real-world examples like collaborations with Blender and integration of Cinema 4D tools highlight its practical value. Whale holdings of 76.47% reflect strong market confidence, ensuring demand stability.

高調行業如遊戲、電影、人工智能等範疇的應用性。由於支援Blender呢個全球大熱創意工具,Render定位為為用家提供高質素、具成本效益嘅分散式渲染方案嘅領導者。Render網絡持續加強GPU雲端渲染功能,令佢喺AI同區塊鏈範疇都極具相關性。實際例子包括與Blender嘅合作、以及整合Cinema 4D工具,都突顯咗其實用價值。鯨魚級持倉高達76.47%,反映出市場信心強勁,有助維持需求穩定。

Forecast: Render is expected to grow significantly as decentralized GPU rendering gains traction. Analysts project the token to reach $12–$15 by 2025, driven by its adoption in industries like gaming, film, and AI. With its continuous integration of new technologies and strategic collaborations, Render is poised to dominate the decentralized GPU ecosystem, attracting both institutional and retail interest.

預測:

隨住分散式GPU渲染愈來愈受重視,Render有望大幅增長。分析師預計到2025年,該代幣有望升至$12至$15,主要受惠於其在遊戲、電影、AI等行業嘅廣泛應用。加上持續整合新技術同策略性合作,Render有機會主導分散式GPU生態圈,吸引機構及零售市場嘅關注。

Sui (SUI)

Risk level: Medium - High

Current price: $4.04

Price change (1Y): +385.27% Market cap: $11.82B Circulating supply: 2.92B SUI

Why should you buy it now?

Sui is a layer-1 blockchain designed for scalability and efficiency, featuring sub-second transaction finality. Its focus on tokenizing real-world assets through partnerships with entities like Franklin Templeton and its integration of Bitcoin liquidity demonstrate its applicability beyond traditional blockchain use cases. The recent surge in total value locked (TVL) and DeFi growth highlights Sui's rising prominence in decentralized finance. Notably, the upcoming token unlock of 64M $SUI tokens on January 1, 2025, is strategically planned, showing the team’s commitment to maintaining market stability. Sui’s developer-focused approach, such as partnerships with Phantom Wallet and Ant Digital, has boosted its ecosystem growth and user adoption, further positioning it as a competitor in the DeFi and tokenization markets.

點解而家要買?

Sui係一條主打擴展性同高效率嘅Layer 1區塊鏈,交易確認時間低於一秒。透過同Franklin Templeton等機構合作推動現實資產代幣化、以及引入比特幣流動性,展現咗Sui超越傳統區塊鏈應用範疇嘅可能性。加上總鎖倉量(TVL)急升、DeFi生態迅速成長,Sui喺去中心化金融領域地位日漸突出。最值得留意嘅係,2025年1月1日會有6,400萬枚$SUI代幣解鎖,規劃周詳,展示團隊維持市場穩定嘅決心。Sui重視開發者,例如同Phantom Wallet及Ant Digital等合作,推動生態成長同用家增長,進一步鞏固佢喺DeFi及資產代幣化市場嘅競爭力。

Forecast:

Sui is anticipated to reach $6–$8 by 2025, supported by its innovative partnerships and rising adoption in decentralized finance and asset tokenization. Analysts highlight its potential as a scalable alternative to Ethereum, particularly for developers seeking efficient and cost-effective blockchain solutions. Continued ecosystem growth and token unlock events will play a critical role in shaping its future trajectory.

預測:

預計到2025年,Sui有望升至$6至$8,原因包括其創新合作同去中心化金融、資產代幣化方面嘅不斷擴展。分析師認為Sui有潛力成為以太坊以外一個高擴展性選擇,特別對想要高效、低成本區塊鏈方案嘅開發者而言有吸引力。生態系統持續成長及代幣解鎖,都會對Sui未來走勢有關鍵影響。

BitTensor (TAO)

Risk level: Medium

Current price: $459.13

Price change (1Y): +49.83% Market cap: $3.38B Circulating supply: 7.38M TAO

Why should you buy it now?

Bittensor merges AI and blockchain, creating a decentralized network for collaborative machine learning. Its unique reward system for AI model contributions ensures scalability and continuous innovation. Partnerships like Innerworks’ RedTeam platform further position it as a leader in ethical AI and cybersecurity solutions, catering to a rapidly growing global demand.

點解而家要買?

Bittensor融合咗AI同區塊鏈技術,打造一個分散式協作機器學習網絡。其獨特嘅AI模型貢獻獎勵制度,確保網絡既可擴展性又可持續創新。與Innerworks [RedTeam]等平台合作,進一步鞏固咗其喺道德AI同網絡安全解決方案方面領先地位,滿足全球市場對AI持續急增嘅需求。

Forecast:

Bittensor is projected to reach $750–$900 by 2025, as decentralized AI solutions become critical for industries ranging from cybersecurity to machine learning. Its ability to incentivize AI innovation and its focus on scalability make it a strong contender in the AI and blockchain sectors. Increased adoption by developers and enterprises is likely to drive sustained value growth.

預測:

分析預計到2025年,Bittensor價值有機會升至$750至$900。隨住分散式AI解決方案喺網絡安全、機器學習等行業變得不可或缺,Bittensor透過激勵AI創新及專注擴展性,成為AI同區塊鏈領域嘅強力競爭者。開發者及企業採用程度提升,料將推動其價值持續增長。

Virtuals Protocol (VIRTUAL)

Risk level: Medium - High

Current price: $3.45

Price change (1Y): +6841.35% Market cap: $3.45B Circulating supply: 1B VIRTUAL

Why should you buy it now?

Virtuals Protocol is at the forefront of decentralized AI agent networks, providing tools to create personalized AI agents for a variety of use cases. With a surge in interest for AI-driven solutions, Virtuals Protocol benefits from its early mover advantage. Its partnerships and integrations with popular decentralized finance (DeFi) platforms further enhance its utility and adoption.

點解而家要買?

Virtuals Protocol係分散式AI代理網絡嘅先行者,為唔同應用場景提供客製化AI代理創建工具。隨住AI解決方案需求激增,Virtuals Protocol受惠於其[先發優勢]。同受歡迎嘅DeFi平台合作同整合,進一步提升了協議嘅實用性及普及度。

Forecast:

Virtuals Protocol is expected to grow to $6–$7 by 2025, driven by the increasing demand for AI-powered solutions across industries. Its focus on personalized AI agents and the growth of its ecosystem position it for sustained expansion. Analysts highlight its potential to become a market leader in decentralized AI networks, especially with broader exchange listings and increased adoption.

預測:

分析師預計到2025年,Virtuals Protocol有望升至$6至$7。因行業對AI解決方案需求持續攀升,加上其專注於客製化AI代理及生態系統擴展,有望保持強勁增長。若能於更多交易所上市及進一步提高市場接受度,Virtuals Protocol有潛力成為分散式AI網絡領域市場領袖。

Closing Thoughts

The cryptocurrency space is no longer just about speculative trading; it's an ecosystem of innovation, driven by cutting-edge technologies and real-world applications.

無論係比特幣作為價值儲存,定係以太坊成為DeFi骨幹,甚至新興項目如Render同Virtuals Protocol帶動AI驅動嘅區塊鏈方案,市場充滿機遇。不過,如一貫,潛在投資者都應該審慎評估,考慮風險水平及長線潛力。只要善用策略性投資同嚴謹風險管理,2025年好有機會成為加密愛好者同投資者嘅轉捩點。

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or legal advice. Always conduct your own research or consult a professional when dealing with cryptocurrency assets.

免責聲明: 本文內容只供教育用途,並不構成任何財務或法律建議。如涉及加密資產交易,請務必自行查證或諮詢專業人士。