貪婪慢慢滲返加密市場,恐懼與貪婪指數去到69,但離全面亢奮仲有一段路。比特幣市佔率61.9%,山寨幣季指數都係低位27,專家都叫得返係「比特幣季」。不過底下啲水其實好深。

其實部分山寨幣,特別係SocialFi、Web3 Gaming同AI基建類,近期都表現搶眼。LAUNCHCOIN瘋狂爆升、GODS受GameFi催化劑帶動、JELLYJELLY大鯨活躍入場,似係早期入局布局。機構都係睇住,今週ETF資金流入達到2.82億美元,市場信心唔少,但散戶反而減持風險。

今週出位嘅升幅戲碼,唔單止炒作,部分係產品有真正進展,有啲就靠迷因力量。

Launch Coin on Believe(LAUNCHCOIN)

7日價格變動: +3389.59% 現價: $0.1964

最新動向

LaunchCoin 推出Solana上一行生成代幣功能,只要用X(Twitter)就可以直接鑄幣。佢同SocialFi平台Believe整合同埋迷因熱潮,大戶包括$1.59M swap從TRUMP轉去LAUNCH,將市值由幾百萬炒上去超過2.5億美元。CoinW上架同自稱去中心化Web3孵化器,進一步吸引目光。雖然交易所塞車,但團隊已經承諾更佳手續費同生態系統v2開發。

預測

LAUNCHCOIN RSI超高,預計85以上,嚴重超買。近期$0.33見頂後調整,現大約$0.19橫行,短期$0.15到$0.21盤整幾大機會。守得住可以向$0.26再試高位,不過波動大。回落到$0.12–$0.14反而健康。炒迷因要密切留意社媒熱度同鯨魚動向。

Aethir(ATH)

7日價格變動: +37.96% 現價: $0.04885

最新動向

Aethir 受惠於蘋果App Store獨大終結,開發者終於可以帶客戶直接用外部支付平台,有利Aethir做去中心化GPU雲端基建,主打無App Store 枷鎖嘅雲上原生遊戲。佢超過428K個GPU container支援高需求任務,已經靠節點授權證出售籌集超$1.5億,吸引機構同Web3遊戲項目,開始提供直達消費者雲串流方案。

預測

ATH保持牛市結構,但暫時係$0.055下整固。RSI接近60,上升空間未過熱,$0.045 支持力不俗,若能企穩$0.050再上,睇$0.06或更高。長綫上有望隨Web3遊戲增長同進。

SKYAI(SKYAI)

7日價格變動: +33.47% 現價: $0.06105

最新動向

SKYAI 因為Binance Futures同 Bitget 上新,槓桿高達50倍而爆紅。BSC Foundation經Mimic.fi買入$75K SKYAI,超越TST成最大持倉,仲爭取到 BNB Chain Incentive Program 10萬 USDT 支持,令SKYAI一度成BSC最大熱門AI幣,社群與大戶信心明顯提升。

預測

SKYAI高位$0.09回落,現企穩$0.061左右。RSI約58,中性偏牛。$0.055有支持,上破$0.065可以挑戰$0.075–$0.08。高槓桿大波幅,炒家要謹慎設止損,後續繼續睇機構動靜。

ether.fi(ETHFI)

7日價格變動: +71.91% 現價: $1.32

最新動向

雖然比高位回落76%,但ETHFI 近期因大戶增持同合約空單爆倉而爆升。Binance 期貨日成交達5億美元,超越 DeFi 實際活躍。ether.fi TVL有68.6億美元,靠EigenLayer再質押同ETH質押推動,但代幣解鎖同散戶參與不足係大風險。槓桿同大戶作用大於用戶增長,暫時唔算可持續上升。

預測

ETHFI RSI高企,近70,超買明顯。$1.50係阻力,預料隨著短倉解決價格可能下試$1.10–$1.20。72%代幣未解鎖,未來放售壓力大,散戶參與唔起來長綫升幅有限,短線要設好止損。

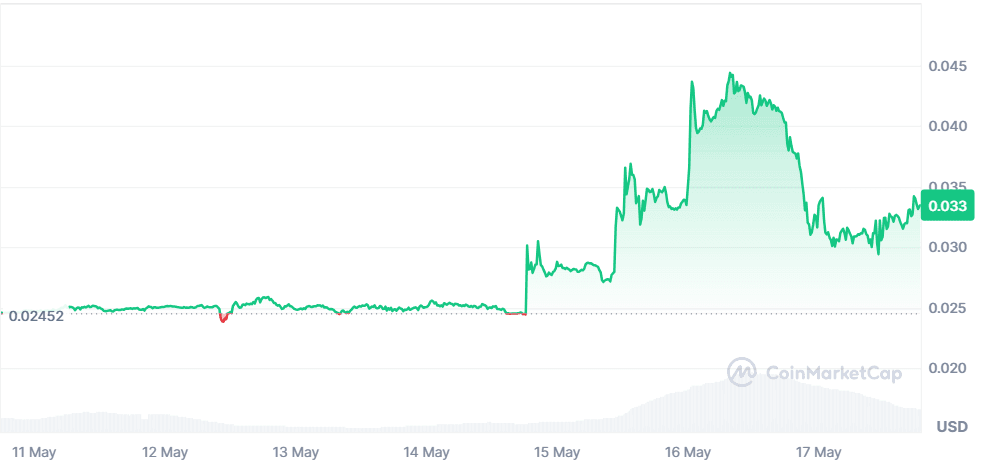

Port3 Network(PORT3)

7日價格變動: +36.04% 現價: $0.03340

最新動向

Port3 Network 最近登上 Binance Alpha,AI社交數據工具Rankit主打量化用戶活躍同項目熱度,2022年後增長急速。上架後人氣急升,陸續登錄MEXC、LBank、KCEX,而且期貨開放高達50倍槓桿,吸引散戶與衍生品炒家。

預測

PORT3爆升後開始橫行,RSI約63,勢頭偏牛但$0.036阻力明顯。$0.030為支持,活動和社群子指標跑得起唔乏有$0.040–$0.045突破機會。高槓桿幣種小心大波動。

Jelly-My-Jelly(JELLYJELLY)

7日價格變動: +11.97% 現價: $0.03236

最新動向

JELLYJELLY 因大戶從Gate.io提走1億零46萬枚JELLYJELLY,市值$4.45M,即使賬面虧損$1.35M都無動搖,表現長期信念。而合約未平倉量暴跌54%,衍生品興趣降温。Hyperliquid下架加上價格回調,零售氣氛轉淡,但大戶收貨迹象一旦貨源緊張有機會反彈。

預測

JELLYJELLY RSI約61,偏向超買,高位$0.07跌落來後穩定在$0.032樓上,短期$0.030–$0.036間橫行。若大戶繼續吸貨而拋盤減弱可能會向上突破睇$0.04。不過成交量減,衍生品資金流走,留意$0.030跌穿會落到$0.027。

Department Of Government Efficiency(DOGE)

7日價格變動: +81.07% 現價: $0.03348

最新動向

DOGE(唔好同Dogecoin混淆),今週因官方團隊積極推行縮減政府開支消息而被炒高。雖然無實際合作,但散戶當支持炒爆,全靠迷因宣傳過30M市值。如果熱度退減隨時大幅回調,慎防波動。

預測

DOGE RSI大約74,短期過熱明顯。炒作延續可以試挑戰$0.038。但冇基本面,一旦無人吹即有機會跌返$0.025或更低。炒家要留意買盤減少同動能指標背馳。

Gods Unchained(GODS)

7日價格變動: +71.75% 現價: $0.2009

最新動向

GODS 公佈遷移到 Immutable zkEVM ...(原文截斷) launch of Battle Pass Season 3. The move improves scalability, lowers fees, and integrates NFTs more efficiently. The exclusive collectibles available in Season 3 have sparked a flurry of demand, driving a bullish wave across the Gods Unchained community. The combination of Web3 gaming, NFT economy, and lower entry barriers has reinvigorated both players and investors.

推出 Battle Pass 第三季。呢個舉措提升咗可擴展性、減低咗手續費,亦令 NFT 整合更加高效。第三季專屬嘅收藏品引發咗大量需求,為 Gods Unchained 社群帶嚟一波強勁升勢。Web3 遊戲、NFT 經濟同低入場門檻嘅結合,重新激活咗玩家同投資者嘅熱情。

Forecast

With RSI nearing 76, GODS is in overbought territory after surging from $0.12 to $0.22. Current consolidation near $0.20 may hold short-term. If demand persists, a break toward $0.24–$0.26 is possible. Support sits at $0.17. Profit-taking is likely soon, especially if NFT hype wanes. Look for decreasing volume as a cooling signal.

預測

RSI 接近 76,GODS 由 $0.12 暴升至 $0.22,進入超買區。現時大約 $0.20 位置有整固,短期內有機會企穩。若需求持續,有機會突破至 $0.24–$0.26。下方支持於 $0.17。短期內可能會有獲利回吐,特別係 NFT 熱度減退時。要留意成交量縮減作為降溫訊號。

Grass (GRASS)

Price Change (7D): +17.59% Current Price: $1.93

News

GRASS hit its highest levels since March following record-breaking data scraping ~1,762 terabytes in a day. Built on Solana L2, GRASS monetizes unused bandwidth from users to train AI models. The foundation rewards contributors in tokens, creating a sustainable ecosystem. With presale hype from SUBBD and listings on Asian exchanges, its user base is growing. However, a 12% dip shows traders are cautious after its $2.32 peak.

GRASS 喺單日創下數據擷取約 1,762 TB 新高之後,價格升到三月以嚟最高水平。GRASS 架設喺 Solana L2 網絡,將用戶閒置頻寬貨幣化用嚟訓練 AI 模型。基金會會以代幣獎勵貢獻者,建立可持續生態圈。受到 SUBBD 預售熱潮同埋亞洲交易所上架帶動,用戶數目持續增長。但喺升到 $2.32 之後回落 12%,反映交易者變得審慎。

Forecast

GRASS RSI is neutral at ~56. Support lies at $1.72, while $2 remains the psychological resistance. A break above $2.05 could lead to a retest of $2.30, and eventually its $3.66 ATH if momentum returns. A drop below $1.70 invalidates the bullish structure. For now, expect consolidation around $1.85–$2 unless volume spikes.

預測

GRASS RSI 約 56,屬中性。$1.72 有支持位,而 $2 係心理阻力。上破 $2.05,有機會再試 $2.30,若勢頭強勁,有望挑戰歷史高位 $3.66。跌穿 $1.70 則打破上升趨勢。暫時預計會喺 $1.85–$2 區間整固,除非有明顯成交量增加。

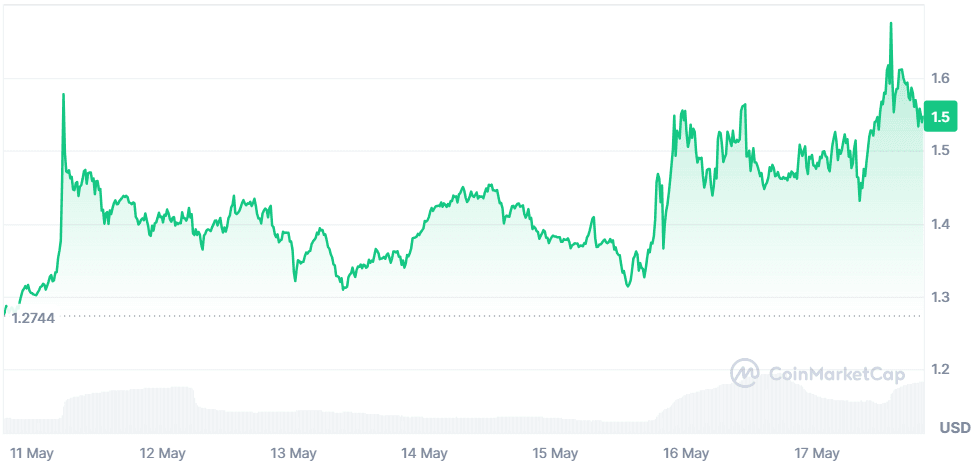

Mask Network (MASK)

Price Change (7D): +20.48% Current Price: $1.54

News

MASK continues to shine as a decentralized bridge between Web2 and Web3, allowing users to access dApps directly from platforms like Twitter. Additionally, Mask Network is promoting Honeypot Finance’s PoL-based meme ecosystem, reinforcing its vision of user-first DeFi infrastructure. With rising daily usage and strong governance value, MASK is building utility atop familiar platforms.

MASK 持續發亮,作為 Web2 與 Web3 之間去中心化橋樑,用戶可以直接喺 Twitter 等平台上接駁 dApp。另外,Mask Network 正推廣 Honeypot Finance 嘅 PoL 模因生態,進一步強化以用戶為本嘅 DeFi 基礎設施理想。隨住每日活躍度上升同強治理價值,MASK 喺熟悉的平台之上加強實用性。

Forecast

MASK is trading near resistance at $1.56 with RSI around 68. If broken, $1.70 is the next target. Support lies at $1.43. Volume remains healthy, but fading momentum may trigger a short-term pullback to $1.40. The long-term trend remains bullish, especially as Web2–Web3 integrations grow. Watch for ecosystem updates as catalysts.

預測

MASK 現時徘徊喺 $1.56 阻力位,RSI 大約 68。如果突破,下一目標係 $1.70。下方支持於 $1.43。成交量保持健康,但升勢若減弱,短期內有機會調整落 $1.40。長遠趨勢仍然看好,特別係隨住 Web2–Web3 整合度提升。要留意生態相關新消息作催化劑。

Closing Thoughts

The broader market sits on the edge of a shift. With $3.26T in market cap and volume topping $100B, the engine is humming. But the data doesn’t lie, this isn't altcoin season yet. It's more of a reconnaissance phase. Bitcoin is holding the fort, but the action in altcoins like LAUNCHCOIN (memes + utility), GODS (GameFi growth), and AETHIR (AI cloud infra) reveals where early adopters are placing long-term bets.

宏觀市場正處於轉變邊緣。市值高達 $3.26 兆美元,交易量超過 $1,000 億美元,動力明顯增加。不過數據反映,目前未係山寨幣季,仲係觀察部署階段。比特幣扮演住守城角色,但如 LAUNCHCOIN(模因+實用)、GODS(GameFi 增長)同 AETHIR(AI 雲基礎建設)等山寨幣動作,可以睇到早期參與者如何下注長線。

SocialFi tokens are showing explosive short-term momentum, riding meme culture and creator tools. Meanwhile, infrastructure plays like ETHFI and AETHIR are benefiting from institutional logic: solve real problems, attract real capital. GameFi, driven by GODS and GRASS, is catching renewed interest thanks to zkEVM integrations and new engagement models like Battle Passes and data mining. Retail traders are chasing hype in meme coins, but whales and funds are positioning around functionality and future-proof narratives. If ETF inflows stay strong and meme coin froth doesn’t spill over into a selloff, we might see the Altcoin Season Index start creeping up in coming weeks.

SocialFi 代幣短線爆發力強,搭住 meme 文化同創作者工具上位。基建類如 ETHFI、AETHIR 受到機構投資青睞:實實在在解決問題,就能吸引真資金。GameFi 由 GODS、GRASS 帶頭,因 zkEVM 整合及 Battle Pass、資料挖礦等新玩法而重獲熱度。散戶仍然追逐模因幣熱潮,大戶與資金則集中功能同未來敘事。如果 ETF 流入保持強勁,而 meme 幣炒風無引發大跌,山寨幣季指數未來幾星期或會慢慢走高。

For now, this was a week of positioning, not full-blown rotation. The altcoin tide isn’t here yet, but it’s definitely forming.

目前只係佈局階段,未係全面輪動。山寨幣潮未正式湧現,但已逐步積聚動力。