隨著比特幣突破$100K大關,DeFi、互操作性和機構採用為加密市場帶來動力。Sui的強大合作及DeFi策略推動增長,Chainlink跨鏈技術進展亦成市場焦點。

Solana與Hedera等山寨幣憑創新升級表現搶眼,Litecoin及Stellar等傳統資產則在競爭下保持穩健。下列十款加密貨幣反映市場變化和新技術動態。

XRP (XRP)

7日價格變動: +26.13% 現價: $3.21

最新動態

XRP 本週價格勁升,主要受惠於監管明朗化、RippleNet's國際拓展及XRP ETF審批預期。

Ripple最近在對SEC訴訟勝訴,大大提升市場信心,XRP因其跨境支付應用及看漲期權帶動,成為機構投資熱門。不過,SEC仍在上訴,繼續質疑XRP零售交易屬證券,引發市場熱議。另外,Ripple 創新串接穩定幣如RLUSD,提升跨境支付效率和市佔率。雖然週中成交一度稍回落,但衍生品活躍及看好情緒保持XRP升勢。

走勢預測 XRP目前RSI約65,接近超買區但仍有上升空間。現時$3.00有支持,$3.50遇主要阻力,若突破有望衝上$4.00,特別若ETF相關利好持續。若轉弱則或回試$2.80. 主要指標如資金利率及衍生品仍反映短線市況偏好。

Solana (SOL)

7日價格變動: +40.26% 現價: $262.07

最新動態 Solana 本週表現搶眼,因其探索通縮經濟及推首個Layer-2方案 Solaxy,促進可擴展性和與以太坊的DeFi協同。

憑藉GOAT 上線及Firedancer升級,Solana佔AI 币市場份額達56.48%。同時推出FDUSD穩定幣、引入近17億美元資產,及Solana ETF報批,吸引機構巨資有望進場。Solana亦推出SIMD-215,推動MoonPay Helio支付平台發展,強化其DeFi生態。各項發展見證Solana於區塊鏈及金融科技影響力增強。

走勢預測 Solana RSI約70,信號過度買入,短線料有整固。即時支持$240,$280為主要阻力,若突破則可望挑戰$300。EMA顯示大方向升勢,50日EMA於$220提供支持。交投活躍反映投資者關注,但獲利盤或引發回調至$240後再重拾升勢。

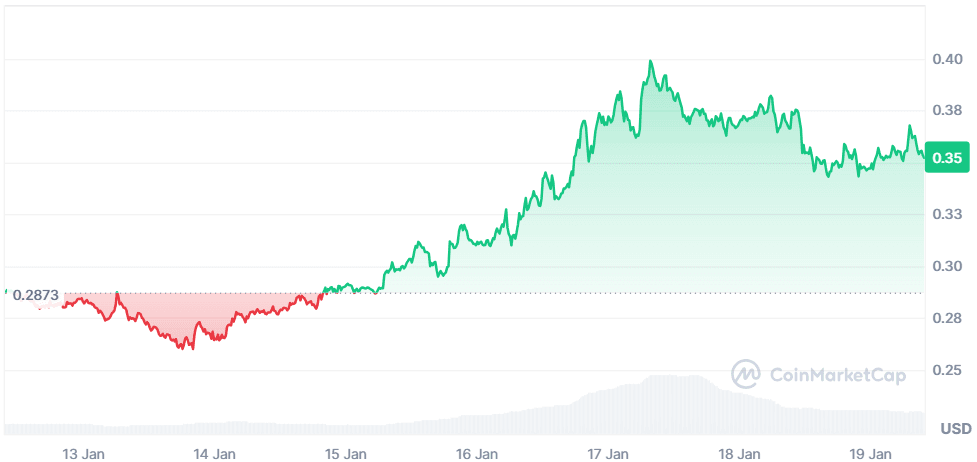

Hedera (HBAR)

7日價格變動: +22.63% 現價: $0.3519

最新動態 Hedera本週增長受惠於與SpaceX、Intel、NVIDIA策略合作,加速區塊鏈融合與資產代幣化倡議。與世界珠寶學會 (WGI)合作,推動不可篡改的電子證書,提升透明度及信心。

菲律賓銀行引入基於Hedera帳本技術的PHPX穩定幣,展示跨境匯款革新潛力。加上HBAR於AI數據安全和工作流程安全的進步,鞏固於金融及科技領域影響力。

走勢預測 HBAR RSI為60,屬中性偏強。$0.33有支持、$0.40是阻力,若突破$0.40有望推上$0.45,受合作消息及代幣化主題帶動。若跌穿$0.33將回試$0.30。移動平均線整體利好,50日線於$0.31為強支援。交投增加,但升勢如交投回落或會減慢。

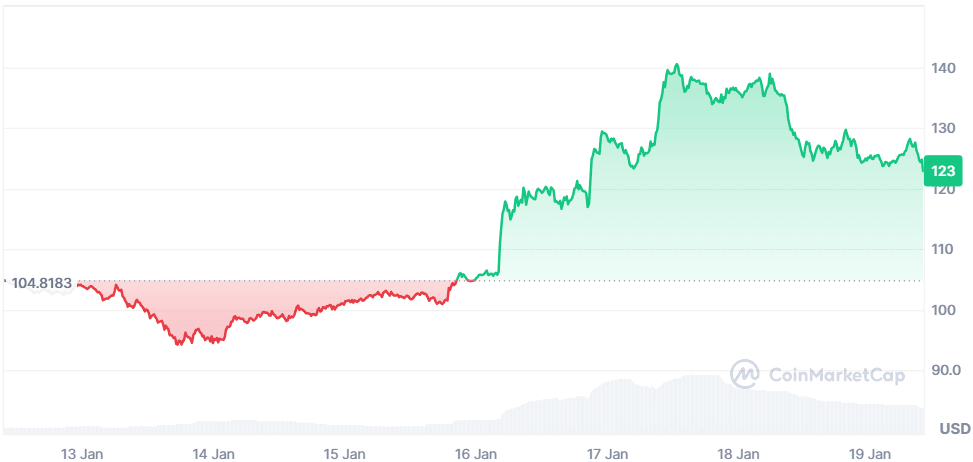

Litecoin (LTC)

7日價格變動: +16.85% 現價: $122.48

最新動態 Litecoin本週受潛在現貨ETF申請憧憬帶動,吸引機構資金和大戶累積。 納斯達克申報Canary Litecoin ETF,連同指定託管方,突顯市場對LTC信心。LTC交易量持續,成2024年於BitPay交易最多加密貨幣。惟本週LTC官方X帳戶被黑,揭示部分安全漏洞,但未嚴重影響市況。衍生品交易增長及Hash率上升,持續推高市場信心。

走勢預測 LTC RSI約68,接近超買。$115有即時支持,$130為阻力,如突破則上望$150,特別ETF消息持續炒作。守不到$115或將回落至$110甚至$105。平均線偏好,50日均線於$110提供支撐。Hash率及衍生品活躍為利好信號,但靠近阻力或有整固。

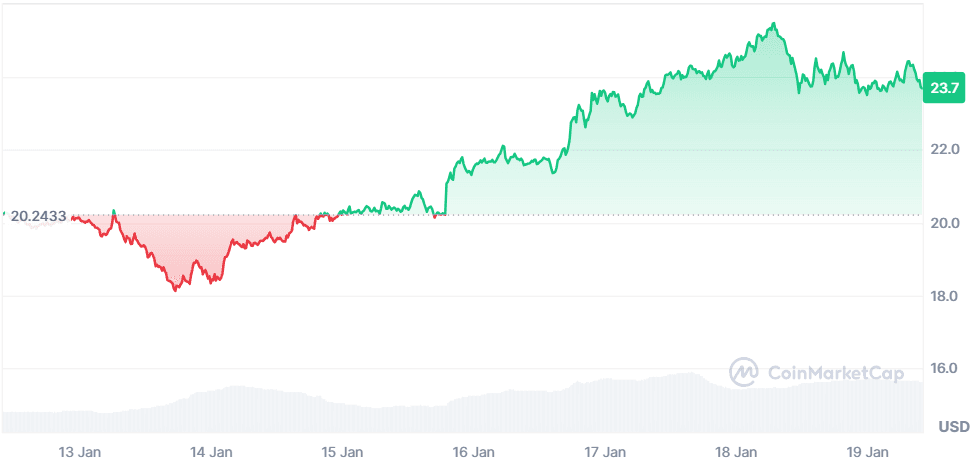

Chainlink (LINK)

7日價格變動: +17.04% 現價: $23.70

最新動態 Chainlink領先提升區塊鏈互操作性,推出跨鏈協議(CCIP) v1.5,實現ERC-20代幣跨鏈整合。與BTguru合作、於Linea主網接入BNB/USD及ETH/USD價格數據,進一步強化其在DeFi的地位。引入低時延數據自動化合約,鞏固去中心交易所角色。此外,StakeStone採用Chainlink進行ETH質押,聯同與Swift於結算領域合作,令其在DeFi生態地位鞏固。

走勢預測 Chainlink RSI約63,顯示溫和升勢。$22為支持,$26為阻力,若突破料望$30,市場對跨鏈互操作需求高則推升市價。若失守$22或回落至$20。50日均線約$21為強支撐,交投活躍反映投資者持續關注。

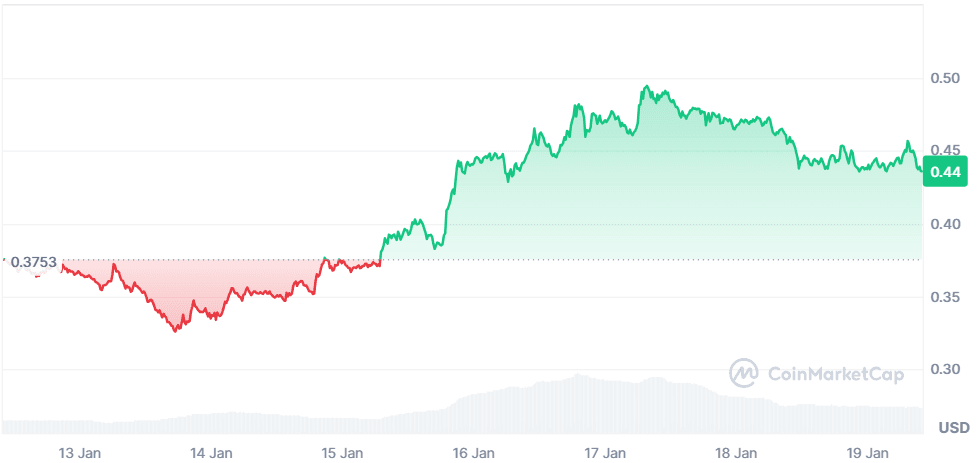

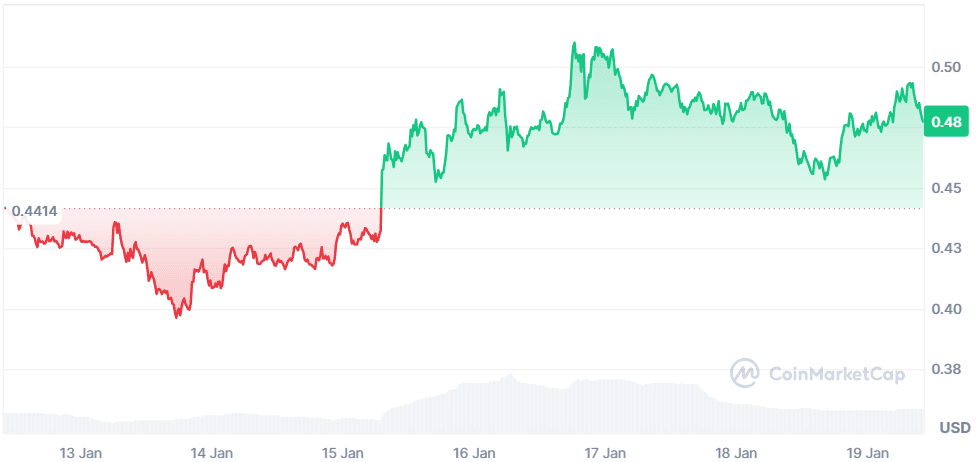

Algorand (ALGO)

7日價格變動: +15.89% 現價: $0.4353

最新動態 Algorand's 4.0 升級令其區塊鏈生態進一步發展, including improved staking rewards and scalability enhancements. This has bolstered both security and developer capabilities, attracting institutional attention. Algorand's collaboration with Mastercard aims to enhance blockchain utility and improve liquidity, while staking upgrades have increased investor confidence. These developments have led to a surge in market activity, with trading volumes spiking over 100% earlier this week.

包括提升的質押獎勵及可擴展性升級。這些改進增強咗安全性同開發者能力,吸引咗機構層面嘅關注。Algorand同Mastercard合作,目標係提升區塊鏈應用度同改善流動性,而質押功能嘅升級亦令投資者信心大增。相關動向帶動市場活躍度,本週早段交易量激增超過100%。

Forecast Algorand’s RSI is currently at 58, indicating neutral-to-bullish momentum. Support is at $0.40, with resistance at $0.50. Breaking above $0.50 could lead to a rally toward $0.55, especially if staking rewards and liquidity improvements continue to drive investor interest. If the price dips below $0.40, it may retest the $0.38 level. The moving averages show a positive trend, with the 50-day moving average at $0.39 providing solid support.

預測

Algorand目前RSI係58,顯示勢頭由中性偏向牛市。支持位係$0.40,阻力位係$0.50。如果升穿$0.50,有機會上衝至$0.55,尤其係質押獎勵同流動性改善續吸引投資者之下。如果跌穿$0.40,就可能要再測試$0.38水平。移動平均線顯示正面趨勢,50日線喺$0.39提供堅實支持。

Stellar (XLM)

Price Change (7D): +8.00%

Current Price: $0.4771

News Stellar has partnered with Nansen AI to enhance on-chain wallet analytics, further improving its ecosystem’s efficiency and transparency. Collaborations with OpenZeppelin to develop a Stellar Contracts Library have strengthened developer tools, supporting growth on the Soroban smart contract platform. Stellar’s integration of advanced on-chain analytics and its ability to handle millions of daily transactions underscore its expanding role in DeFi and blockchain-based finance.

新聞

Stellar同Nansen AI合作,加強鏈上錢包分析,令生態系統更有效率同透明度。與OpenZeppelin共同開發Stellar合約庫,增強開發工具,支援Soroban智能合約平台增長。Stellar整合先進鏈上分析、每日處理數百萬交易能力,進一步彰顯其於DeFi及區塊鏈金融日益擴大嘅作用。

Forecast Stellar’s RSI is at 54, indicating a neutral market position. Support lies at $0.45, with resistance at $0.50. If Stellar breaks above $0.50, it could target $0.55, driven by increased developer adoption and ecosystem growth. However, a decline below $0.45 could lead to further downside toward $0.42. Moving averages suggest consolidation, with the 50-day moving average at $0.46 providing stability.

預測

Stellar目前RSI為54,屬中性局面。支持位$0.45,阻力位$0.50。若升穿$0.50,目標將上試$0.55,主要受開發者採用率提升及生態系統增長帶動。不過若跌穿$0.45,潛在會下試$0.42。移動平均線顯示盤整情況,50日線$0.46構成穩定支持。

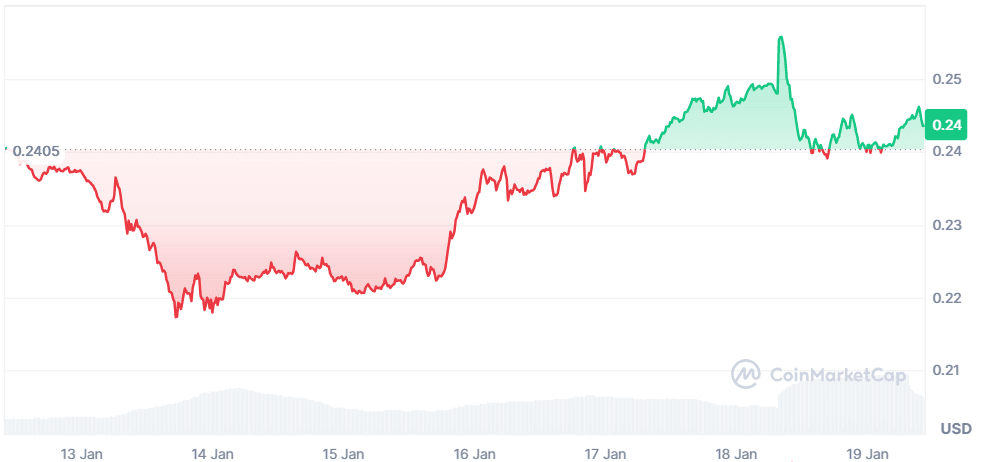

TRON (TRX)

Price Change (7D): +1.24%

Current Price: $0.2435

News TRON has made headlines with its interception of $132 million in illicit funds through a collaboration with Tether, highlighting its focus on security and regulatory compliance. The launch of USDD 2.0 stablecoin with a 20% yield and its adoption for tokenized legal notices in Hong Kong courts have showcased TRON's expanding utility in financial systems and legal frameworks. Additionally, TRON’s sponsorship of major crypto events and its potential ties with Trump-backed World Liberty Financial are drawing attention to its role in the blockchain ecosystem.

新聞

TRON聯同Tether成功截獲$1.32億非法資金,突顯項目對安全同法規遵從嘅重視。USDD 2.0穩定幣推出,年化回報達20%,同時貨幣被香港法院用於發出代幣化法律通知,彰顯TRON於金融及法律範疇應用持續擴展。再加上,TRON贊助多項大型加密活動,及與特朗普支持嘅World Liberty Financial合作潛力,進一步鞏固其區塊鏈生態位。

Forecast TRON’s RSI is at 51, signaling a neutral outlook. Support is seen at $0.24, with resistance at $0.25. A breakout above $0.25 could pave the way for a move toward $0.27, fueled by increasing adoption and positive sentiment around stablecoin innovations. However, if TRON falls below $0.24, it may retest $0.22. The moving averages suggest consolidation, with the 50-day moving average at $0.23 providing support.

預測

TRON目前RSI為51,反映市場中性。支持位$0.24,阻力位$0.25。若突破$0.25,有望推升至$0.27,主要受穩定幣創新及採納率上升帶動。但若跌穿$0.24,可能回測$0.22。移動平均線顯示盤整走勢,50日線$0.23形成支持。

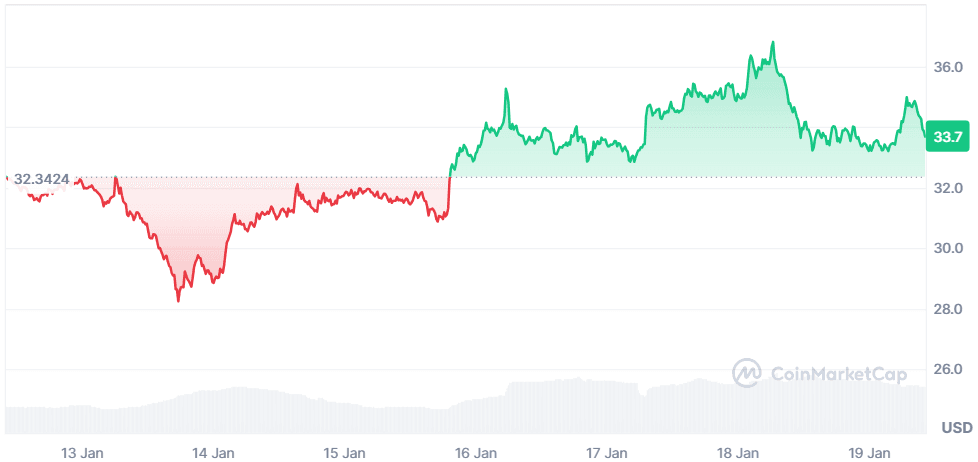

Ethereum Name Service (ENS)

Price Change (7D): +4.25%

Current Price: $33.69

News Ethereum Name Service (ENS) continues to expand its infrastructure role with Venmo and PayPal integrating .eth names, signaling future adoption potential. During frENSday, Vitalik Buterin emphasized ENS’s infrastructure potential, while Venmo and PayPal revealed steps to bridge traditional payment systems with blockchain technology. These developments highlight ENS’s growing utility and its potential to become a critical part of blockchain-based digital identity systems.

新聞

Ethereum Name Service (ENS)進一步擴展基建角色,Venmo及PayPal接入.eth域名,顯示未來應用潛力。在frENSday活動上,Vitalik Buterin強調ENS基建潛力,而Venmo同PayPal亦展示咗連結傳統支付同區塊鏈科技嘅新措施。這些發展凸顯ENS實用性增強,有潛力成為區塊鏈數碼身份系統重要一環。

Forecast ENS’s RSI is at 49, indicating a neutral trend. Support is at $32, with resistance at $35. If ENS breaks above $35, it could target $38, driven by adoption in mainstream financial systems. However, a decline below $32 could lead to a drop to $30. The moving averages are flat, indicating a consolidation phase, with the 50-day moving average at $31 providing additional support.

預測

ENS現時RSI為49,屬趨勢中性。支持位$32,阻力位$35。如突破$35,或上試$38,受主流金融系統應用推動。但若失守$32,可能回落至$30。移動平均線亦見橫行,50日線$31對價格構成額外支持。

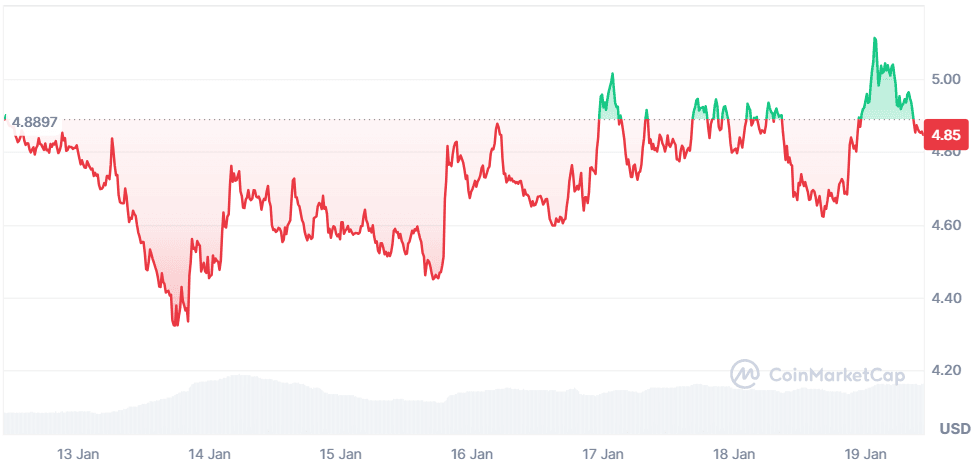

Sui (SUI)

Price Change (7D): +0.76%

Current Price: $4.85

News Sui has strengthened its presence in the blockchain space with significant advancements in both security and DeFi. Its partnership with Chainalysis enhances on-chain activity monitoring, bolstering security measures. The Sui Foundation has also driven DeFi growth through protocols like DeepBook and Suilend, alongside the adoption of stablecoins, contributing to its Total Value Locked (TVL) reaching $1.8 billion. Additionally, its collaboration with SEED to revolutionize gaming technology for 100 million users underscores its commitment to innovation and scalability.

新聞

Sui在區塊鏈領域持續增強地位,無論安全或DeFi發展均有重大突破。與Chainalysis合作加強鏈上活動監控,提升安全防護。Sui基金會推動DeepBook同Suilend等協議發展DeFi,加上穩定幣採納,令總鎖倉量(TVL)達18億美元。另外,聯同SEED開發一億用戶級Web3遊戲生態,進一步體現其創新同擴展承諾。

Forecast Sui’s RSI stands at 52, indicating a neutral position with the potential for upward momentum. Support lies at $4.60, while resistance is seen at $5.10. Breaking above $5.10 could see Sui rally toward $5.50, driven by continued DeFi adoption and gaming-related initiatives. However, if the price falls below $4.60, it may retest the $4.40 level. Increased trading volumes this week highlight sustained interest, positioning Sui for further growth in the DeFi sector.

預測

Sui現時RSI為52,呈中性,但有向上動力。支持位$4.60,阻力位$5.10。如突破$5.10,有望再上$5.50,受持續DeFi採納同遊戲相關發展帶動。但若跌穿$4.60,或需回測$4.40。本週交易量上升,顯示市場熱度持續,令Sui於DeFi板塊有望進一步增長。

Bitcoin (BTC)

Price Change (7D): +1.33%

Current Price: $104,753.56

News Bitcoin crossed the $100K mark once again amid a surge in institutional interest. BlackRock’s ETF purchases of 5,250 BTC and over $1.3 billion in ETF inflows have signaled widespread adoption and mainstream acceptance. The SEC’s approval of spot Bitcoin ETFs in 2024 has generated $30 billion in investments, while states like Oklahoma are exploring Bitcoin reserves as strategic assets. Bitcoin’s Total Value Locked (TVL) in DeFi has skyrocketed by 2,000% in 2024, driven by staking and innovative financial applications.

新聞

比特幣再次突破十萬美元關口,機構層面興趣顯著升溫。BlackRock透過ETF增持5,250枚BTC,ETF流入超過$13億,反映率先被主流市場廣泛接納。2024年SEC批出現貨比特幣ETF,帶動投資規模達三百億美元。美國如奧克拉荷馬州等正考慮將比特幣作為戰略資產儲備。2024年比特幣於DeFi總鎖倉價值(TVL)暴升2,000%,受質押應用及創新金融產品推動。

Forecast Bitcoin’s RSI is at 70, indicating overbought conditions and potential for short-term consolidation. Support lies at $100K, with strong resistance near $110K. A breakout above $110K could pave the way for a rally toward $120K, supported by increasing institutional demand and ETF inflows. If BTC fails to hold $100K, a correction to $95K is possible. The exponential moving averages show a bullish trend, with the 50-day EMA at $97K acting as critical support. Bitcoin’s dominance and consistent trading volume underscore its strong position as a market leader.

預測

比特幣RSI已達70,屬超買區,短線可能會整固。支持位$100,000,強阻力則喺$110,000。如突破$110,000,有望升向$120,000,受機構需求和ETF持續流入推動。若失守$100,000,有可能調整至$95,000。指數移動平均線維持強勢,50天EMA喺$97,000為重要支持。比特幣主導地位及穩健交易量突顯其市場領先角色。

Closing Thoughts

The crypto market this week is characterized by a clear shift towards institutional adoption and cross-chain interoperability.

本週加密貨幣市場明顯向機構採納及跨鏈互通進發。

Bitcoin’s dominance is bolstered by ETF inflows and mainstream acceptance, while altcoins like Chainlink and Sui continue to lead in DeFi innovation. The interoperability sector is seeing strong participation, with coins like Chainlink and Sui pioneering new solutions. Meanwhile, assets like Stellar and Hedera emphasize blockchain’s integration into traditional finance. As the market gains momentum, DeFi and interoperability stand out as the most active sectors, setting the stage for continued growth and adoption across the ecosystem.

比特幣主導地位受ETF資金流入和主流認受加強,同時Chainlink、Sui等山寨幣在DeFi創新方面繼續領先。互操作性領域活躍,Chainlink、Sui等帶頭開創新方案。Stellar、Hedera等資產則強調區塊鏈與傳統金融銜接。隨着市況升溫,DeFi及跨鏈互操作成最活躍範疇,為生態系統持續發展及採納奠定基礎。