加密貨幣交易型基金(ETFs)的興起,徹底改變了數位資產產業。美國於2024年初批准相關產品後,僅第一季現貨比特幣ETF就吸引超過120億美元資金。貝萊德的iShares Bitcoin Trust更在不到兩個月便募集100億美元——據稱創下ETF最速紀錄,同期比特幣一度突破七萬美元創新高。那麼,我們該把ETF流向視為關鍵的市場情緒指標嗎?

重點整理:

- 美國第一季現貨比特幣ETF吸引超過120億美元,貝萊德的產品更創ETF募資紀錄之最

- 2024年中,近1,000家傳統金融機構持有比特幣ETF,顯示機構廣泛採用

- 專家警告,資金流向多為落後指標,僅呈現整體加密市場的一個面向

傳統投資者已以前所未有的速度,透過這類熟悉的投資工具進入加密市場。包括貝萊德、Fidelity等金融巨擘及資產管理機構的進場,讓曾經邊緣化的資產類別獲得正規化。

「美國現貨比特幣ETF獲批,已向投資人傳達加密貨幣是合法資產類別訊號。」Coin Bureau研究主管Daniel Krupka如是說。

這類產品讓機構與個人,不必直接操作代幣也能參與比特幣表現,其發展亦十分迅速。到2024年中,將近上千家傳統金融公司,從銀行到退休金基金,都已持有比特幣ETF。Krupka強調,在「ETF持續累積比特幣」的現象下,比特幣的流動性加深,波動性下降,主要大戶如貝萊德等,亦加強了市場對「加密貨幣正逐步成熟」的認知。

一個關鍵問題由此浮現:加密ETF的進出資金,能否可靠地反映市場情緒?當資金大量流入,是不是代表投資者看多?而大量贖回又是否預示市場即將轉空?在傳統市場裡,資金流動經常被用來判斷風險偏好。在波動劇烈的加密市場,每週ETF投資流向,近年也成為備受關注的觀察指標。

何謂ETF與加密ETF?

ETF在證券交易所上市,通常追蹤一項標的資產或資產組合,投資人像買賣股票一樣買賣ETF,能方便取得特定市場的曝險。

加密ETF則是把數位代幣包裝為受監管且由機構託管的金融商品。例如比特幣ETF持有或連接比特幣,反映加密幣價格,讓投資人透過傳統交易所以間接方式參與比特幣表現,而毋需自持或存放實體加密貨幣。

加密ETF分為多種類型。所謂「現貨」ETF直接持有加密資產或等值權益。投資人購買該ETF,管理公司就須實際買入比特幣,壯大資產規模。若有賣壓,管理公司則出售持幣以應對贖回需求。透過創造/贖回機制,使ETF價格緊貼加密市場價格。

期貨型加密ETF則不持有實體幣,而是投資於跟加密貨幣價格綁定的期貨合約。這類型率先在美國獲批,首支產品為2021年10月上市的ProShares Bitcoin Strategy ETF(BITO),其運作受限於期貨交易所監理。雖然期貨ETF能帶來幣價曝險,但受合約價差、轉倉成本等複雜因素影響,與現貨價格可能出現偏離。

兩者最大差異在於,期貨ETF追蹤的是預期未來價格(合約),現貨ETF則直接持有標的資產——等於投資人實際擁有部分比特幣。

Bitcoin remains the most common underlying asset for crypto ETFs, with Ethereum following suit.

美國監管機關於2023年底首度核准以太幣相關ETF,初期為期貨型,至2024年才批現貨ETF。市面上有些ETF更同時持有多種加密貨幣或追蹤指數,用單一代碼即享多元曝險。

加密ETF大幅降低了市場進入門檻。原先要直接購買加密貨幣,須開設數位交易所帳戶、管理電子錢包與承擔託管風險,讓許多投資人裹足不前。ETF以傳統法律結構包裝加密資產,提供便利、熟悉感及監管保障。投資人申報資產更簡單,也無需擔心資安或自行託管風險。

對機構投資人而言,ETF符合合規需求,有些退休基金無法持有實體比特幣,但可持有合法ETF股份。正因這些優勢,加密ETF成為資本湧入的熱門管道,也解釋了新產品上市會成為主流採用的里程碑。

加密ETF簡史

今日的加密ETF市場格局,誕生過程充滿監管挑戰。比特幣ETF概念首見於2013年,由Winklevoss兄弟向納斯達克申請掛牌。但隨後數年,美國監管機構一直存疑。

2017年,美國證券交易委員會(SEC)以市場操縱疑慮及比特幣交易場所規範問題為由,否決Winklevoss等多項申請案。當時美國看來難以同意直接持有加密幣的ETF。

反觀歐洲較早啟動,2015年已推行追蹤加密幣的交易所票據,2021年2月,加拿大批准北美第一支比特幣ETF。國際產品證明市場需求,並為美國評估提供參考。

重大突破發生於2021年10月,美國監管首度允許比特幣期貨ETF問世。ProShares的BITO於紐約證交所掛牌,反應熱烈。BITO上市兩日資產突破10億美元,刷新ETF達標速度紀錄。比特幣一度飆升至約67,000美元創新高,交易量爆增。

隨後數檔比特幣期貨ETF上市,雖然未有產品複製BITO起步時的資金流入,但明確顯示:只要獲批,加密投資基金後市潛力龐大。

2022至2023年期間,市場對SEC核准現貨比特幣ETF壓力漸增。Grayscale Investments甚至為此提告監管機構。2023年中,貝萊德遞交現貨比特幣ETF申請,令市場信心大增。

2024年1月,SEC終於同時批准約12家大型公司現貨比特幣ETF——整個產業的重要時刻。美國現貨ETF隨即於2024年1月中開放交易且大舉吸金,數週內約有70億美元流入,多支新ETF亮相推升幣價,吸引機構表態持有。

到2024年3月,貝萊德IBIT基金資產超過100億美元——僅約兩個月即達成,堪稱ETF歷史創舉。美國加密ETF總資產規模暴增,據稱全球加密ETF/ETP資產在2024年中已突破600億美元。

全球里程碑陸續展開。2024年5月,美國首度批准現貨以太幣ETF,加密ETF正式納入市值第二大幣種。歐洲早有多檔實體支持型加密ETP,並持續推新產品如山寨幣綜合籃子基金。巴西、澳洲等市場也推出在地交易的加密ETF。

到2025年,加密貨幣ETF已穩踞全球資本市場。這個「ETF時代」讓散戶與機構空前便利地調整比特幣、以太幣乃至細分資產配置。隨著這種整合深化,ETF資金流已成加密分析重要指標,正如股票基金流向用以判別股市情緒一樣。

資金流向作為情緒指標:多頭流入與空頭流出

合理推論,對加密市場看好的投資者,會增持加密基金,悲觀者則撤資。這一動態在加密ETF上屢屢驗證,強化了「流向即情緒」的看法。

牛市或利多消息期間,加密ETF大量吸引資金,有分析師據此認為市場偏多。相反地,空頭或宏觀恐慌時期,ETF資金外流,被視為信心轉弱。

近期案例很能說明這一點。2023年6月下旬,連續9週小幅流出後,加密投資基金單週突然吸金約1.99億美元,創一整年的新高,幾乎都是流入比特幣相關產品。

CoinShares分析師將這一逆轉歸因於貝萊德等巨頭遞交現貨ETF申請所激發的市場轉趨樂觀。比特幣也剛創下年度新高,資金流入被視為提前布局監管利好。不僅如此,「做空比特幣」型基金同時出現資金撤出,顯示空方減碼。

「我們認為,這波正面情緒的再度湧現,來自於知名ETP發行商近期公告。」CoinShares報告指出,這些消息與投資人情緒可量化地產生呼應。

2024年1月,美國現貨比特幣ETF上市所帶來的龐大資金流入,再次展現了資金流對情緒判讀的強大指標作用。 Net inflows of approximately $7–12 billion into bitcoin ETFs over just months reflected resurging enthusiasm among retail and institutional investors. Bitcoin prices reached all-time highs amid this optimism.

在短短幾個月內,比特幣ETF約70到120億美元的淨流入,反映了散戶與機構投資人熱情重燃。在這股樂觀情緒下,比特幣價格創下歷史新高。

"The fact there's regulated vehicles now" unleashed pent-up demand, one analyst noted, with rapidly growing fund sizes evidencing widespread interest in safer crypto exposure options. The bullish sentiment extended beyond U.S. borders, with crypto ETPs in Europe, Canada and other regions reporting rising inflows as global investors gained confidence in broader crypto market recovery.

一位分析師指出:「現在有受監管的投資工具」,釋放了累積已久的市場需求,規模迅速成長的基金顯示大家對更安全加密資產產品的濃厚興趣。這股樂觀情緒也擴展到美國以外,歐洲、加拿大等地的加密ETP都有流入增加的情況,反映全球投資人對加密市場全面復甦的信心提升。

Even on shorter timeframes, traders monitor ETF flows for sentiment shifts. A streak of weekly inflows into crypto funds generally suggests building upward momentum. CoinShares data in late 2024 showed a remarkable 19-week streak of consecutive digital asset fund inflows, signaling sustained optimism that coincided with recovering crypto prices.

即使在較短的時間尺度內,交易者也會觀察ETF資金流動來偵測市場情緒變化。連續多週的資金流入通常代表上升動能正在累積。CoinShares在2024年末的數據顯示,數位資產基金連續19週淨流入,這一創紀錄的長度顯示市場持續樂觀,加密價格也同步回升。

When that streak finally broke in early 2025 with sudden outflows, analysts viewed it as a sentiment inflection point. One report described "massive outflows" marking a significant shift after prolonged steady inflows – investors had grown cautious and begun reducing exposure, foreshadowing market cooling.

當這波連續流入在2025年初因突然流出而終止時,分析師將此視為情緒轉折點。有報導形容這波「大規模流出」為長期穩定流入後的重大變化――投資者轉趨謹慎並開始減碼,預示市場可能降溫。

Geographical flow patterns offer additional sentiment insights. During a crypto market drawdown in first-quarter 2025, data revealed regional divergence: U.S.-based investors withdrew funds aggressively while European and Canadian investors maintained modest inflows. CoinDesk noted U.S. sentiment appeared "particularly bearish" with nearly $1 billion in U.S. provider outflows over weeks, while sentiment elsewhere remained more neutral or slightly positive.

地區性資金流動更能反映情緒差異。2025年第一季加密市場下挫時,數據顯示美國投資人積極撤資,而歐洲、加拿大的投資人還在小幅流入。CoinDesk指出,美國市場情緒明顯偏空,單是美國發行者流出就有接近10億美元,而其他地區氣氛則較為中性或略帶正面。

Such differences often reflect local factors – U.S. investors potentially reacting to domestic regulatory crackdowns or macro concerns while international investors remained comparatively optimistic. Flow data analysis allowed analysts to conclude "investor sentiment in the U.S. is particularly bearish," identifying regional sentiment variations.

這些差異往往與當地因素有關,比如美國投資者可能回應國內監管風險或經濟環境疑慮,而海外投資人則相對樂觀。透過資金流數據分析,專家得出「美國投資人情緒特別悲觀」這一結論,明確辨識出不同地區情緒分布。

Inverse or short product flows provide additional signals. In October 2022, crypto funds experienced slight net outflows overall, but most withdrawals came from short bitcoin ETFs designed to profit from price declines. Those bearish funds saw approximately $15 million in redemptions, the largest short-product outflow on record, suggesting bears closing positions while modest inflows continued into long bitcoin funds.

反向或做空產品的資金流也提供額外線索。2022年10月,加密基金雖整體略有淨流出,但多數贖回來自做空比特幣ETF(預期比特幣價格下跌會賺錢的產品)。這類看空產品單月流出約1,500萬美元,創下新高,顯示空頭開始回補部位,而做多比特幣基金則繼續有小幅流入。

CoinShares' head of research, James Butterfill, remarked: "This suggests sentiment remains positive," despite minor headline outflows. When money exits bearish bets, it often indicates bullish sentiment shifts, demonstrating flow analysis nuance: examining which fund types experience inflows or outflows matters. Rotation from "short" to "long" ETFs typically signals fading pessimism and growing optimism.

CoinShares研究主管James Butterfill表示:「這顯示投資情緒仍為正面。」雖然表面上總體有小幅流出,但當資金撤出做空部位時,往往意味著市場情緒正由悲觀轉向樂觀,顯示流量分析需精細區分基金類型。從「做空」ETFs轉向「做多」ETFs,常常代表悲觀情緒消退,樂觀氛圍增強。

Multiple times, large inflows have coincided with or slightly preceded rallies, supporting their utility as sentiment gauges. When bitcoin broke above key price levels during recoveries, spikes in ETF buying often accompanied these moves. Market commentators frequently note correlations like "crypto fund inflows quadrupled last week, a sign of positive sentiment as bitcoin's price climbed."

多次經驗顯示,大額流入經常與行情啟動或上漲初期同步甚至領先出現,說明ETF資金流具有反映情緒的價值。比特幣突破重要價位時,ETF買盤大增的情景屢見不鮮。市場評論家經常提到:「上週加密基金流入量暴增四倍,是比特幣價格走揚下樂觀情緒的明顯訊號。」

Fund flow reports have essentially become sentiment scoreboards: substantial weekly inflows suggest rising bullish sentiment; net redemptions indicate declining sentiment. Media outlets and analysts rely on such data to explain price movements.

基金流量報告實質上成了情緒記分板:大量週流入表示市場樂觀情緒升溫,淨贖回則顯示信心轉弱。媒體與分析師經常依賴這些數據說明價格走勢。

In April 2025, U.S. spot bitcoin ETFs recorded their highest daily inflows since January – $381 million in one day – coinciding with bitcoin approaching new highs, widely cited as evidence of strengthening investor confidence. This feedback loop can amplify trends: rising prices attract momentum-driven investors, adding buying pressure that potentially pushes prices higher.

2025年4月,美國現貨比特幣ETF單日流入達到自1月以來的新高,僅一天即流入3.81億美元,與比特幣逼近新高相呼應,被廣泛視為投資人信心加強的證明。這種反饋鍊能放大行情趨勢:價格上漲吸引動能投資者進場,進一步推高買盤,可能形成價格續漲。

Substantial evidence suggests crypto ETF inflows and outflows mirror prevailing market sentiment. Bullish investors increase fund allocations while bearish or fearful investors withdraw capital. Flow magnitude can indicate sentiment intensity: record-setting inflows typically occur during euphoria or high conviction periods, while record outflows often accompany panic or deep pessimism.

大量證據顯示,加密ETF的資金流動反映了當前市場情緒。看多投資人會增加基金配置,看空或恐慌投資人則選擇撤資。資金流規模往往代表情緒強度:歷史新高的流入常見於樂觀或信心爆棚時期,而大量流出通常伴隨恐慌或極度悲觀。

為何加密ETF資金流有時會誤導(質疑與反駁)

Despite the intuitive appeal of using ETF flows as sentiment indicators, several caveats warrant consideration. Market veterans caution that fund flows, especially in emerging markets like crypto, aren't always straightforward indicators – and sometimes function as contrarian signals.

儘管ETF流量作為情緒指標直觀且具吸引力,仍有不少盲點值得注意。經驗豐富的投資人提醒,資金流(特別是在如加密貨幣這類新興市場)未必簡單反映未來行情――有時反而可作為反向指標。

Flows often follow rather than predict price trends. Investors typically chase performance; money usually enters after assets have risen (when bullish sentiment is widespread) and exits after prices have fallen (when fear predominates). This means by the time flows clearly indicate extreme sentiment, market moves may be well underway or approaching exhaustion.

資金流通常是跟隨(而非預示)價格趨勢。群眾普遍追逐績效:行情好時才投入(即情緒普遍樂觀時錢才進來),價跌時恐慌出場。這意味著當ETF流動明顯反映極端情緒時,行情往往已走到半場甚至將近尾聲。

A historical example: ProShares BITO launch in October 2021 attracted over $1 billion in two days amid bitcoin's surge to record highs. Within weeks of that euphoric inflow spike, bitcoin peaked and began declining sharply, with BITO interest waning as prices fell. The massive inflows reflected top-of-market exuberance – a lagging rather than leading indicator.

例如:2021年10月ProShares BITO上市,兩天吸金逾10億美元,當時比特幣漲至歷史新高。但就在這波熱錢湧入後幾週內,比特幣很快見頂回落,BITO交易量與關注度同步降溫。這次大量流入實質反映的是市場最高點的亢奮,是落後而非領先指標。

Similarly, some of the largest crypto fund outflows occurred during the 2022 bear market after prices had already collapsed from highs, essentially confirming bearish sentiment that had persisted for months.

同樣道理,2022年熊市中最大規模的基金流出,也是發生在價格早已重挫之後,流量不過證實市場早已持續數月的悲觀氛圍罷了。

In essence, fund flows often reveal current rather than future sentiment direction.

本質上,ETF資金流往往揭露的是現狀,而非未來的情緒走向。

Additionally, crypto ETF flows represent only a segment of the overall market, with signals potentially distorted by factors unrelated to broader crypto holder sentiment. Most bitcoin and cryptocurrencies exist outside ETFs – on exchanges, in private wallets, and with long-term holders. These participants may behave differently from ETF investors.

此外,加密ETF的流量僅反映市場部分資金,且可能被與整體加密持有人情緒無關的因素所扭曲。絕大多數比特幣等加密貨幣並不在ETF內,而是分散在各大交易所、私人錢包,或由長線持有者掌控。這些群體的行為未必和ETF投資人一致。

During downturns, traditional investors might withdraw from ETFs (perhaps during broader cash flights) while crypto-native buyers or institutional arbitrageurs quietly accumulate coins at lower prices outside ETF structures. The ETF outflows would suggest bearishness even as other market segments turn bullish.

於市場低迷時,傳統投資人可能從ETF抽身(或因市場普遍逃現趨勢),而加密圈原生買家或機構套利者卻可能在ETF以外悄悄低接現貨。這時ETF流出雖顯示悲觀,實際上其他市場參與者卻正轉向樂觀。

Early 2025 showed hints of this phenomenon: as U.S. ETF outflows continued for weeks amid macro concerns, bitcoin prices surprisingly maintained certain levels and even rallied temporarily. That rally stemmed from spot exchange buying (possibly overseas or by longer-term investors) despite U.S. fund investor selling.

2025年初就出現這種現象:美國ETF連續數週流出、宏觀情勢不明時,比特幣價格卻意外穩住並短暫回升,這波反彈來自於現貨市場的買盤(或許來自海外,或長線投資人),即便美國基金投資人選擇外逃。

Such divergences suggest ETF flows primarily reflect sentiment among specific investor segments (often Western, institutional-leaning participants) without capturing the complete global crypto market sentiment picture.

這類落差顯示ETF流動其實主要反映特定族群(多數為西方市場、機構色彩較重的投資者情緒),無法完整涵蓋全球加密市場情感全貌。

Macroeconomic forces further complicate interpretation. Crypto ETFs, as traditional financial instruments, exist within broader portfolio contexts. During risk-off environments – triggered by geopolitical tensions or recession fears – investors often reduce exposure across all assets. They might simultaneously sell stocks, commodities, and crypto ETFs to increase cash positions or reduce risk.

宏觀經濟因素會使解讀更加複雜。加密ETF身為傳統金融商品,會在整體資產配置考量下被調整。在「避險」氛圍下(如地緣局勢不穩、衰退風險升高等),投資人不分資產類別全面減碼:股票、原物料、加密ETF一同被拋售,以增持現金與降低風險。

In such scenarios, crypto fund outflows might indicate general risk aversion rather than crypto-specific bearish views. A vivid example occurred in April 2025: President Trump's tariff announcement and subsequent market uncertainty triggered five consecutive days of U.S. spot bitcoin and ether ETF outflows, even as crypto prices temporarily rebounded on positive news developments.

這種情境下,加密基金流出可能反映的是普遍避險,而非針對加密幣的單獨看空。例如2025年4月,川普總統宣布關稅措施、導致市場信心動搖,美國現貨比特幣、乙太ETF連續五天被大量贖回,即使期間有利多令價格短暫反彈。

Analysts noted that "dwindling demand" for ETFs stemmed from uncertainty, with macro-oriented investors "selling every asset, including crypto ETFs, for cash" amid turmoil. This underscores context importance: distinguishing whether crypto fund flows respond to crypto-specific developments (like regulatory decisions or security breaches) or broader market sentiment is crucial. When broader factors dominate, flows may reveal little about intrinsic crypto outlook.

分析師指出,ETF「需求減弱」是因不確定性升高,目光放在大局的投資人於動盪時段「不分對象全面賣出,連加密ETF也不留」。這提醒我們解讀數據時必須看清脈絡:區分加密資金流反應的是本身利空(如監管、駭客)還是整體市場氛圍。當大環境主導時,這些流動其實無法說明加密市場本質前景。

Large fund flow movements can also result from idiosyncratic, one-time factors. A single major institutional investor allocating to or redeeming from an ETF can skew weekly data. If a large pension fund took profits by withdrawing $500 million from a bitcoin ETF, that would register as a major outflow (bearish signal) even if thousands of smaller investors were net buyers during the same period.

有時大規模資金變動只是偶發事件或單一因素。比方說,某大型機構進出或贖回,就能大幅影響當週數據。如果某退休基金一次贖回5億美元比特幣ETF,帳面上會顯現「重大流出」(偏空訊號),即使同樣期間有數千小投資人淨買入,都被這筆大額交易淹沒。

Conversely, inflow surges might occur when new ETFs launch and quickly gather assets (reflecting excitement or initial positioning). These mechanical or one-time flows may not represent "average" crypto investor sentiment.

相反,新ETF上市時也容易衝出巨額流入(反映市場興奮或初始建倉)。這些機械性或偶發性的流動,並不代表「平均」投資人情緒。

History suggests caution: during risk-off environments, investors often sell indiscriminately, as one analyst observed, "narrative aside."

歷史經驗告訴我們,避險時期投資人往往毫無差別地拋售,「無論故事如何」都先落袋為安。

Not every outflow indicates long-term bearish crypto sentiment – sometimes it reflects temporary exposure reduction due to external needs or short-term concerns.

並非每一次流出都代表長線加密幣市場看空――有時僅是基於外部需求或短線考量的臨時減碼。

Rotation and substitution phenomena add complexity. The expanding crypto fund universe contains multiple overlapping products. Investors may move between funds, creating outflows in one product and inflows in another, obscuring sentiment signals.

資金在各基金間流轉與替代,也讓解讀變複雜。加密基金產品不斷擴增、彼此重疊,投資人經常在不同產品間調整部位,導致某基金出現流出、另一則流入,令單一產品流動難以反映真實情緒。

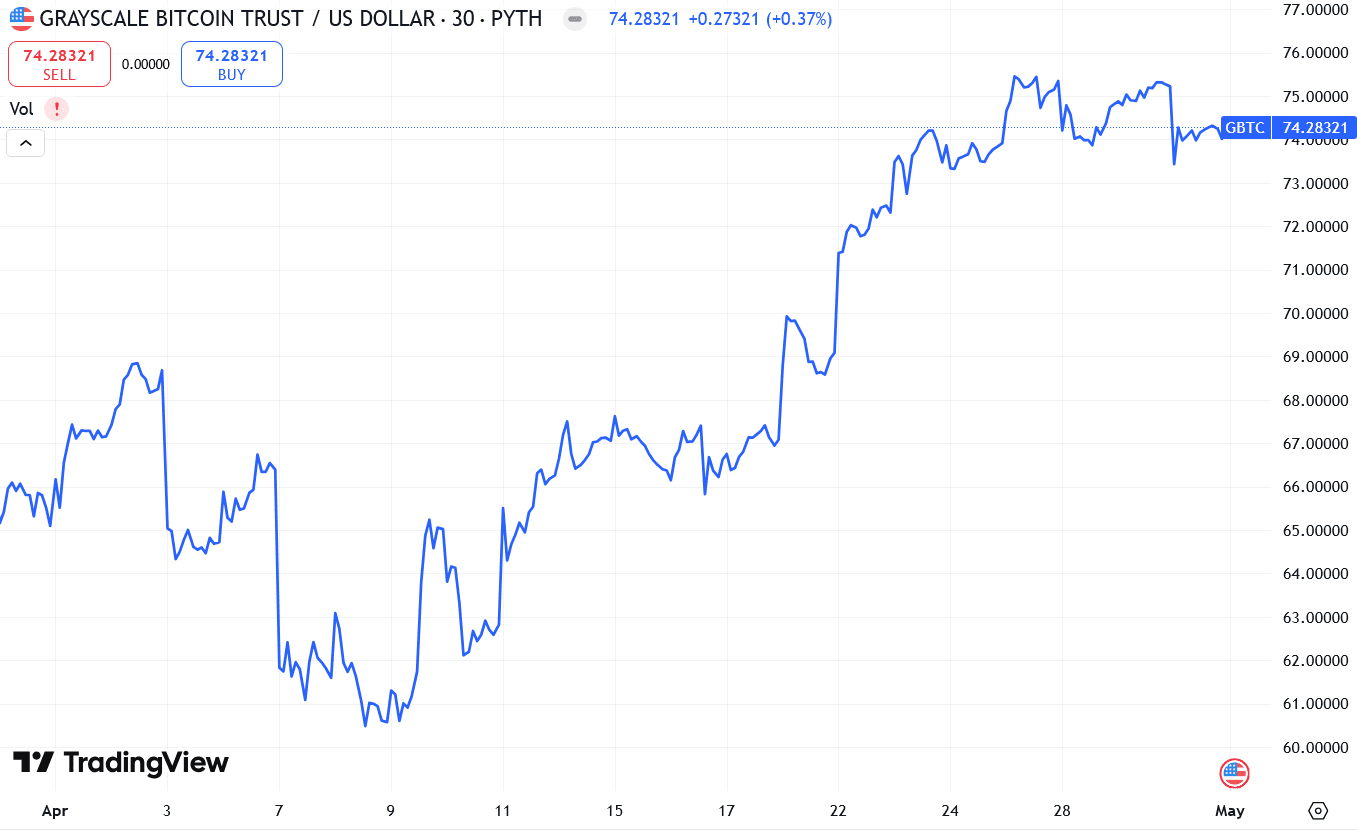

A prominent example occurred during late 2023 into 2024 when U.S. spot ETFs launched: many Grayscale Bitcoin Trust (GBTC) investors sold shares (causing what appeared as $12 billion in "outflows") and switched to new ETFs. Superficially, Grayscale's outflows appeared bearish, but these funds weren't exiting crypto – they were migrating to preferred structures.

例如2023年底到2024年,美國現貨ETF上市時,不少Grayscale比特幣信託(GBTC)投資人拋售持股(帳面顯示「流出」達120億美元)並轉進新ETF。表面上Grayscale流出彷彿意味悲觀,實事上僅是資金「搬家」,並未離開加密市場。

Similarly, when investors shift from one provider's bitcoin ETF to a lower-fee competitor, flow data might misleadingly show large outflows from one fund and inflows to another that offset in terms of overall exposure. Such rotations necessitate aggregating flows across the ecosystem to gauge net sentiment

同樣地,投資人從一家供應商轉移到費用更低的比特幣ETF時,流量數據會顯示個別產品大幅流出/流入,但整體市場曝險無增減。這類資金搬移必須全市場彙整觀察,才能抓住淨情緒趨勢。rather than being misled by inter-fund movements.

而不是被基金間資金移動所誤導。

Another pitfall: extreme inflow events sometimes mark euphoria – and counterintuitively precede downturns. Once everyone interested in buying has purchased (fully investing via ETFs), markets may lack fuel for continued rises.

另一個陷阱:極端的大額流入事件有時代表了過度興奮——而且出乎意料地會在下跌前出現。當所有有意購買的人都已經買入(透過 ETF 進場),市場可能就缺乏繼續上漲的動力。

Some analysts cite traditional market instances where record fund inflows coincided with market tops as final buyers rushed in.

有些分析師指出,傳統市場中曾經發生過資金大量湧入與市場見頂同時發生的情況,當時最後的買家蜂擁而入。

Crypto markets experience intense hype cycles, so sudden massive inflows might indicate near-term overexuberance rather than guaranteeing continued gains. The 2021 BITO episode demonstrated this – blockbuster inflows and new price highs followed by trend reversal. Similarly, when crypto ETFs attracted approximately $7 billion in January 2024, initial euphoria gave way to a sharp 15%+ bitcoin correction from peak levels within months as enthusiasm cooled and profit-taking emerged.

加密貨幣市場經常出現劇烈的炒作循環,因此,突然的大規模流入可能反映短期的過度樂觀,而非保證漲勢持續。2021 年 BITO 案例就說明了這一點——大量資金湧入與價格創新高後隨即反轉。同樣,當 2024 年 1 月加密貨幣 ETF 吸引約 70 億美元時,最初的興奮氣氛迅速轉為比特幣在數月內自高點大幅修正超過 15%,因為熱情冷卻和獲利了結浮現。

Critics argue crypto ETF flows, while informative, shouldn't be viewed in isolation or as unambiguous sentiment signals. They represent one piece of a complex puzzle. Factors like investor profiles (retail vs. institutional), capital movement motivations (fundamental vs. macro vs. technical), and parallel developments (price action, on-chain trends) all matter.

批評者認為,加密貨幣 ETF 資金流雖然具有參考價值,但不應被單獨或直接視為市場情緒的明確指標。它們僅呈現複雜拼圖中的其中一塊。像投資者類型(散戶與機構)、資金移動動機(基本面、宏觀或技術因素)、以及同時發生的其他變化(價格走勢、鏈上數據趨勢)都同樣重要。

As crypto markets mature with increasing cross-currents, simplistic flow interpretations – "big inflow = bullish, big outflow = bearish" – require greater nuance. Sophisticated investors monitor flows alongside multiple indicators to accurately gauge market sentiment.

隨著加密貨幣市場日益成熟並出現更多交錯因素,簡單地解讀資金流——「大筆流入=看多,大筆流出=看空」——需要更細緻的分析。精明的投資者會結合多種指標來觀察資金流,以更準確掌握市場情緒。

Closing Thoughts

ETF flows serve as useful sentiment indicators, corroborating signals from price trends, surveys, and other metrics about market psychology. However, the relationship isn't perfectly linear. Crypto ETF flows reflect sentiment while simultaneously reinforcing and sometimes lagging it, potentially sending misleading signals without proper context. Large institutional investors, macroeconomic factors, and structural market shifts can all distort flow data.

ETF 資金流是有用的情緒指標,能佐證價格走勢、調查及其他市場情緒相關數據。然而,其關係並非完全線性。加密貨幣 ETF 資金流既反映情緒,同時又可能強化甚至落後於情緒,在缺乏適當脈絡時可能導致錯誤判斷。大型機構投資者、總體經濟因素,以及市場結構性的變動皆可能扭曲資金流數據。

Market participants should treat crypto ETF inflows and outflows as one sentiment gauge among many. While tangible and quantifiable investor action indicators, they should be interpreted cautiously. Just as driving requires more than rear-view mirror observation, predicting crypto's future requires more than yesterday's fund flow data.

市場參與者應將加密貨幣 ETF 的流入與流出視為眾多市場情緒指標之一。雖然它們是具體可量化的投資行動訊號,但仍應謹慎解讀。正如駕駛不僅僅靠後照鏡,預測加密貨幣未來也不能只看昨日的資金流數據。

Ultimately, crypto ETF flows reflect sentiment while simultaneously shaping it by signaling confidence or concern. As with many cryptocurrency aspects, the truth exists in feedback loops. Investors become bullish as others invest; they turn bearish as others withdraw. Recognizing this reflexivity is essential. ETF flows provide valuable sentiment insights without offering perfect predictive power – they reveal current investor feelings, leaving future implications for us to determine.

最終,加密貨幣 ETF 資金流一方面反映市場情緒,同時藉由傳遞信心或隱憂來塑造情緒。和許多加密貨幣現象相同,真相存在於回饋循環中——看到他人進場會變得看多,看到他人撤出又會轉為看空。理解這種反身性極為關鍵。ETF 資金流能提供寶貴的市場情緒洞見,但並非萬無一失的預測工具——它呈現的是當下投資者的感受,至於未來結果仍需我們自行判斷。