監管進展與以安全為導向的創新正形塑本週加密貨幣的主要趨勢。Alchemy Pay (ACH) 因牌照獲批強勢上漲,而 GoPlus Security (GPS) 也持續拓展其 Web3 保護基礎設施。

市場參與者也密切關注 Wormhole (W) 與 XYO (XYO) 等基礎設施專案,它們推動跨鏈應用發展。同時,DeXe (DEXE) 與 Usual (USUAL) 表現出質押與治理仍是強勢主題。隨著多項代幣突破關鍵阻力,交易者正在觀察下一步走勢,或將定調更廣泛加密市場的節奏。

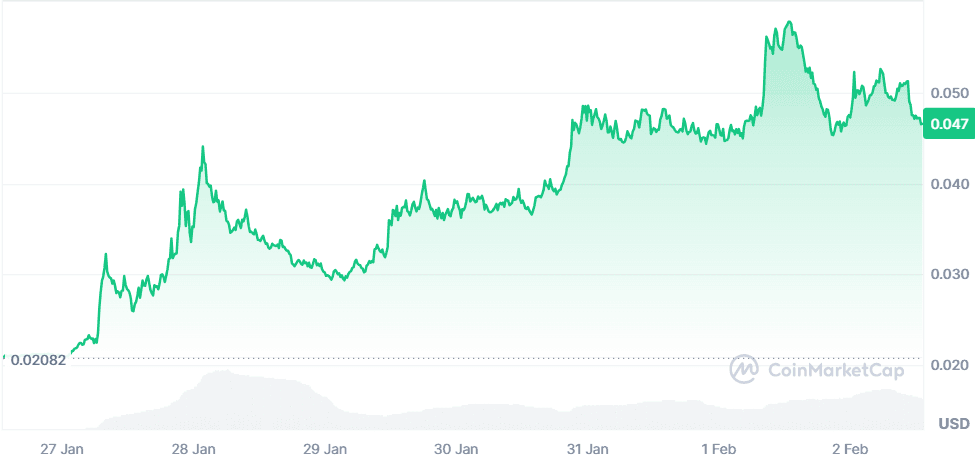

Alchemy Pay (ACH)

價格變動(7日): +126.66% 現價: $0.04715

新聞

Alchemy Pay 取得澳洲數字貨幣兌換商牌照後,價格急升,擴展法幣對加密服務。其現已持有12項全球牌照,亦積極爭取更多監管認可。公司最近一輪 1,000 萬美元融資,估值達 4 億美元,吸引機構關注。與 Movement 合作強化其市場地位,助推區塊鏈應用法幣入場無縫化。高效能 Layer 1 支付方案 Alchemy Chain 上線,更進一步強化其作為串聯加密與傳統金融的「橋樑」角色。

展望

ACH 突破 $0.0515 阻力,確認多頭趨勢。下個目標是 $0.0930,與 50% 費波納契回撤位一致。若勢頭延續,價位甚至可上探 $0.12;若遭遇回檔,則可能在 $0.0425 附近震盪整理後再漲。如成交量走低,價格或跌至 $0.0380,但只要維持於 $0.0350 上方,多頭架構不變。RSI 顯示買盤強勁,MACD 持續釋放多頭背離訊號。移動均線於 $0.0440 具備支撐,短線回檔視為潛在佈局機會。

GoPlus Security (GPS)

價格變動(7日): +38.31% 現價: $0.1812

新聞

GoPlus Security 作為 Web3 首個去中心化安全層,持續擴展服務,並整合 AI 風險分析於區塊鏈交易。該代幣因與 UXLink 及 Virtuals 等戰略合作後大漲,強化 DApp 安全智能分析。CoinMarketCap 現已導入 GoPlus Security 風險分析,讓用戶可與 CertiK 報告交叉參考鏈上安全隱患。透過空投活動,錢包申請數突破 50 萬,顯示生態快速擴展。團隊持續改進去中心化架構,運用 AI 技術打造可擴展、無需信任的公鏈安全層。

展望

GPS 在 $0.20 遭遇賣壓測試阻力。若能突破,有機會上攻 $0.225,市場情緒極佳時下一關鍵目標為 $0.25。若失守 $0.175,可能回調至 $0.155,屆時可能再次吸引買盤。MACD 顯示動能減弱,RSI 則暗示短線可能修正,不過交易量維持高檔,長線仍偏多。主力支撐於 $0.165,歷史上該區買氣明顯。

XYO (XYO)

價格變動(7日): +31.22% 現價: $0.01825

新聞

XYO 推出 Layer 1 區塊鏈 XYO Layer One,專為 AI 應用、實體資產管理及去中心化數據分析打造,帶動價格飆升。市場對與 特斯拉 潛在合作的揣測,引發投資者極大興趣,帶動單週漲幅逾 42%。項目受益於美國本土布局,若未來國內加密貨幣項目實施零資本利得稅,將具備長線優勢。治理機制確保鏈上架構去中心化,成為新興去中心化實體基礎設施網(DePIN)領域的關鍵玩家。

展望

XYO 如今位於下跌楔形突破位之上,預示有望上攻 $0.0245。若多頭動能延續,下一阻力位於 $0.0270;如未守穩 $0.0175,則可能回調測試 $0.0150 支撐,該區為過往買主承接點。MACD 延續多頭趨勢,RSI 則逼近超買,意味短線有拉回可能。若 XYO 可在 $0.0180 上方盤整,將累積底部動能,並伺機上攻 $0.0300 重大關卡。

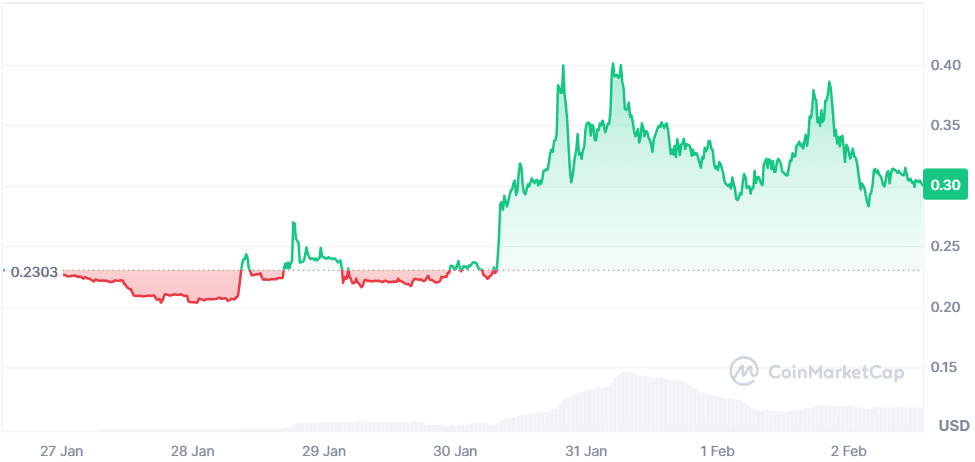

Neon EVM (NEON)

價格變動(7日): +30.44% 現價: $0.3004

新聞

Neon EVM 在整合 EIP-1559 之後受到關注,將以太坊動態手續費結構引入 Solana 生態,提高交易費率預測性,便利開發者將以太坊 DApp 移植至 Solana。專案基本面強勁,逾 200 個專案準備上線部署,成為以太坊與 Solana 重要橋梁。2月7日 NEON 代幣解鎖討論熱烈,也推高交易量。其基礎設施讓開發團隊無需修改智能合約即可存取 Solana 的高速交易,提升生態成長潛力。

展望

NEON 現正挑戰 $0.315 阻力。若突破將有機會推升至 $0.38 並挑戰前高。多方若能持續發力,或可回測 $0.42,但若無法守穩,則恐回落至 $0.265 範圍盤整。RSI 靠近超買區,提醒短線有利多拉回需求。50 日均線於 $0.275 提供強勁支撐,一旦守穩將吸引新買盤,下一關注點為 $0.35 心理壓力位。

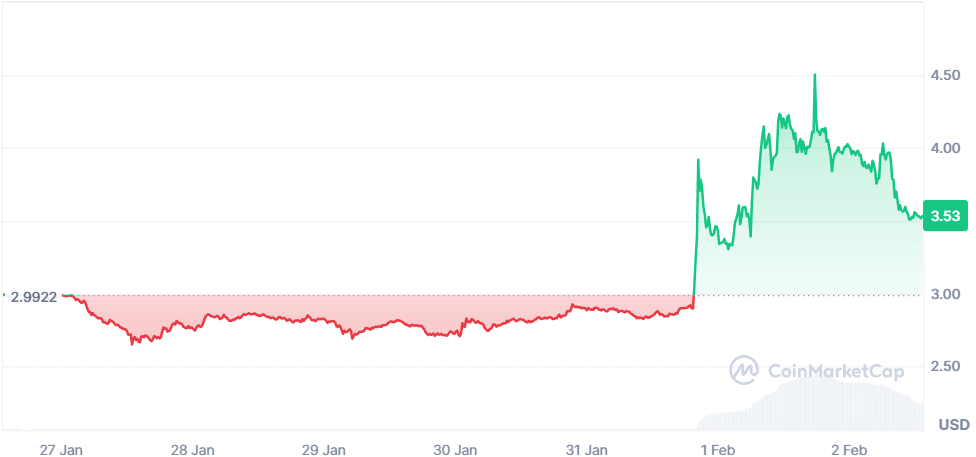

Qtum (QTUM)

價格變動(7日): +18.18% 現價: $3.53

新聞

Qtum 由於量子計算類股大漲,帶動幣價明顯上揚,顯示市場對區塊鏈擴容方案再度產生興趣。該專案結合比特幣 UTXO 模型與以太坊智能合約,讓去中心化應用更加安全高效。近期於抗量子密碼學實作取得成果,強化安全與長遠生命週期。機構投資人對使用權益證明(PoS)混合共識機制的 QTUM 表現出極大興趣。項目也持續整合前沿區塊鏈升級,成為高效智能合約平台中具競爭力的領跑者。

展望 QTUM 於 $3.80 遭遇強壓,此前屢成賣壓集中區。若能突破,將有望挑戰 $4.45,且 $5 為下個大阻力。若空方壓力增加,價格恐回落至 $3.25,屆時多方或趁低進場。MACD 持續在正區,RSI 則顯示略有超買。如 QTUM 能守於 $3.50 以上,整理後再啟動下一波漲勢。重點支撐落在 $3.30,過往為多頭回補區。

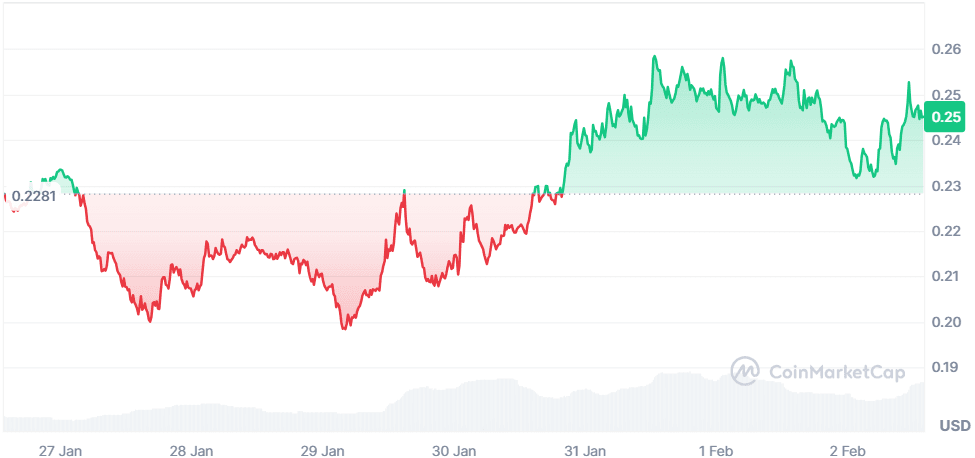

Wormhole (W)

價格變動(7日): +7.38% 現價: $0.2451

新聞

Wormhole 持續擴展跨鏈互操作能力,迎來多項重大整合。Securitize 宣佈以 Wormhole 作為主要跨鏈服務方案,協助包括 BlackRock 與 Hamilton Lane 在內的機構投資人流動更多鏈上資產。此外,Cronos 也整合 LayerZero,連結超過 115 條公鏈,進一步壯大 Wormhole 生態圈。該協議已促成逾 550 億美元的跨鏈流量,多平台 DeFi 領域挹注其基礎設施動能。

展望

Wormhole 目前於 $0.24 支撐上方盤整,正試圖建立更強多方基礎以推動新一波上漲。短期之內 $0.26 是明確阻力,若有效突破,價格有望推升至 $0.30,正好落在先前流動性密集區。若動能延續,下一目標為 $0.34。 level not seen since early January. However, if the price fails to hold above $0.235, a retest of $0.22 is likely, which has served as a strong accumulation zone. A breakdown below $0.22 would weaken the bullish case, potentially leading to a decline toward $0.20 before any meaningful recovery. The RSI remains neutral, indicating that a breakout or breakdown will depend on broader market sentiment and trading volume in the coming days.

自1月初以來未見的價格水準。然而,如果價格未能守穩在$0.235之上,則很可能會回測$0.22,該位置一直是重要的累積區域。若跌破$0.22,將削弱多頭走勢,並可能進一步下探至$0.20,之後才有望出現有意義的反彈。RSI維持中性,顯示未來幾天的突破或下破將取決於整體市場情緒及成交量。

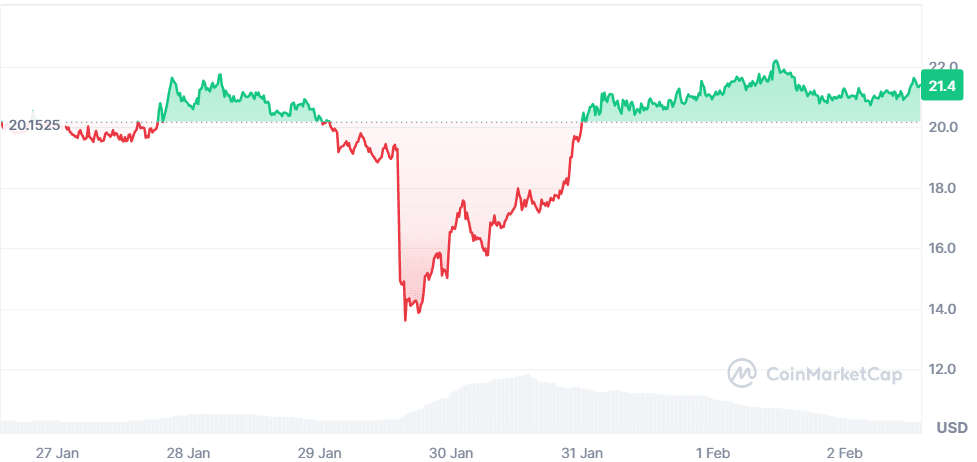

DeXe (DEXE)

Price Change (7D): +5.83%

Current Price: $21.33

News

DeXe Protocol saw increased activity as staking participation surged, with over 16.3 million DEXE staked, locking nearly 20% of circulating supply. The token also benefits from strong whale accumulation, with 99.22% held by large addresses. DeXe’s recent collaboration with GraFun added enhanced anti-sniping protection to token launches, increasing demand for its governance features. The project remains a leader in DAO governance and staking mechanisms, attracting institutional and long-term holders.

DeXe協議近期活動增加,質押參與度大幅上升,目前已逾1,630萬枚DEXE被質押,鎖定了近20%的流通供應量。該代幣同樣受惠於大戶累積,99.22%持有於大型錢包地址。DeXe最近與GraFun合作,強化了新代幣發行的反搶先機(anti-sniping)機制,使其治理相關功能更受青睞。該項目在DAO治理及質押機制方面持續領先,吸引了機構及長期持有者進駐。

Forecast

DeXe is facing resistance at $22, which has acted as a local high in previous trading sessions. A confirmed breakout above this level could see the price climb to $24, where the next resistance zone is located. If strong buy pressure sustains, the next key target would be $27, aligning with a prior liquidity area. The MACD indicates continued bullish momentum, but RSI nearing overbought territory suggests some potential for short-term retracement. If DEXE fails to break $22, a pullback toward $19.50 could occur, with $18.80 being a key level to watch. A breakdown below this range could lead to further downside, targeting $17.50 as the next major support level. As staking participation increases and more supply is locked, any dips may present buying opportunities for long-term holders.

DeXe目前面臨$22阻力,這一價位過去數次成為區間高點。若能有效突破此關卡,目標價可望挑戰$24,該處為下一處阻力帶。若買盤持續強勢,下一個關鍵目標將是$27,這與先前的流動性區域相符。MACD顯示多頭動能延續,但RSI接近超買區,需留意短線回調風險。若DEXE無法突破$22,價格可能回落至$19.50,$18.80則是下一重要支撐。若下破該區間,跌勢恐延續,$17.50為下一大支撐位。隨著質押率提升、流通量被鎖住,每次回檔對長線投資人來說或將是進場良機。

Usual (USUAL)

Price Change (7D): -0.93%

Current Price: $0.3169

News

Usual partnered with Chainlink to integrate price feeds and proof of reserve mechanisms for USDO and USDO++. This strengthens its position as a transparent and reliable stablecoin issuer. Nearly 50% of its circulating supply is staked in USUALx, and another 11% has been captured by early redemption, reducing sell pressure. Recent exchange listings, including Kraken, have increased liquidity. Despite market-wide corrections, Usual continues to build strategic partnerships and expand its adoption.

Usual與Chainlink合作,將其價格預言機及儲備金證明機制整合至USDO及USDO++,進一步鞏固了其作為透明可靠穩定幣發行商的地位。近50%的流通供應量已質押於USUALx產品中,另有11%經由提前贖回而減少拋售壓力。近期包含Kraken在內的多家交易所上架也帶動了流動性。儘管大盤修正,Usual仍持續拓展策略夥伴與應用落地。

Forecast

USUAL remains in a corrective phase after failing to sustain its rally above $0.35. To regain momentum, the price needs to reclaim the $0.33 level, where stronger demand is expected. If successful, the next resistance level at $0.38 could be tested, followed by $0.42 if volume increases. A sustained uptrend could eventually bring USUAL back to the $0.45-$0.48 range. However, if the price fails to hold above $0.30, the next critical support is at $0.27, which previously served as a reversal point. The 50-day moving average is hovering near $0.29, making it a crucial area to watch for potential buying interest. Given the high staking percentage, reduced circulating supply could limit downside pressure, but weak market sentiment could still push USUAL lower before recovery attempts.

USUAL上攻$0.35未果後仍處於修正階段。若要重拾漲勢,價格需站回$0.33,該區預期將有較強買盤。如有突破,可望進一步挑戰$0.38,若成交量放大則可能再上攻$0.42。若多頭氣氛延續,漲幅最終或可將USUAL帶回$0.45-$0.48區間。不過,若價格守不住$0.30,下方重要支撐在$0.27,這裡曾作為反轉區。50日均線目前位於$0.29附近,也是觀察買盤是否進場的關鍵水準。在高質押比例下,流通量減少有助於降低下跌壓力,惟若市況疲弱,USUAL在回升前仍有下行風險。

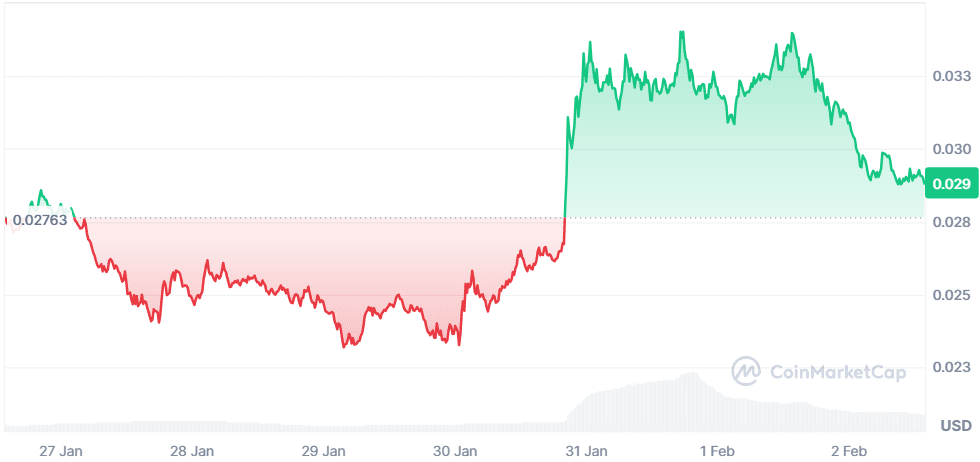

JasmyCoin (JASMY)

Price Change (7D): +4.13%

Current Price: $0.02881

News

JasmyCoin has been in focus following its breakout from a falling wedge pattern. The price initially surged past $0.030 but has since retested this breakout level. Whale holdings remain high at 49.64%, suggesting strong investor interest. JASMY’s performance remains closely tied to Ethereum, which is also testing its own breakout levels. If Ethereum sustains its uptrend, JASMY could see further upside as well.

JasmyCoin自突破下降楔形型態後成為市場焦點。價格一度突破$0.030,近期則回測該突破點。大戶持幣比重高達49.64%,反映出投資人關注度依舊強勁。JASMY的表現與以太坊高度相關,而ETH目前同樣在測試關鍵突破位置。若以太坊延續漲勢,JASMY也有望順勢上揚。

Forecast

JASMY has held above its critical support at $0.028, indicating some resilience despite recent market weakness. The next resistance stands at $0.032, and a breakout above this level could open the way to $0.036, where a previous rejection occurred. If market sentiment remains strong, the next target of $0.041 comes into play, which aligns with a key Fibonacci retracement level. However, if JASMY fails to sustain above $0.028, a pullback toward $0.025 is likely, followed by $0.022 in a more extended decline. The RSI is nearing neutral levels, suggesting room for upward movement, but trading volume needs to increase for a sustainable breakout. If Ethereum rebounds, JASMY could follow, given their correlated price action in recent trading sessions.

JASMY近來能守住$0.028關鍵支撐,顯示儘管市況疲弱仍具韌性。下一道壓力在$0.032,若突破將有機會上看$0.036,該處曾遭遇賣壓。如市場氣氛續強,接下來有望挑戰$0.041,這也是重要費波那契回檔位。但若JASMY無法穩守$0.028,回測$0.025甚或進一步下探$0.022的可能性升高。RSI已貼近中性水準,顯示仍有上行空間,但若要走出有效突破,成交量必須增加。若以太坊出現反彈,JASMY亦有望跟漲,因兩者近期走勢密切相關。

Closing Thoughts

Crypto adoption is clearly accelerating, particularly in payment solutions and cross-chain interoperability. Alchemy Pay's strong performance highlights growing regulatory acceptance of crypto payments, while Usual’s integration with Chainlink reflects increasing demand for transparency in stablecoins.

Security remains a dominant sector, with GoPlus Security reinforcing its position as a Web3 infrastructure leader. DeFi participation remains steady, as seen with DEXE’s strong staking numbers, but price action remains mixed. Cross-chain interoperability is another major theme, with Wormhole and XYO making strides. Overall, the market is favoring utility-driven projects over speculation, signaling a maturing ecosystem where adoption and security play leading roles.

加密貨幣應用明顯加速,特別是在支付解決方案及跨鏈互操作領域。Alchemy Pay的亮眼表現突顯數位資產支付日益獲得監管認可,而Usual與Chainlink的整合則反映出穩定幣對透明度需求持續提升。

安全性依舊是領頭產業,GoPlus Security持續鞏固其Web3基礎建設領導地位。DeFi參與度穩定,從DEXE質押數據即可見一斑,惟幣價走勢表現分歧。跨鏈互操作性則成為另一重要主題,Wormhole與XYO皆有重要進展。整體來看,市場越來越重視實用性項目多於純投機,顯示生態系逐漸成熟,應用落地及安全性將是主流。