貪婪情緒悄悄重返加密市場,恐懼與貪婪指數達 69,但距離全面亢奮仍有段距離。比特幣主導率維持 61.9%,替代幣季節指數僅 27,顯示市場仍處於分析師所說的「比特幣季節」。然而,表面之下的動態更為複雜。

部分替代幣,尤其扣連 SocialFi、Web3 遊戲及 AI 基礎設施的幣種,已超越大盤表現。LAUNCHCOIN 拋物線式暴漲,GODS 受惠 GameFi 催化劑,JELLYJELLY 也因巨鯨買盤而重新受矚,顯示早階段佈局已悄然展開。機構同時觀察市場,本週 ETF 流入 2.82 億美元,代表主流資金逐漸增強信心,即使散戶減碼風險。

本週強勢標的,並不全是投機炒作,有的直接反映產品重大里程碑,有的則受迷因推動動能。

Launch Coin on Believe (LAUNCHCOIN)

7日漲跌: +3389.59% 現價: $0.1964

消息

LaunchCoin 在 Solana 上推出一句話創幣功能,允許用戶僅透過 X(Twitter)即可鑄造代幣,幣價應聲暴漲。和 SocialFi 平台 Believe 的整合、迷因熱度上升、巨鯨操作(包含 TRUMP 資金 $1.59M 轉換成 LAUNCH)帶動市值自數百萬美元飆升至逾 $2.5 億美元。CoinW 上市及去中心化 Web3 孵化器定位,同步吸引大量關注。即使交易所壅塞,團隊已承諾優化手續費結構與生態系開發至 v2。

展望

LAUNCHCOIN RSI 現已高於 85,顯示嚴重超買。曾於 $0.33 高點回檔,目前於 $0.19 附近震盪,短期大概率於 $0.15-$0.21 區間整固。若支撐有效,下一波將挑戰 $0.26,但波動劇烈。若回落至 $0.12–$0.14 屬健康修正。強化社群監控與巨鯨跟單,對交易此迷因幣極為關鍵。

Aethir (ATH)

7日漲跌: +37.96% 現價: $0.04885

消息

Aethir 本週上漲,與蘋果應用商城壟斷結束同步,開發者可引導用戶外部付款平台。這對 Aethir 去中心化 GPU 雲端架構大為利好,讓其成為去中心化、免應用商店雲遊戲的重要推手。平台已部署超過 428K GPU 容器 執行高階負載,節點授權銷售資金募集超過 1.5 億美元,成功吸引機構資金及 Web3 遊戲專案,提供面向消費者的雲端串流新選擇。

展望

ATH 結構偏多,但目前壓力位於 $0.055 下方盤整,RSI 接近 60,尚有上升空間。重要支撐在 $0.045,若能順利突破 $0.050,有望展開新一波漲勢向 $0.06 甚至更高。成交量收縮意味突破臨近;長期走勢仍與 Web3 遊戲生態發展高度相關。

SKYAI (SKYAI)

7日漲跌: +33.47% 現價: $0.06105

消息

SKYAI 於 Binance Futures 及 Bitget 上市,開放最高 50 倍槓桿後聲勢大漲。BSC 基金會則通過 Mimic.fi 購入 $75K SKYAI,已成最大部位,擠下 TST。加上專案獲得 BNB Chain Incentive Program 提供 10 萬 USDT,SKYAI 憑高交易量登上 BSC 熱門榜,顯示社群與巨鯨力挺 AI 幣。

展望

衝高至 $0.09 後快速回檔,目前於 $0.061 穩定,RSI 約 58,屬多空均衡偏多格局。支撐接近 $0.055,若有效突破 $0.065 則有機會回測 $0.075–$0.08。提供高槓桿使波動升高,交易者需嚴控風險。可持續追蹤機構操作作為潛在催化劑。

ether.fi (ETHFI)

7日漲跌: +71.91% 現價: $1.32

消息

ETHFI 距最高點下修 76%,本週因 巨鯨布局 及合約市場空頭回補而大漲,幣安合約單日成交達五億美元,超越實際 DeFi 活躍度。ether.fi 的 TVL 高達 68.6 億美元,得益於 EigenLayer 再質押及以太坊質押熱潮,但代幣解鎖與零售參與度偏低為主要隱憂。巨鯨與高槓桿比真正用戶增長更具影響,短線拉抬恐不易持續。

展望

ETHFI RSI 接近 70 屬高檔壓力。阻力位於 $1.50;短線回落至 $1.10–$1.20 區間為常態修正,因空頭回補結束。代幣仍有 72% 未解鎖,解鎖潮將造成賣壓。除非基本面零售成長明顯,否則長線空間受限。以嚴格停損控管當前進場風險。

Port3 Network (PORT3)

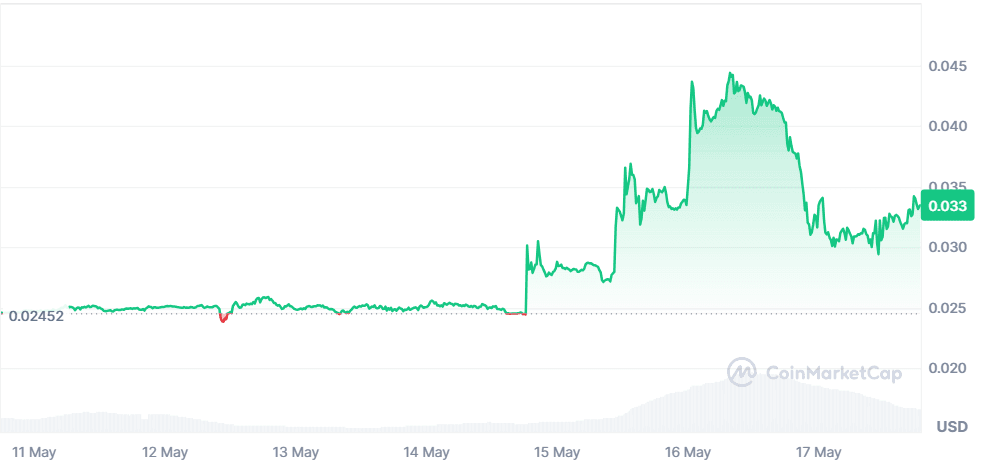

7日漲跌: +36.04% 現價: $0.03340

消息

Port3 Network 近期登陸 Binance Alpha,是平台成長的重大里程碑。旗下 AI 驅動社交分析工具 Rankit,能量化區塊鏈圈用戶活躍度與專案熱度等指標。自 2022 年快速擴張,上市後熱度再升,同步於 MEXC、LBank 及 KCEX 上市。合約最高 50 倍槓桿正式開放,吸引零售及衍生品投機資金進駐。

展望

PORT3 上市暴漲後逐步回穩,RSI 約 63,略現多頭格局,但遲遲未能突破 $0.036 阻力。支撐區接近 $0.030,若交易熱度延續,有機會突破 $0.040–$0.045。高槓桿環境下波動加劇,需審慎應對。

Jelly-My-Jelly (JELLYJELLY)

7日漲跌: +11.97% 現價: $0.03236

消息

JELLYJELLY 因巨鯨於 Gate.io 提領 1.0046 億顆代幣(價值 $445 萬美元)而激起市場興趣。即使該巨鯨目前浮虧 $135 萬美元,仍展現長線看好信念。未平倉合約週比大減 54%,衍生品熱度降溫,加上 Hyperliquid 下市與價格回檔,零售信心受挫。然巨鯨逢低加碼,若流通量進一步收縮,後市有機會反彈。

展望

JELLYJELLY RSI 61,接有效超買。高點 $0.07 之後回落,目前於 $0.032 上方整理,短線料於 $0.030–$0.036 區間震盪。若巨鯨續買且賣盤減弱,有望突破 $0.04,但成交量下滑與衍生品資金撤退,應持審慎態度。如 $0.030 跌破則看 $0.027。

Department Of Government Efficiency (DOGE)

7日漲跌: +81.07% 現價: $0.03348

消息

DOGE(非 Dogecoin)因團隊致力於降低政府支出而走紅。雖無官方連結,市場將此視為間接利多。缺乏其他產品進展,此次上漲明顯屬炒作拉抬。迷因與病毒行銷推助市值破 $3,000 萬美元,若熱度消退隨時可能劇烈回檔。

展望

DOGE RSI 昇至 74,近日飆升有高檔過熱疑慮。若炒作持續,價格有望挑戰 $0.038,但基本面弱,隨時有跌回 $0.025 或更低的風險。需關注買盤減弱與動能指標出現背離訊號。

Gods Unchained (GODS)

launch of Battle Pass Season 3. The move improves scalability, lowers fees, and integrates NFTs more efficiently. The exclusive collectibles available in Season 3 have sparked a flurry of demand, driving a bullish wave across the Gods Unchained community. The combination of Web3 gaming, NFT economy, and lower entry barriers has reinvigorated both players and investors.

launch of Battle Pass Season 3. The move improves scalability, lowers fees, and integrates NFTs more efficiently. The exclusive collectibles available in Season 3 have sparked a flurry of demand, driving a bullish wave across the Gods Unchained community. The combination of Web3 gaming, NFT economy, and lower entry barriers has reinvigorated both players and investors.

Battle Pass 第三賽季的推出。此舉提升了擴展性、降低了手續費,並更有效地整合了 NFT。於 第三賽季 中提供的獨家收藏品引發了強勁需求,推動 Gods Unchained 社群掀起一波多頭熱潮。Web3 遊戲、NFT 經濟及降低進場門檻的結合,重新激發了玩家與投資人的活力。

Forecast

With RSI nearing 76, GODS is in overbought territory after surging from $0.12 to $0.22. Current consolidation near $0.20 may hold short-term. If demand persists, a break toward $0.24–$0.26 is possible. Support sits at $0.17. Profit-taking is likely soon, especially if NFT hype wanes. Look for decreasing volume as a cooling signal.

展望

RSI 接近 76,GODS 由 $0.12 急漲至 $0.22,處於超買區。現階段於 $0.20 附近盤整,短線有望維持,若需求延續,或可突破至 $0.24–$0.26。下方支撐在 $0.17。如 NFT 熱潮消退,獲利了結壓力將增加,可留意成交量下降作為降溫訊號。

Grass (GRASS)

Price Change (7D): +17.59% Current Price: $1.93

News

GRASS hit its highest levels since March following record-breaking data scraping ~1,762 terabytes in a day. Built on Solana L2, GRASS monetizes unused bandwidth from users to train AI models. The foundation rewards contributors in tokens, creating a sustainable ecosystem. With presale hype from SUBBD and listings on Asian exchanges, its user base is growing. However, a 12% dip shows traders are cautious after its $2.32 peak.

新聞

GRASS 單日資料擷取量創下 約 1,762 TB 新高,推動價格自三月以來來到高點。GRASS 建構於 Solana L2,將用戶閒置頻寬貨幣化,以訓練 AI 模型。基金會以代幣獎勵貢獻者,建立可持續生態系。SUBBD 預售炒作及亞洲交易所上架推動用戶基數穩步增長。但自 $2.32 高點回落 12%,顯示交易者保持謹慎。

Forecast

GRASS RSI is neutral at ~56. Support lies at $1.72, while $2 remains the psychological resistance. A break above $2.05 could lead to a retest of $2.30, and eventually its $3.66 ATH if momentum returns. A drop below $1.70 invalidates the bullish structure. For now, expect consolidation around $1.85–$2 unless volume spikes.

展望

GRASS RSI 約 56,處於中性。下方支撐為 $1.72,$2 則為心理壓力位。若突破 $2.05,可望再測 $2.30,若動能回歸,終有機會再挑戰歷史高點 $3.66。如跌破 $1.70,則多頭結構失效。目前預期於 $1.85–$2 區間震盪,除非有明顯放量。

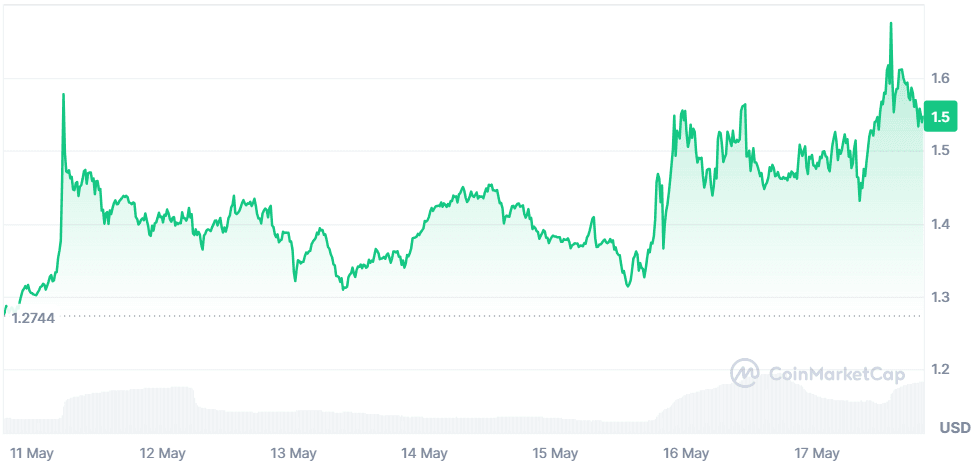

Mask Network (MASK)

Price Change (7D): +20.48% Current Price: $1.54

News

MASK continues to shine as a decentralized bridge between Web2 and Web3, allowing users to access dApps directly from platforms like Twitter. Additionally, Mask Network is promoting Honeypot Finance’s PoL-based meme ecosystem, reinforcing its vision of user-first DeFi infrastructure. With rising daily usage and strong governance value, MASK is building utility atop familiar platforms.

新聞

MASK 持續成為 Web2 與 Web3 間去中心化橋樑,用戶可直接從像是 Twitter 這類平台使用 dApp。此外,Mask Network 正推廣 Honeypot Finance 基於 PoL 的迷因生態圈,強化其以用戶為本的 DeFi 基礎設施願景。日活用戶上升及治理價值穩健,MASK 正於既有平台上拓展應用場景。

Forecast

MASK is trading near resistance at $1.56 with RSI around 68. If broken, $1.70 is the next target. Support lies at $1.43. Volume remains healthy, but fading momentum may trigger a short-term pullback to $1.40. The long-term trend remains bullish, especially as Web2–Web3 integrations grow. Watch for ecosystem updates as catalysts.

展望

MASK 現於 $1.56 壓力位附近交易,RSI 約 68。若突破,上方目標為 $1.70。下方支撐在 $1.43。成交量尚屬健康,但動能減弱可能引發短線回調至 $1.40。整體趨勢仍偏多,隨著 Web2–Web3 融合日益加深,長線利好。留意生態系最新動態做為催化劑。

Closing Thoughts

The broader market sits on the edge of a shift. With $3.26T in market cap and volume topping $100B, the engine is humming. But the data doesn’t lie, this isn't altcoin season yet. It's more of a reconnaissance phase. Bitcoin is holding the fort, but the action in altcoins like LAUNCHCOIN (memes + utility), GODS (GameFi growth), and AETHIR (AI cloud infra) reveals where early adopters are placing long-term bets.

總結觀點

整體市場正處於變革邊緣,總市值達 3.26 兆美元,成交量突破 1,000 億美元,動能充沛。但數據顯示,山寨幣季尚未真正到來,目前更像是偵查階段。比特幣穩住局面,但 LAUNCHCOIN(迷因+實用)、GODS(GameFi 成長)、AETHIR(AI 雲基礎)的表現,透露出早期採用者正佈局長線賭注。

SocialFi tokens are showing explosive short-term momentum, riding meme culture and creator tools. Meanwhile, infrastructure plays like ETHFI and AETHIR are benefiting from institutional logic: solve real problems, attract real capital. GameFi, driven by GODS and GRASS, is catching renewed interest thanks to zkEVM integrations and new engagement models like Battle Passes and data mining. Retail traders are chasing hype in meme coins, but whales and funds are positioning around functionality and future-proof narratives. If ETF inflows stay strong and meme coin froth doesn’t spill over into a selloff, we might see the Altcoin Season Index start creeping up in coming weeks.

SocialFi 代幣憑藉迷因文化與創作者工具掀起短線爆發動能。基礎設施型項目如 ETHFI、AETHIR 則因機構資本偏好「解決真問題、吸引真資金」受益。GameFi 方面,GODS 與 GRASS 推動下,伴隨 zkEVM 整合及 Battle Pass、資料挖掘等新互動機制,再度引發市場關注。散戶追逐迷因熱潮;巨鯨與基金則布局於功能性及抗風險敘事。只要 ETF 資金持續流入、迷因幣泡沫未擴大至拋售,未來幾週或能見到山寨指數逐步上揚。

For now, this was a week of positioning, not full-blown rotation. The altcoin tide isn’t here yet, but it’s definitely forming.

目前來看,這週仍偏向提前佈局,而非全面換倉。山寨浪潮尚未真正來臨,但已在醞釀之中。