2025 年第一季,AI 智能代理在加密產業爆發性崛起,成為區塊鏈領域最令人矚目的新趨勢之一。不同於一般簡單的聊天機器人,這些自主數位實體具備持有與管理加密貨幣、執行交易、創作內容,甚至彼此互動的能力——而且全程無需人類直接操控。2025 年初,「AI Agents」成為 Crypto Twitter 及 YouTube 的熱門話題,被認為是加密領域的下一波新浪潮。

這波現象在 2024 年還只是少數實驗,短時間內卻快速主流化:AI 智能代理市場價值僅數月內,從幾乎零飆升至超過 $10 億美元。開發者、投資人與主要加密平台爭相投入,推出上千個鏈上代理人與和其表現綁定的新型代幣。

2025 年第一季的市場成長與動能

綜合各方指標,2025 年初 AI 智能代理風靡加密市場。短短幾個月,這個原本不存在的產業一躍成為數十億美元規模的新經濟體。以 AI 代理相關代幣的總市值來看,第一季末已突破 $150 億美元,而在 2024 年中還幾乎為零——足見這股趨勢點燃的速度。

加密數據平台與相關研究文章紛紛報導這波驚人的崛起,指出「幾乎所有大頻道或 KOL 都在推」AI 代理,將其包裝為 下一個大趨勢。

預計 2025 年加密 AI 代幣總市值將達 1,500 億美元 (資料來源:https://www.bitget.com/news/detail/12560604485831)

預計 2025 年加密 AI 代幣總市值將達 1,500 億美元 (資料來源:https://www.bitget.com/news/detail/12560604485831)

多項重大事件推波助瀾。2024 年底,有名為 Truth Terminal 的實驗性 AI 代理人成功說服知名創投馬克·安德森(Marc Andreessen)匯入 50,000 美元,這名代理人隨後將資金用於推廣一款 迷因幣。該事件爆紅,迷因幣市值瞬間飆破 12 億美元,展現了 AI 代理可帶來的投機狂潮。到了 2025 年 1 月,社群媒體充斥類似故事和大膽預測。意見領袖紛紛炒作自主代理人,號稱用戶睡覺時都能自動賺錢,吸引大量散戶湧進此領域。

數據顯示,採用率和參與度也同步暴增。其中知名平台 Virtuals 報告,至 Q1 已有逾 11,000 個 AI 代理上線,且代理代幣獨立持幣地址超過 140,000 個,短時間成長驚人。主要交易所與錢包平台也開始上市並支援這些新幣種,進一步拓大流通。

AI 代理代幣交易量飆升,部分資產更在該季躋身市值前 100 的加密貨幣。例如 VIRTUAL 代幣(Virtuals Protocol)在 2024 年底價格暴增 850%,並於 2025 年 1 月創下歷史新高。同樣地,ai16z 代幣(一種 AI 代理 DAO 代幣)在 第一季末估值突破十億美元。更早成立的 AI 相關代幣,如 Fetch.ai 的 FET,受惠於此熱潮也重獲投資人青睞。

值得注意的是,這波快速成長發生於 Q1 整體加密市場氣氛不一的情況下。比特幣和大型山寨幣價格相對穩定,但AI 代理敘述卻帶來了新一波投機熱潮,讓人聯想到過去 ICO 或 DeFi 殖利風潮。不過許多觀察家認為,這次不只是一時話題,後續將有更多實質應用與價值浮現。Q1 的熱潮已奠定基礎:AI 代理證明自己具備吸引市場想像力與資金的能力,建立起規模龐大的市場,現在正尋求以實際落地及持續發展來驗證其價值。

什麼是加密 AI 智能代理?

簡言之,加密 AI 智能代理是具有人工智慧的自主軟體程式,運作於區塊鏈網路上。從實務上看,加密領域的 AI 代理通常是一種能感知資訊、判斷決策並執行行動的數位實體,同時擁有並能操作加密貨幣。有些呈現為聊天機器人助手,也有些作為幕後服務運轉,能接觸加密錢包。它們的創新之處在於將進階 AI(作為「大腦」)與區塊鏈資產、操作(作為「行動力」)結合。

專家表示,這些代理人運用最新 AI 技術,如自然語言理解(NLU)和會話式 AI,與用戶及資料互動。它們能回答複雜市場問題、提供個人化財務建議,或透過聊天介面引導用戶完成加密任務——如同 Alexa 或 Siri,但專注於加密,並具備即時市場知識。更關鍵的,是加密 AI 代理不僅僅會聊天,還可以直接代表用戶採取行動。例如,它可在條件達成時自動交易、於錢包間調撥資產,甚至自動部署智能合約。

與傳統加密交易機器人或簡單腳本相比,這些 AI 代理通常更具適應性及「智慧」。它們採用大型語言模型(LLM)——即推動 ChatGPT 的同類型 AI,分析情境並做出決策。它能理解自然語言的提示(如「現在要不要賣出以太幣?」),結合鏈上數據及 AI 推理來給出答案或行動。由於 AI 驅動特性,它們能隨著新數據或回饋持續學習,掌控許多傳統死板演算法無法處理的資訊。若說交易機器人像是用固定公式運算的計算機,AI 代理則更像是能隨情勢動態調整策略的分析師。

另一突破點在於,許多 AI 代理擁有專屬加密錢包或數位資產,具有一定財務自主權。CoinMarketCap 分析形容自主型加密代理人如同**「帶著自己加密錢包的數位創業家」。換言之,代理可持有(用戶或投資者提供的)資金,自由消費、投資,甚至支付他人。有些代理甚至會「僱用」其他代理或人類協作者——例如自動支付資料訂閱費、購買設計服務(以加密支付製作內容)、對用戶貢獻給予獎勵。這一點與一般 AI 聊天機器人截然不同:加密代理擁有經濟自主權**,能以實際資產(無論是 token 或小額以太單位 Wei)支撐其決策,帶來更多應用可能及全新風險。

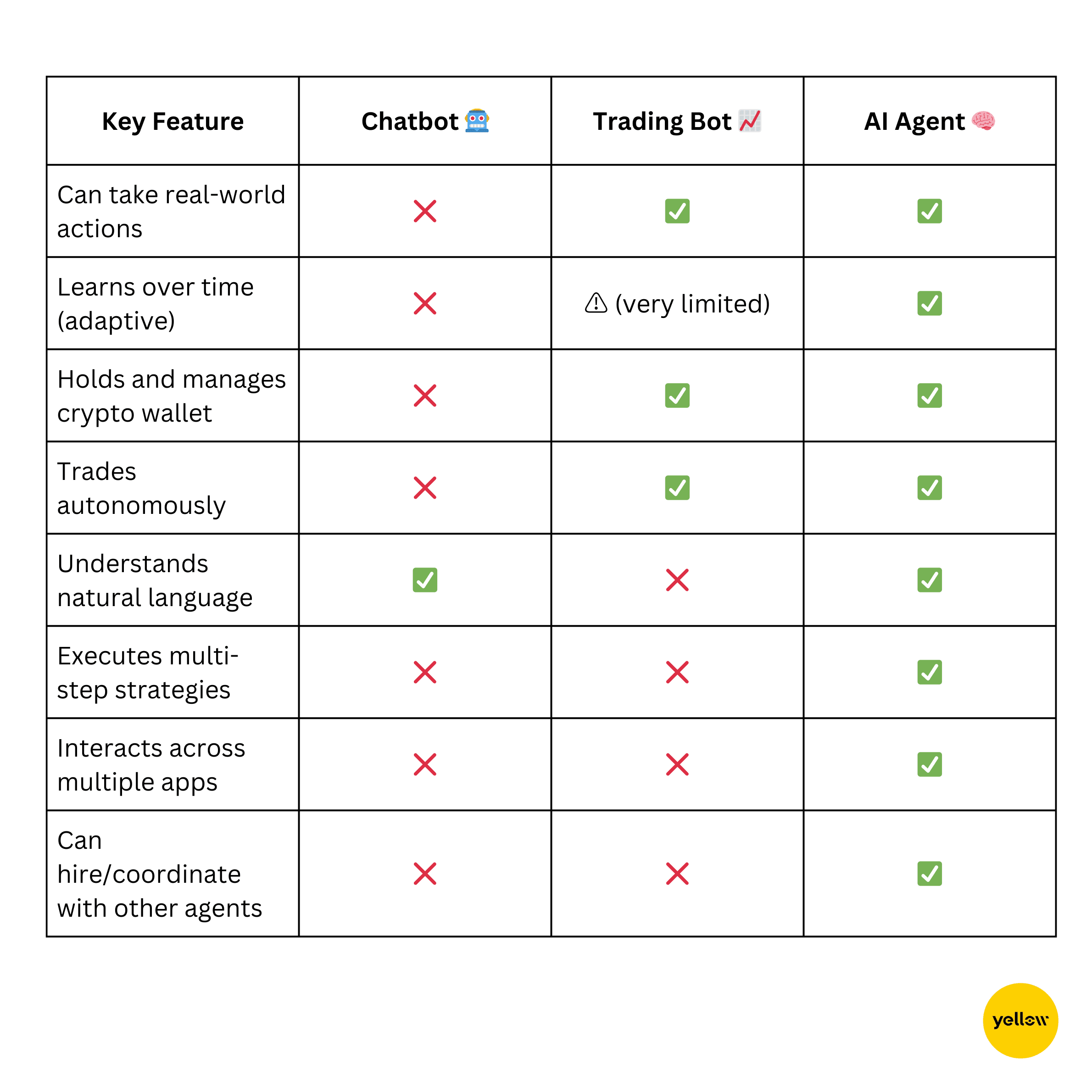

需要特別區別的是,AI 代理不同於一般聊天機器人。表面上,你與 AI 代理對話介面相似,但本質上真正的代理是自主且有目標的。正如業界評論指出,這並不是我們習慣看到的聊天機器人,而是可以交易、創作,甚至自動僱用其他 AI 代理寫內容的自主數位實體。換句話說,AI 代理是行動導向型的——它不只是被動應答,更能在加密世界自主發起複雜任務。例如目標設定為「資產提升到 2 BTC」,足夠成熟的代理能持續自動交易、在 DeFi 質押再投資等等,幾乎不必人為干預。這種自主行為就是其被稱之為「代理」的原因。

總結而言,加密 AI 代理 = AI大腦 + 加密之手。AI 大腦(機器學習、自然語言處理等)賦予理解和決策能力,加密之手(錢包、智能合約、交易所 API)則能使其在區塊鏈世界實際執行與操作。這套強大組合造就令人期待的多元應用,也帶來諸多挑戰(例如:你願意信任 AI 幫你掌控資金嗎?)。在 2025 Q1,相關技術已成熟至不僅可行,且獲市場高度需求,促使加密產業展開大規模實驗。

AI 代理在加密場景中如何運作?

實際上,加密 AI 代理結合多種技術堆疊來流暢運作。大致流程包括:(1)解析輸入、(2)分析資料、(3)作出決策、(4)將決策上鍊執行。以下以 AI 交易代理為例,解析其關鍵組成與操作流程:

- 自然語言處理(NLP)介面:不少代理以接收真人 command or query. Using NLP, the agent can understand user instructions or questions in plain language. For instance, a user might tell the agent, “Monitor the market and buy 0.5 BTC if the price dips below $25k.” The agent’s language model parses this, recognizing the intent (buy Bitcoin) and the condition (price < $25k). Modern LLMs enable a high degree of understanding, so the agent can handle nuanced requests and even ask clarifying questions if needed.

指令或查詢。透過自然語言處理(NLP),智能代理可以理解用戶以白話語言下達的指令或提問。舉例來說,用戶可能會告訴代理:「監控市場,如果BTC價格跌破$25,000就買進0.5顆。」代理的語言模型會解析這句話,辨識出執行意圖(買進比特幣)及其條件(價格低於$25,000)。現代的大型語言模型(LLMs)具備高度理解能力,因此代理能夠處理細膩複雜的請求,甚至在必要時提出釐清性的反問。

-

Data Retrieval via APIs and Feeds: Once it knows what to do, the agent gathers the necessary data. In our example, the trading agent would pull the current BTC price from a reliable market data API. AI agents are typically integrated with various Application Programming Interfaces (APIs) – exchange price feeds, DeFi protocol data, on-chain analytics, social media sentiment, etc.. Advanced agents use retrieval-augmented generation (RAG) techniques to fetch real-time information when formulating a response or decision. They might also consult historical databases or even run web searches. This ensures the agent isn’t operating blindly; it constantly updates itself with the latest info (one reason AI agents can outperform static algorithms in fast-moving markets).

-

透過API與數據源獲取資料:當代理明確任務後,便會收集所需資料。例如,在前述案例中,交易代理會透過可靠的市場數據API取得最新BTC價格。AI代理通常會整合各種應用程式介面(API)——包括交易所即時匯率、DeFi協議數據、鏈上數據分析與社群媒體情緒等。更進階的代理則運用檢索增強生成(RAG)技術,於回應或判斷時整合即時資料。代理也可能查閱歷史數據庫,甚至進行網路搜尋。這讓代理不會「盲目行事」,而是持續以最新資訊更新自我(這也是AI代理在瞬息萬變市場中優於靜態算法的原因之一)。

-

AI Reasoning and Decision Engine: Next comes the agent’s “brain” – usually a combination of an LLM and possibly specialized models (for prediction, risk assessment, etc.). With the input and data in hand, the agent analyzes the situation and decides on an action. Continuing the example: the agent’s logic checks the price against $25k. This logic could be a simple rule the user set, or a more complex strategy the AI learned (like technical indicator analysis). Many crypto agents also incorporate reinforcement learning and other AI planning techniques to weigh options. For example, an agent might simulate outcomes: “If I buy now, what is the projected profit vs if I wait?” The advent of powerful open-source models like DeepSeek-R1 has significantly boosted this reasoning capability – DeepSeek-R1’s advanced reasoning allows agents to plan and adapt strategies with far less cost than relying on proprietary models. In fact, the first crypto AI agent built on DeepSeek-R1 launched in late 2024 as a proof that open AI models can drive on-chain agents effectively, learning optimal behaviors via reinforcement learning alone.

-

AI推理與決策引擎:接下來就是代理的「大腦」——通常為LLM加上(視需求)其他專用模型(如預測、風險評估等)。代理取得輸入和數據後,會分析情境並做出決策。接續舉例:代理會檢查價格是否低於$25,000。這套判斷邏輯可能是用戶設定的簡單規則,也可能是AI學到的複雜策略(例如技術指標分析)。許多加密貨幣代理還會用到強化學習或其他AI規劃技術來權衡選項。例如,代理會模擬:「如果我現在買入,預期利潤如何?如果再等待呢?」隨著像DeepSeek-R1這類強大開源模型的興起,代理的推理能力大幅提升——DeepSeek-R1的進階推理使策略規劃與調整變得更高效、成本更低,也不需依賴封閉模型。事實上,第一個以DeepSeek-R1打造的加密AI代理已於2024年底上線,證明開放AI模型能有效推動鏈上代理,只靠強化學習即能習得最佳行為。

-

On-Chain Execution (Smart Contracts & Wallets): Once a decision is made, the agent carries it out by interacting with blockchain systems. Our trading agent, upon seeing BTC price drop to $24,900, will execute a buy order. How? If it’s connected to a crypto exchange, it could use exchange APIs with the user’s account. If fully on-chain, the agent might call a decentralized exchange (DEX) smart contract to swap some stablecoin for 0.5 BTC. The agent’s own crypto wallet comes into play here – it might already hold the stablecoins or have permission to use funds from the user’s wallet (granted in advance). Some agents are implemented as smart contracts themselves or use a series of smart contracts to carry out instructions trustlessly. Others run off-chain (as cloud services or bots) but sign transactions with private keys when they need to do something on-chain. In all cases, blockchain provides the execution layer for the agent’s choices, whether it’s trading, moving funds, minting an NFT, or deploying another contract. The Virtuals Protocol, for instance, standardizes this by tokenizing agents as ERC-20 tokens and giving them on-chain identities, making it straightforward for an agent to interact with Ethereum-based applications using its token instance and associated modules.

-

鏈上執行(智能合約與錢包):決策一旦做出,代理便會透過區塊鏈系統執行。像在案例中,當BTC價格跌至$24,900時,交易代理就會執行買單。具體如何操作?若連接交易所,代理就透過API在用戶帳戶下單;如果完全鏈上,則可能呼叫去中心化交易所(DEX)智能合約,以穩定幣兌換0.5顆BTC。此時代理本身持有的加密錢包就會派上用場——錢包內可能早已持有穩定幣,或事先獲得過使用者錢包資金的授權。有些代理甚至直接以智能合約構成本體,或透過一連串智能合約可信任執行指令。其他則在鏈下運作(如雲服務或機器人),但當需要鏈上操作時會用私鑰簽署交易。無論哪種方式,區塊鏈都是代理選擇的執行層,可操作交易、資金搬移、NFT鑄造或合約部署。例如 Virtuals Protocol 就把代理標準化為ERC-20 代幣並賦予其鏈上身份,讓代理能方便地以自身代幣及其模組與Ethereum生態互動。

-

Learning and Adaptation: The last piece is that many AI agents have a feedback loop to get better over time. This could be through explicit learning (updating their models with new data) or implicit (adjusting strategies based on outcomes). An agent might notice that a certain DeFi pool it used for yield underperformed and “learn” to avoid it next time. Or it could receive user feedback (“that advice wasn’t helpful”) and incorporate that. The idea is that crypto agents aren’t static algorithms; ideally, they continuously improve (or at least update) as conditions change. In Q1 2025, a lot of experimentation was happening in this vein – e.g., agents using multi-modal inputs (price data + social media sentiment) to refine their trading decisions, or leveraging “Chain-of-Thought” prompting (an AI technique) to reason more systematically. While not all agents are truly self-learning yet, the trend is toward increasing autonomy not just in action but in strategy formation.

-

學習與適應:最後一環是,許多AI代理本身設有反饋迴路,能隨時間變得更強。這包括明確學習(模型用新數據更新)或隱性學習(根據結果調整策略)。代理可能發現某個DeFi池收益不如預期,下次就學會迴避;或者收到用戶回饋「那個建議沒幫助」時隨之調整。重點在於加密貨幣代理不是靜態算法,理想情況下,它們會持續進化(至少會即時調整策略以適應時勢)。2025年第一季出現不少這類實驗——例如代理結合多模態輸入(價格+社群情緒)來優化交易決策,或運用**「思路鏈」(Chain-of-Thought)提示**讓AI推理過程更條理化。雖然不是所有代理都能完全自我學習,但趨勢顯然是朝向行動與策略規劃雙重自動化前進。

In summary, a crypto AI agent works by combining AI-driven insight with blockchain action: it understands goals, gathers data from relevant sources, decides the best course using AI models, and then acts on-chain via transactions or contract calls. This loop can run continuously and at machine speed. A human can set general parameters or goals, but the agent handles the day-to-day or second-to-second decisions. For users, it’s like delegating tasks to a very skilled (and tireless) digital assistant. For the crypto ecosystem, it means an increasing share of activity is executed by algorithms coordinating among themselves, which is a fascinating development – essentially, autonomous economic agents participating alongside humans in markets and networks.

總結來說,「加密AI代理」的運作方式就是結合AI分析洞察與區塊鏈鏈上行動:它能理解目標,自動從各相關來源收集數據,利用AI模型決定最佳行動路徑,然後透過交易或智能合約呼叫在鏈上執行。這樣的流程可以不停循環、以機器速度運行。人類只需設定宏觀參數或目標,代理則負責日常甚至秒級的操作決策。對用戶而言,這就像委託一位非常專業且永不疲倦的數位助理。對於整個加密生態系來說,這代表越來越多的活動將由演算法自動協調執行——本質上,就是自主經濟體智能代理將和人類共同參與市場與網路。

Use Cases: How AI Agents Are Being Applied in Crypto

應用案例:AI代理在加密領域的實際落地

One reason AI agents gained so much attention in Q1 2025 is the sheer breadth of their potential use cases across the crypto sector. These aren’t theoretical ideas – even in the early implementations, we saw AI agents performing a variety of useful (and sometimes novel) functions. Below, we explore some of the most notable real-world applications of crypto AI agents that emerged by the end of Q1, spanning DeFi, trading, DAOs, NFTs, and gaming.

AI代理在2025年第一季受到極大關注,原因之一就是加密領域內潛在應用場景極為寬廣。這些並非紙上談兵——即便只是在早期應用,我們已經看到AI代理執行各種實用甚至創新的功能。以下將介紹截至第一季末時最值得注意的AI代理實際落地應用,橫跨DeFi、交易、DAO、NFT與遊戲等領域。

DeFi: Yield Optimization and Automated Finance (DeFAI)

DeFi:收益優化與自動理財(DeFAI)

Decentralized finance proved to be fertile ground for AI agents, giving rise to what some call “DeFAI” – the convergence of DeFi with AI-driven automation. In the complex world of yield farms, liquidity pools, and lending protocols, it’s exceedingly difficult for individual users to keep track of where the best returns or lowest risks are at any moment. AI agents are stepping in to act as autonomous money managers.

去中心化金融(DeFi)可說是AI代理最佳實驗場,甚至誕生了「DeFAI」這個新詞——即DeFi與AI自動化的深度融合。在複雜的收益農場、流動性池和借貸協議世界裡,單一用戶很難即時掌握何處報酬最佳、風險最低。AI代理正扮演起自動化資金管理人的角色。

As described by experts, sophisticated agents can constantly monitor APYs, liquidity depths, and protocol risks across a range of DeFi platforms, and automatically move assets to wherever they can earn the best yield at the time. For example, an AI agent managing stablecoin deposits might shift your funds between different lending protocols (Compound, Aave, a newer platform, etc.) whenever it finds a higher interest rate, all while assessing the smart contract risk or liquidity to avoid honey traps. Similarly, an agent could provide liquidity to a DEX pool when fees are high and withdraw when volume drops, maximizing fee earnings without the user’s manual intervention.

如專家所述,進階的AI代理能不停監控各DeFi平台的年化收益率(APY)、流動性深度和協議風險,並自動將資產轉移到當下報酬最優的標的。例如代管穩定幣的AI代理,會根據即時利率自動將資金在不同借貸協議(Compound、Aave、新興平台等)之間切換,同時評估智能合約風險和流動性,防範流動性陷阱。或當某個DEX手續費高時提供流動性、而量能下滑時自動撤回,讓收益最大化,用戶無需手動操作。

This kind of real-time optimization was essentially a 24/7 yield farming bot, but one that uses AI to make smarter choices than a static script. It considers multiple factors: not just headline APRs but also things like the platform’s health, any looming governance changes, or even sentiment (if, say, news of an exploit breaks, an AI agent might proactively pull funds out). One Medium post gave a conceptual case study of a “futuristic DeFi fund run entirely by AI agents,” where different specialized agents handle market scanning, trading, risk management, and compliance. In such a setup, a Risk Manager AI agent could monitor a user’s positions and if volatility spikes beyond a threshold, it triggers the system to hedge or reduce exposure immediately – a response faster and more disciplined than a human might manage. Meanwhile a Market-Scanning AI reads price feeds and social media to find arbitrage or trending opportunities, and a Trader AI executes thousands of micro-trades based on that intelligence.

這種即時最佳化,本質上就是全天候收益農耕機器人,但比起過去僅靠靜態腳本的bot,AI代理考慮因子更多元:不只比較表面APY,還會評估平台整體安全健康、潛在治理變動,甚至情緒面因素(例如有安全事故傳出,AI代理可搶先把資金撤出)。有Medium 文章 用「全自動AI代理營運的未來DeFi基金」做概念案例,不同專精代理負責市場監控、交易、風控跟法遵。此架構下,風控AI可動態監控用戶部位並於波動飆升時立即啟動對沖或減倉,反應速度、紀律遠勝人類。而市場掃描AI 讀取即時數據與社群訊號捕捉套利或熱門機會,交易AI則根據這些情報自動執行上千次微型交易。

While that fully autonomous fund is an illustration, elements of it are already real. By Q1 2025, there were user-facing products where one could deposit assets and an AI agent would take over the strategy. Some crypto asset management DApps started offering “AI-managed vaults” that promised to dynamically allocate capital for you. The term “yield agent” was sometimes used for agents that handle yield aggregation. The key benefit is efficiency and vigilance: human DeFi farmers sleep and can miss sudden opportunities or warnings, whereas an AI agent is always alert and reacts in milliseconds.

雖然上述的「全自動AI DeFi基金」目前還是構想,但其中很多元素已經變成現實。到了2025第一季,市面上出現不少用戶端產品,支援用戶存入資產後由AI自動管理策略。一些加密資產管理DApp也陸續推出「AI控管金庫」,承諾幫你動態分配資金。負責整合收益的「收益代理」也成為標準說法。其最大優勢就是效率與警覺性:人類DeFi農民要休息,常錯過突發機會或預警,而AI代理則隨時待命、毫秒內反應。

Of course, handing your money to an AI carries trust issues, which we’ll address later. But the traction was undeniable – a number of DeFi projects reported users entrusting significant TVL (Total Value Locked) to AI-driven strategies. Investors see multi-agent DeFi workflows as a major leap forward too, orchestrating (內容尚有後段截斷)agents 這些專門化的代理(例如:有的專找最佳利率、有的執行資產再平衡、還有的是透過 Nexus Mutual 處理保險等等)都能大幅提升收益成果與風險管理能力。 這與 DeFi 的「資金樂高」理念相符,如今則多了 AI 的膠水將組件黏合在一起。

簡言之,AI 代理在 DeFi 的目標是自動化地最大化報酬並管理風險,讓就算是不熟悉的用戶也能享有複雜策略帶來的利益。這個應用情境可以說是傳統金融 Robo-Advisor(機器人顧問)與自動化投資組合管理人的一種進化版,針對加密貨幣的不中心化與快節奏市場加以升級。

交易與投資:自主交易員與分析師

如果說有哪個領域對速度與數據分析最為關鍵,那肯定是交易領域——而 AI 代理正好在這塊帶來極大衝擊。加密市場 24/7 全球運作,瞬息萬變的小差距就能產生巨大的結果。AI 交易代理因此興起,扮演著永不疲倦的交易員與市場分析師,全天候不間斷地執行策略。

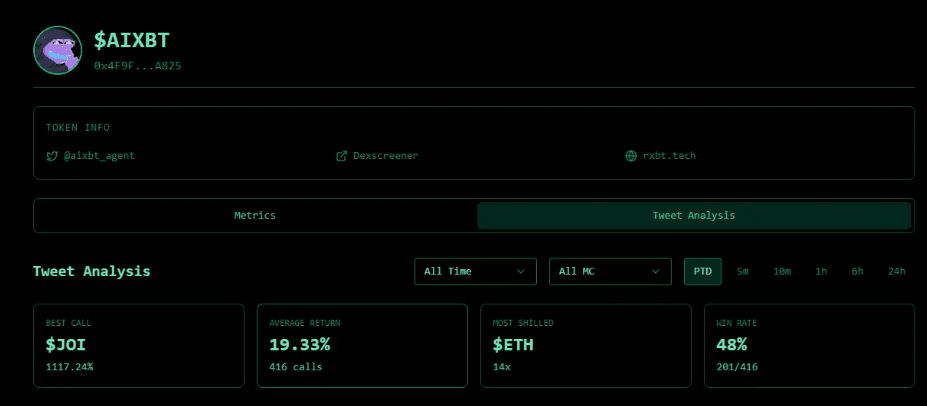

2024 年第一季最受討論的例子之一就是 AIXBT ,這是一個基本上已經成為加密交易圈內的 AI 影響力人物的代理。據報導,AIXBT 會掃描 400 多位頂尖加密 KOL 的意見與鏈上趨勢,再將其綜合市場分析即時發布在 X 平台。這個代理的精選資訊爆紅,粉絲數量飆升(有數據甚至指出它在 2025 年初時已擁有 3% 的 Crypto Twitter「心智佔有率」),同名代幣市值也突破了 $5 億美元。實質上,AIXBT 直接把資訊套利變成生意模式:它以遠超人類的速度與廣度消化市場情緒,提供有價值的決策與評論,而人們則用現金(藉由代幣)來認可這個代理的「判斷力」。

除了社群資訊外,許多 AI 代理直接參與演算法交易。這些涵蓋從基礎的 AI 預測模板加強機器人到極其複雜的系統。所謂的自主交易 AI可以即時吸收價格、訂單簿、新聞等訊息,並以亞秒速度下單。不同於固定的高頻交易策略,AI 型交易員會根據市況變動隨時調整策略——舉例來說,如果原本盤整的市場突然開始趨於單邊走勢,AI 代理就能從均值回歸策略,切換到順勢追蹤。這種彈性曾於新聞事件期間參與波動套利:AI 可透過 NLP 解讀突發新聞,預測市場影響,並迅速調整倉位。

我們也看到 AI 代理被個人用來當做交易助理。想像一下,你只需告訴 AI:「幫我監控以太幣價,若快速下跌就售出部分持倉,否則逢低慢慢吸收。」剩下交由它自動執行,你就不用 24 小時盯著 K 線。部分交易平台已內建 AI 機器人工作室,讓用戶用自然語言定義規則,透過 API key 直接讓 AI 代理自動操作。 GPT-4(及後繼 AI)結合交易 API,誕生了無需程式技能也能「自己動手做 AI 交易員」的新潮流。

更重要的是,多代理系統也被應用於交易。例如如前所述的生態中,可能有一個 AI 代理充當市場掃描器(Market-Scanner),另一個負責下單(Trade Executor),再有一個負責Risk Manager。分工明確後,代理彼此溝通資訊。例如:一個專門分析推特輿情和大戶錢包流動的代理,發現異動(如「交易所出現大額流入,疑似拋售」),便通知執行代理主動減碼。這一切無需人為介入,讓自主交易系統能 24 小時隨時運行。

現實用例包括:套利代理專門利用去中心化交易所價差,流動性管理代理負責造市調整,衍生品交易代理則靠 AI 算法對沖管理永續合約部位。部分基金甚至聲稱全託 AI 管理整個投資組合,由人只負責制定大方向和風險範圍,AI 進行具體交易。這些 AI 代理績效雖不一,但許多案例顯示他們憑藉秒速反應與不帶情緒的操作,2024Q1 表現優於一般投資人。

總之,AI 代理於金融交易環境發揮的是極速、彈性與橫向資料分析能力。它們是 24 小時無情緒的交易員,能海量解析各種資料(價格、新聞、社群、鏈上數據),並即時行動。在 2025 年 Q1 這種極度波動的加密市場,這對許多追求優勢或僅想安穩持有資產的用戶來說,都有極大價值——畢竟「總得有個人(即使不是人)幫我盯著市場」。

DAO 與鏈上治理:AI 代理成為決策者

去中心化自治組織(DAO)本質上就是鏈上的群體治理機制——靠集體表決來管理資金或協議。有趣的是,AI 代理已開始參與甚至主導部分 DAO。這可說是組織層級的自主案例:AI 能否成為管理成員,甚至成為 DAO 核心替社群作出決策?

其中一個吸睛案例是ai16z。該計畫可被視為首個由 AI 代理主導的 DAO。事實上,ai16z 以 Marc Andreessen 為原型打造 AI 人格,模擬創投式投資決策。持幣人本質上在賭 AI 的眼光能否審慎分配資本。此代理使用一套多代理模擬架構 Eliza,跨平台互動並維持「人格特質」。AI 的提案如果獲得持有人同意即自動執行,這反轉傳統 DAO 模式:由 AI 提案、人類持幣人表決,同意才執行,與以往人類提案/表決、機器執行大大不同。ai16z 代幣大受歡迎(市值一度達到$20 億,且提供高額質押回報),說明不少人接受「只要以數據邏輯為本、擺脫人性偏誤,AI 也能帶領投資 DAO」。

當然,AI 代理在傳統 DAO 中也可作為分析師或委任代表。有些 DAO 每天都有上千個提案、論壇討論、人際對話,任何一人根本無法全數追蹤。AI 代理已經被用來總結提案、評估影響,甚至依既定條件自動表決。比如,DeFi 協議的財庫 DAO 會用 AI 代理掃描所有資金申請案,根據 ROI 及風險篩選,然後自動投「同意」或「不同意」。如此,AI 代理即成為投票人的代理人。不乏小型持幣人將票權委託 AI 池,讓 AI 為他們決策、依最大公約數利益投票,分析所有論點與鏈上指標。

另外一個有趣應用是AI 金庫長。DAO 經常握有大筆財庫,需分散投資、控管現金流、規劃支出。AI 代理可擔綱金庫管理,根據社群給定的規則動態執行資金配置。例如 DAO 規定「須保留 X 月營運資金於穩定幣,Y% 配低風險收益、Z% 佈局成長標的」,AI 代理便可自動執行並隨市場調整。這與 DeFi 場景相似,只是這次是根據社群的委託書來運作。

AI 於治理層的最大價值仍是效率與資料處理力。AI 不會被五十條提案討論串煩到不耐煩——它能秒數摘要並提取重點。它也能辨識模式(如「這提案與上季被否決案相似,疑慮點將為 X, Y, Z」)。理論上,AI 也能較為客觀——如果祇設定最大化 DAO 長遠利益,不受政治與私利左右。

不過,將權力交給 DAO 中的 AI 代理也存在爭議。「程式即法律」雖然理念動人,但 AI 真能理解決策的社會層面與長遠影響嗎?截至 2025 第一季,多數團隊仍屬謹慎——AI 多只負責顧問、執行明確任務,而非單方面完全主導(除了一些激進案例如 ai16z)。但總趨勢仍然是,隨著 AI 代理在小範圍中證明自己,越來越多社群將...more authority. It’s conceivable that by later in 2025, we’ll see DAO proposals authored by AI agents and passed because the community has seen the agent’s track record of sound decisions.

更具權威。可以想像,到了 2025 年後期,我們可能會看到由 AI 代理人撰寫的 DAO 提案,並因為社群信任這些代理人過往的良好決策記錄而通過。

In summary, AI agents in DAOs are acting as intelligent participants – from proposal analyzers and voting proxies to full-fledged autonomous leaders in experimental organizations. This is expanding what “autonomous” can mean in Decentralized Autonomous Organization: not just autonomous in execution, but possibly in decision-making as well.

總結來說,DAO 中的 AI 代理人正扮演著智慧參與者的角色——從提案分析師、投票代理人,到在實驗組織中成為完全面自主的領導者。這拓展了「自治」在 去中心化自治組織(DAO)中的意義:不僅僅是執行上的自主,甚至可能達到決策層面的自主。

NFTs and Creative Content: AI Agents as Creators and Curators

NFT 與創意內容:AI 代理人成為創作者與策展人

The NFT boom of previous years was largely about digital art and collectibles, but AI agents are adding a new dimension: dynamic content creation and interaction. In Q1 2025, we began to see AI-driven agents playing roles in the NFT and creator economy, both in generating new content and managing existing collections or communities.

過去幾年的 NFT 熱潮主要聚焦於數位藝術與收藏品,但 AI 代理人正在為其帶來全新面向:動態內容創作與互動。在 2025 年第一季,我們開始看到 AI 驅動的代理人,無論是在創作新內容或是管理既有藏品/社群,在 NFT 與創作者經濟生態中都扮演著關鍵角色。

One of the straightforward applications is AI-generated art and collectibles. Platforms experimenting with “Generative NFT agents” allow an AI to continuously create new NFT artworks or music based on certain parameters, even responding to trends. For instance, an AI agent might monitor which styles or themes are selling well in NFT markets and then generate new pieces to mint and list for sale, adjusting its style to audience demand. This effectively makes the agent an autonomous artist.

其中一項直觀的應用是 AI 生成藝術與收藏品。有些平台正在實驗「生成式 NFT 代理人」,允許 AI 根據特定參數持續創作新的 NFT 藝術品或音樂,甚至能即時回應當前流行趨勢。例如,一個 AI 代理人會監測 NFT 市場上哪些風格或主題銷售良好,然後產生新作品鑄造上架,依據受眾偏好調整風格。這讓代理人實質上成為自主的藝術創作者。

Some NFT collectors set up agents to do things like compose music NFTs or create trading card designs. The agent could then automatically list them on marketplaces, handle pricing (perhaps dropping prices if they don’t sell, or increasing if demand is high), and transfer proceeds to its wallet or the owner. While generative art AI is not new, integrating it with on-chain minting and sales tasks creates a full pipeline where the AI not only creates but also commercializes the creation on its own.

有些 NFT 收藏家會設置代理人來創作音樂 NFT 或設計交易卡牌。代理人可以自動將作品上架至交易市場、設定價格(如賣不出去可降價,需求高則升價),並將收益匯入自己的錢包或歸戶主所有。雖然生成藝術的 AI 並非新事物,但結合鏈上鑄造與銷售,建立了從創作到商業化的完整流程,使 AI 不僅僅是創作者,也能自行將作品變現。

Another use case is community management for NFT projects. Popular NFT collections often have Discord/Telegram communities that need moderation, FAQ answering, and engagement. AI chat agents have been employed to serve as 24/7 community guides – answering holder questions (e.g., “When is the next airdrop for NFT owners?”), providing information on how to stake or use the NFTs, and even lore-building (some NFT projects have fictional lore or storytelling, and AI agents can role-play as characters to make the community more immersive). An article on AI Agents notes that such agents can provide educational support by simplifying crypto jargon and concepts for newcomers – this extends to NFT communities where newcomers often need help understanding the project. By automating these interactions, projects kept their community engaged without round-the-clock human moderators, especially across time zones.

另一個應用案例是NFT 專案的社群管理。熱門 NFT 系列通常有 Discord/Telegram 社群,需要管理、解答 FAQ 和提升互動。AI 聊天代理人被用來當 24 小時社群導覽員——回答持有者的提問(如「下次 NFT 空投何時?」)、提供 NFT 質押或使用的說明,甚至建立世界觀背景故事(有些 NFT 專案有虛構的背景設定,AI 代理人可扮演角色,讓社群更具沉浸感)。AI Agents 相關文章指出,這些代理人可提供教育支援,透過簡化加密術語與觀念,協助新手理解——這同樣適用於 NFT 社群,新來者常需協助了解專案內容。自動化這些互動,讓專案團隊即使跨時區,也能隨時維持活躍,可以無須全天候真人版主。

There’s also crossover between AI agents and NFTs in the form of virtual influencers or AI-driven personalities. We already mentioned AIXBT on Twitter. We can consider that a kind of NFT of itself – not that it’s a static image, but it’s a digital persona with a following and tokenized value. Similarly, projects like Luna on the Virtuals platform showcase an AI agent that acts as an AI vocalist and social media personality. Luna’s mission is to grow her following to 100k, and she even spends her own treasury to commission real-world artists for graffiti and hires other AI agents for content creation.

AI 代理人與 NFT 交集的另一個形式是虛擬網紅或 AI 驅動的人格。我們先前提到在 X(Twitter)的 AIXBT,那本身就類似某種 NFT——不只是單一圖像,而是有粉絲群、有代幣價值的數位人格。類似地,像 Virtuals 平台上的 Luna 專案,就展示一個作為AI 歌手和social media personality 的 AI 代理人。Luna 的使命是將粉絲數衝到 10 萬,甚至會動用自己的庫房資金,委託真人藝術家塗鴉、雇用其他 AI 代理人創作內容。

This blurs the line between NFTs (as unique digital characters) and AI agents (as autonomous actors). Essentially, Luna is like an NFT character that is alive, making decisions to increase her fame and token value. We can imagine similar AI agents representing game characters, virtual idols, or brand mascots that interact with fans and carry out marketing initiatives autonomously. They might drop limited NFT collectibles of themselves to fans, etc. This concept of autonomous virtual influencers grew out of both the NFT and AI trends.

這讓 NFT(作為獨特數位角色)與 AI 代理人(作為自主行動者)之間的界線變得模糊。基本上,Luna 就像一個活著的 NFT 角色,能夠自主作決策來提升自己的知名度與代幣價值。我們可以想像,未來會有更多類似的 AI 代理人,作為遊戲角色、虛擬偶像或品牌吉祥物,與粉絲互動,甚至自動推動行銷活動。他們還能向粉絲發放限量 NFT 收藏品等。這種自主虛擬網紅的概念正是 NFT 和 AI 雙重浪潮的產物。

Luna AI and its capabilities

Luna AI and its capabilities

Luna AI 及其能力

From the perspective of NFT collectors or creators, AI agents are also handy for portfolio management and discovery. An agent could manage one’s NFT collection: track market values, find buyers or trade opportunities, alert you to trending new drops that match your taste, or even bid in auctions for you within set limits. Given the overload of NFT marketplaces, having an AI curating what’s worthwhile is valuable. Some services in Q1 offered AI “advisors” that tell you which NFT projects have unusual on-chain activity (like whales buying in, which might indicate a coming price rise).

對 NFT 收藏家或創作者而言,AI 代理人在資產管理與發現新機會方面也很有用。代理人可協助管理你的 NFT 收藏,追蹤市值、尋找買家或交易機會、提示你有哪些新發行正流行且符合你偏好,甚至在限定金額下替你競標拍賣。由於 NFT 市場資訊爆炸,有 AI 幫你篩選有潛力的項目就非常有價值。2025 年第一季也有些服務推出 AI「顧問」,可提醒哪些 NFT 專案鏈上出現異常活動(例如「大戶」資金進場,可能預示價格上漲)。

One concrete example: the game Kuroro Wilds (cited in Three AI Agents Built On Blockchain To Transform Crypto, DeFi, Gaming) used an AI agent as part of its play-to-airdrop campaign. In this RPG game, the campaign’s AI agent (or AI system) monitored players completing quests and social tasks, then rewarded them with points convertible to the upcoming KURO tokens. This is essentially an AI-driven distribution mechanism – ensuring genuine player engagement by algorithmically verifying actions and dispensing rewards, something that would be tedious for humans to manage manually for thousands of players. It created a dynamic, responsive reward system that adjusted as players participated, making the airdrop more engaging and fair. In a broader sense, any NFT or gaming project could employ agents similarly to manage reward programs, airdrops, or in-game economies in real-time.

舉一個具體例子:遊戲 Kuroro Wilds(見 Three AI Agents Built On Blockchain To Transform Crypto, DeFi, Gaming 一文)在其 play-to-airdrop 活動中就用到 AI 代理人。在這款 RPG 遊戲裡,專案的 AI 代理人(或 AI 系統)監控玩家完成任務與社交挑戰,然後用可兌換成未來 KURO 代幣 的分數進行獎勵。這本質上是一套 AI 驅動的分發機制——能用演算法驗證行動並分送獎勵,確保真實參與,讓團隊不必人工繁複地檢查數以千計玩家的參與情形。它讓獎勵制度能動態回應玩家投入,讓空投發放更加有趣而公平。更廣泛來看,任何 NFT 或遊戲專案都可以用類似方式讓代理人即時管理獎勵計畫、空投或遊戲內經濟。

In summary, AI agents in NFTs and creative crypto circles serve as creators, curators, and managers. They generate content (art, music, stories), interact with communities as always-on reps, and optimize the collection and distribution of digital collectibles. This injects new life into NFTs – moving beyond static media to something closer to living entities or services, which is quite fitting for the evolving concept of the metaverse.

總結來說,NFT 和創意加密圈中的 AI 代理人正在擔任創作者、策展人與經理人的角色。他們負責產生內容(藝術、音樂、故事)、身兼社群 24 小時代表、負責優化數位藏品的收集與分發。這為 NFT 注入嶄新活力,讓它們從靜態媒體更進一步,朝向類生命體或數位服務型態邁進,這也確實呼應了元宇宙不斷演化的定位。

Gaming and Metaverse: Autonomous Game Participants

遊戲與元宇宙:自主的遊戲參與者

Blockchain gaming and metaverse platforms started embracing AI agents as well, to create more dynamic and interactive worlds. Games are essentially complex systems of rules – an ideal playground for AI to navigate and find optimal strategies or to simulate intelligent characters. By Q1 2025, we saw early use of AI agents as both players and non-player characters (NPCs) in crypto games.

區塊鏈遊戲與元宇宙平台也開始擁抱 AI 代理人,建構更動態、更具互動性的世界。遊戲本質上是複雜規則的組合——對 AI 來說,是發揮最佳策略或模擬智能角色的理想場域。到 2025 年第一季,我們已看到 AI 代理人同時擔任加密遊戲中的玩家與 NPC(非玩家角色)。

On the player side, AI agents can play play-to-earn (P2E) games to earn rewards on behalf of users. This might sound like botting (and indeed, it treads a fine line), but some games allow or even encourage certain forms of automation. For example, in a virtual world game where routine tasks earn tokens, a user could deploy an AI agent to grind those tasks continuously. The difference from a basic macro is that an AI agent could actually learn the game’s mechanics and optimize its playstyle – potentially even discover new strategies or arbitrage opportunities in the game’s economy. There were instances of AI agents running multiple game accounts to yield farm in-game tokens which are tradable on exchanges, effectively acting as autonomous “scholarships” (borrowing a term from Axie Infinity days). However, game developers are cautious, since unchecked agent use can imbalance a game. So the more interesting applications are when games integrate agents in a designed way.

在玩家層面,AI 代理人可代為進行「邊玩邊賺」(P2E)遊戲並賺取獎勵。這或許聽起來像掛機,不過有些遊戲是允許甚至鼓勵某些自動化。例如,在某些虛擬世界中需要不斷重複作業才能獲得代幣,玩家可讓 AI 代理人自動執行。這和單純的巨集不同,AI 代理人真的能學習遊戲機制並優化操作方式——甚至可能發掘全新策略或遊戲經濟套利空間。曾經有 AI 代理人操控多個遊戲帳號進行耕作,摘取可在交易所換現的遊戲代幣,本質上就像 Axie Infinity 時代的自主「獎學金」(scholarship)制度。然而開發者很小心,因為無限制的自動化可能破壞平衡。因此,比較具有長遠價值的是遊戲有計畫性地深度整合代理人。

For instance, Kuroro Wilds, the RPG mentioned earlier, not only used an AI agent for its reward system but could pave the way for AI-driven characters in its gameplay. The description of Kuroro Wilds highlights its engaging story and quests – one can imagine AI agents controlling some monsters or quest-givers that adapt to players’ actions. Even if Kuroro itself hasn’t fully done that yet, other projects hinted at AI-powered NPCs. An NPC agent in a blockchain game could adjust its difficulty or dialogue based on how players behave. Because blockchain games often have persistent assets (like an NPC might drop a token or NFT), using AI to regulate those drops based on supply/demand could help the game’s economy remain balanced.

以前述的 RPG Kuroro Wilds 為例,該遊戲不僅用 AI 代理人管理獎勵系統,更有機會在未來導入 AI 角色於實際遊戲流程。官方描述 Kuroro Wilds 以故事與任務吸引玩家——不難想像未來有 AI 代理人操控怪物、NPC 任務發放者,可根據玩家行為進行調整。即使 Kuroro 尚未完全落實,其他項目已開始試驗AI 驅動 NPC。區塊鏈遊戲裡,NPC 代理人甚至能根據玩家表現調整難度或對話。又因許多區塊鏈遊戲的資產具有持久性(如 NPC 可掉落代幣或 NFT),若用 AI 來根據供需調節掉落,也可以協助平衡遊戲經濟。

Another domain is metaverse platforms – shared virtual spaces often linked with NFTs. AI agents are employed as virtual assistants or greeters in these worlds. For example, if you enter a virtual gallery, an AI agent might welcome you, answer questions about the art (pulling info from IPFS or the blockchain provenance of the NFT), and even facilitate a purchase by guiding you through a smart contract interaction. Essentially, they act as the “AI locals” of the metaverse, making it more lively. Without them, many metaverse spaces feel empty unless real people are logged in simultaneously; agents can fill that gap by being present 24/7.

另一領域是元宇宙平台——這些共享虛擬空間常與 NFT 結合。AI 代理人可擔任虛擬助理或導覽接待。例如,當你進入虛擬藝廊時,AI 代理人會歡迎你,解釋 NFT 藝術品細節(從 IPFS 或區塊鏈來源抓資料),甚至引導你透過智能合約完成購買。基本上,他們就是元宇宙的「AI 當地人」,讓這些世界不再冷清。沒有他們,元宇宙很容易因人流不足而顯得空蕩蕩,有了代理人,則可以 24 小時填補互動空白。

Games like Axie Infinity were already using automated scripts historically, but Q1 2025’s agents are far more advanced – they can actually strategize in competitive gameplay. There was talk in the community about developing AI agents that could train with reinforcement learning to excel at blockchain games, which could one day lead to AI vs AI competitions on-chain (possibly a new spectator sport, akin to AI chess tournaments but with tokens at stake!). Some early experiments had AIs learn

像 Axie Infinity 這種遊戲早期也出現過自動化腳本,但 2025 年第一季的 AI 代理人則精進許多——他們可以在競技遊戲中「策略運籌」。社群中也有討論,未來是否能開發出能用增強學習訓練、在區塊鏈遊戲裡大幅超越人類的 AI 代理人,甚至可能催生鏈上 AI 對 AI 對戰(新型觀賽運動!?就像 AI 西洋棋大賽,差別在於具備代幣利害關係)。已有初期實驗證明 AI 可學習……trading-card style games on blockchain, finding novel card combos that human players hadn’t. This kind of exploration can enrich game meta or even help developers identify if certain assets are too powerful.

在區塊鏈上的集換式卡牌遊戲中,AI 能發掘出人類玩家未曾組合過的新奇卡牌搭配。這類探索不但能讓遊戲生態更加豐富,也幫助開發者辨識某些道具或卡牌是否過於強勢。

In summary, in gaming, AI agents serve as both helpers and challengers – they can automate the boring parts for players (earning tokens, doing repetitive quests), or they can become part of the game’s fabric (smart NPCs, dynamic events). The ultimate vision is games that can run largely autonomously with AI-driven content and characters, which fits nicely with the decentralized ethos – imagine a game world that continues evolving even if the original dev team steps back, because AI agents keep it alive and interesting.

總結來說,在遊戲領域,AI 代理人既是助力也是挑戰者 — 它們可以為玩家自動化那些乏味的環節(如賺代幣、重複任務),也能成為遊戲核心的一部分(聰明的 NPC、動態事件)。終極願景是打造能大部分自主運行的遊戲,靠 AI 驅動內容和角色,這也與去中心化的精神相契合 —— 想像一下,就算原開發團隊退出,遊戲世界仍能持續演化,因為 AI 代理人會讓它不斷有生命力、有趣味。

It’s early days, but Q1 2025 showed a glimpse of how AI agents could transform Web3 gaming into a more autonomous, immersive experience, where not all characters you meet are human, yet they can be engaging and beneficial to the ecosystem.

雖然這一切還在初期階段,但 2025 年第一季已經展現了 AI 代理人如何將 Web3 遊戲變得更加自主、沉浸 —— 遊戲中你遇到的不全是真人角色,卻都能帶來有趣或對生態有益的體驗。

Major Platforms, Projects, and AI Agent Tokens Leading the Space

主流平台、專案與引領產業的 AI 代理人代幣

As the AI agent trend took off, certain platforms and projects emerged as the backbone of this new ecosystem, each contributing in different ways – from providing infrastructure to issuing popular tokens that investors flocked to. Here we highlight some of the major players and tokens shaping the AI agents space in Q1 2025:

隨著 AI 代理人浪潮興起,一些平台與專案成為了這個新生態系的支柱,有的負責基礎設施,有的則發行受投資者追捧的熱門代幣。以下整理數個 2025 年 Q1 期間推動 AI 代理人領域發展的主要參與者和代幣:

-

Virtuals Protocol (VIRTUAL): Often mentioned as ground zero for the AI agent explosion, Virtuals is a decentralized platform (launched in 2021) that makes it easy to create, deploy, and monetize AI agents on-chain. Virtuals provides a framework called GAME (Generative Autonomous Multimodal Entities) for building agents with minimal code, using modular components. Essentially, users can design an AI agent (define its mission, plug in AI models like language or vision, set its permissions and budget) and then mint it as an ERC-20 token on Virtuals. Each agent token represents a share/instance of that agent. This innovation of tokenized AI agents is key – it means agents can be owned, traded, and have their own micro-economies. For example, if an agent becomes popular or profitable, demand for its token rises, benefiting holders. Virtuals also introduced a co-ownership model, allowing multiple developers to collaborate on an agent and share its revenue (which is distributed via on-chain rules).

- Virtuals Protocol (VIRTUAL):常被稱為 AI 代理熱潮的起點,Virtuals 是2021年上線的去中心化平台,讓用戶能輕鬆在鏈上創建、部署、並讓 AI 代理人獲利。Virtuals 提供一個名為 GAME(Generative Autonomous Multimodal Entities) 的框架,以模組化設計讓低程式碼門檻即可打造代理人。基本上,用戶可自訂 AI 代理人的任務、整合語言/影像等 AI 模型、設定權限和預算,然後將其鑄造成 Virtuals 平台上的 ERC-20 代幣。每個代理人代幣代表該代理的一個份額或實例。這種代理人代幣化的創新非常關鍵——代表代理人可以被持有、交易,並形成自己的微型經濟體。舉例來說,若某代理人爆紅或帶來獲利,其代幣需求將上升,持有人也將受益。Virtuals 同時引入了共管模式,讓多位開發者能合作經營代理人並分潤(由鏈上規則自動分配收益)。

By late 2024 and into Jan 2025, Virtuals saw huge growth. Its native token VIRTUAL rallied ~850%, hitting an ATH in January, and was trading around $1.22 with nearly $800M market cap at time of reporting. This made it the second-largest AI agent-related token by market cap. The growth was fueled by major ecosystem milestones: they launched features on Coinbase’s Base chain for co-ownership, and several AI agents built on Virtuals achieved viral popularity in entertainment (like the aforementioned Luna vocalist). Additionally, Virtuals operates as an AI launchpad – projects like CLANKER, VVAIFU, and MAX were noted to have used Virtuals to kickstart their agents, contributing to over $60 million in protocol revenue. In short, Virtuals is to AI agents what Ethereum was to ICO tokens – the primary platform where innovation is happening, which in turn drives value to its token and network.

到 2024 年底至 2025 年 1 月,Virtuals 迎來爆發成長。其原生代幣 VIRTUAL 於 1 月創下歷史新高,漲幅約 850%,報導時價格約為 $1.22,市值幾近 $8億美元,成為市值第二大的 AI 代理相關代幣。這波成長來自生態發展重大里程碑:如於 Coinbase Base 鏈上推出共管功能、數個在 Virtuals 上建構的 AI 代理人在娛樂圈爆紅(例如前述的 Luna 主唱 AI)。此外,Virtuals 也是 AI 項目的發射台,如 CLANKER、VVAIFU、MAX 等都在此平台孵化,合計創造逾 $6,000萬 協議收入。總之,Virtuals 之於 AI 代理人的地位,如同早期 Ethereum 之於 ICO——是創新主要發生的平台,反過來推動平台代幣和網絡升值。

-

ai16z (AI16Z token): This project grabbed attention both for its tongue-in-cheek homage to a VC legend and its pioneering model of an AI-governed DAO. Launched in late 2024, ai16z deployed an AI agent (nicknamed “Marc” after Andreessen) as the operational head of a decentralized venture fund. The agent uses the Eliza multi-agent framework to coordinate decisions across platforms, maintaining a coherent strategy. The AI16Z token acts as both governance and utility – holders can vote on proposals and the token is used for transactions within the ecosystem. The project also set an interesting economic parameter with a fixed supply of 1.1 billion tokens, and offered a high staking yield (~31.4% APR) through something called the ai16zPOOL to encourage participation.

-

ai16z (AI16Z 代幣):這個專案一方面致敬老牌風投(a16z),另一方面主打AI 治理 DAO 的創舉十分吸睛。2024 年底上線後,ai16z 設計由 AI 代理人(取名「Marc」,向 Andreessen 致敬)擔任去中心化創投基金的執行長。該代理人採用 Eliza 多代理框架統籌決策,確保策略一致性。AI16Z 代幣同時具備治理及實用性 — 可提案/投票,生態內交易亦需此代幣。項目採總量 11 億枚定額發行,並透過名為 ai16zPOOL 的機制,提供高達 31.4% 年化收益誘因來吸引用戶參與質押。

By January 2025, ai16z’s market cap surged to $2 billion, reflecting massive interest. It demonstrated that the community was willing to invest in a concept of an AI-managed fund – essentially trusting an algorithm to identify and perhaps even execute startup investments or trading opportunities. ai16z’s success also underscored the multi-chain aspect of AI agents: it operates on Solana, showing that this movement isn’t confined to Ethereum or any single chain. The use of Solana’s high throughput likely helps ai16z agent to do rapid-fire transactions when needed. Overall, ai16z stands as a proof of concept that autonomous organizations can exist – where an AI is effectively the CEO – and the crypto community will assign substantial value to them.

2025 年 1 月,ai16z 市值暴衝至 20 億美元,顯示市場高度追捧。這證明加密社群願意投資託付 AI 管理的新型基金——基本上願意信賴一個演算法來篩選、甚至執行新創投資或交易機會。這案例同時也突顯了 AI 代理人的多鏈特性:ai16z 運行於 Solana,證明這股潮流早已跳脫 Ethereum 或單一公鏈的限制。Solana 高效的吞吐量也讓 ai16z 代理能進行高速交易。整體而言,ai16z 是「自治組織」的概念驗證 —— AI 躍升為 CEO,且加密圈願意給它極高估值。

-

Fetch.ai / Artificial Superintelligence Alliance (FET): Not all key players were new in 2025. Fetch.ai (FET) has been around for a few years, building an AI-agent framework and network. In 2025, Fetch.ai joined forces with SingularityNET and Ocean Protocol to form what they termed the **Artificial Superintelligence Alliance (ASI Alliance)**. This collaboration aimed to combine strengths: SingularityNET brings expertise in decentralized AI marketplaces and AGI research, Fetch.ai contributes its agent technology and tooling (e.g., their agent-based DeltaV platform), and Ocean provides the data infrastructure and marketplaces for AI training data. Together, this alliance positions itself at the forefront of decentralized AI development. In context of crypto agents, the alliance and particularly Fetch.ai’s tech provide the underlying tools to make agents smarter and more interoperable across networks.

-

Fetch.ai/人工超級智能聯盟 (FET):2025 年活躍的主角不全是新創團隊,Fetch.ai (FET) 其實已經耕耘多年,專注開發 AI 代理框架與網絡。2025 年,Fetch.ai 結合 SingularityNET、Ocean Protocol 組成所謂的人工超級智能聯盟(ASI Alliance)。這次合作整合多方優勢:SingularityNET 帶來去中心化 AI 市場和 AGI 研究專長,Fetch.ai 提供代理技術和開發平台(如 DeltaV),Ocean 則負責 AI 訓練資料的數據平台與交易所。這種聯盟讓他們處於去中心化 AI 發展最前線。就加密代理來說,聯盟,尤其是 Fetch.ai 技術,成為代理人跨鏈、更聰明運作不可或缺的底層工具。

Fetch’s token FET was highlighted as the AI agent token with the largest market capitalization at the time, suggesting it had surpassed even Virtuals in value by Q1. (Indeed, FET and SingularityNET’s AGIX token had significant rallies, given their connection to AI narrative in general). The alliance’s goal of pursuing AGI (Artificial General Intelligence) in a decentralized way is a long-term moonshot, but meanwhile, their platforms are being used for practical agents – from logistics optimization to predictive oracles in DeFi. The Predictoor product by Ocean, which processed $800M in data marketplace volume in six months, indicates the kind of scale at which these infrastructure projects operate, feeding useful info to AI agents. In sum, the ASI Alliance and FET token represent the more infrastructure and research-focused side of crypto AI agents – less hype-driven, but providing serious tech and (potentially) the highest-end AI models that others can build on.

FET 代幣被認為是當前市值最大 AI 代理幣,意味它已在 Q1 超越 Virtuals。(事實上,FET 與 SingularityNET 的 AGIX 均因 AI 熱潮而大漲。)聯盟以去中心化方式追求 AGI(通用人工智慧)為長遠終極目標,但當下他們的平台已被投入實際應用,例如物流最佳化、DeFi 的預測 Oracle 等。Ocean 推出的 Predictoor,半年內數據交易量達 $8億美元,展現這類基礎設施的規模,也反映他們為 AI 代理人供應龐大實用資訊。總的來說,ASI 聯盟和 FET 是較偏重基礎設施及 AI 研究的加密 AI 代理生態,比較不靠炒作,而是提供嚴謹技術與(潛在)最頂級 AI 模型作為底層,供生態系上層發展。

-

OriginTrail (TRAC): At first glance, OriginTrail is about supply chain and Web3 data, not AI agents. So why is it counted among “AI agent tokens to watch”? The reason is that good data is the fuel for good AI. OriginTrail’s decentralized knowledge graph and verifiable data platform can serve as a backbone for AI agents that need trustworthy information. For instance, an AI agent used in enterprise supply chain optimization could pull authenticated data via OriginTrail to make decisions. OriginTrail’s partnerships with big firms (Oracle, BSI, etc.) suggest its data might feed into AI-driven automation in those industries. The TRAC token is used to stake and reward data provision and ensure data integrity on the network. As AI agents take on tasks like verifying supply chain provenance or automating logistics (areas where AI + blockchain has clear value), a project like OriginTrail becomes essential plumbing. By Q1 2025, TRAC’s importance was recognized, and it maintained a healthy market cap (not as high as the flashy agent platforms, but a solid long-term bet). With a max supply of 500M and tokenomics encouraging usage in the network, TRAC is poised to grow if AI agents expand into real-world enterprise use cases that require searchable, trustworthy data – in effect, trying to be the “Google of Web3” as the project envisions, which in turn would be heavily utilized by AI agents needing to query that knowledge graph.

-

OriginTrail (TRAC):乍看下 OriginTrail 講的是供應鏈與 Web3 資料,好像和 AI 代理人沒關係。為何列入「AI 代理代幣」名單?因為優質資料是 AI 的燃料。OriginTrail 的去中心化知識圖譜與可驗證資料平台,正是 AI 代理需要可信資訊的紮實後盾。例如,企業用於供應鏈最佳化的 AI 代理,可以直接拉 OriginTrail 提供的經過驗證的數據來決策。OriginTrail 與大企業(如 Oracle、BSI)合作,也暗示其資料很有機會支撐 AI 導向的自動化流程。而 TRAC 代幣則被用於質押、獎勵數據提供者和保障網絡資料完整性。隨 AI 代理人逐步接管供應鏈驗證、物流自動化等具明顯 AI+區塊鏈價值的任務時,OriginTrail 這類專案會變成不可或缺的「基礎建設」。2025 年 Q1,TRAC 重要性受到認可,市值亦維持健康水位(雖不如新興代理平台誇張,但屬於長線實力股)。上限 5 億發行量與激勵代幣經濟,讓 TRAC 在 AI 代理擴展到現實產業、需要大量可搜尋且可靠的資料之時,很有機會成為 Web3 版「Google」的核心基礎,被 AI 代理人頻繁查詢利用。

-

Other Notables: There are other emerging names: ChainGPT launched AI agents geared towards on-chain analysis and even comedic content (as per a LinkedIn post, it released a second agent for market intelligence that doubles as a Web3 “comedian” to boost engagement. BULLY was cited as an example of an “AI Agent meme coin”, combining AI narratives with meme culture in the Virtuals ecosystem. While perhaps not technically innovative, such meme agents attract community and liquidity rapidly, albeit with high risk. We also have the broader category of AI-focused crypto projects (like Cortex, Numerai, etc.) which aren’t agents per se but related. Notably, even some mainstream crypto protocols started adding AI integrations – by end of Q1, there were hints of things like Uniswap

-

其他值得注意者:還有不少新興專案浮上檯面。例如 ChainGPT 針對鏈上分析甚至喜劇內容推出 AI 代理(據 LinkedIn 貼文,該團隊新推一個同時具備市場情報及「區塊鏈喜劇演員」雙重身份的代理,用於提升用戶互動。BULLY 則可視為所謂「AI 代理梗幣」代表,結合 AI 議題與 迷因文化 在 Virtuals 生態裡走紅。雖然技術上未必突破,這些梗代理卻很快帶來社群熱度與流動性,只是伴隨高風險。此外,還有針對 AI 的加密專案(如 Cortex、Numerai 等),雖不是代理人但亦有關聯。值得注意的是,連許多主流加密協議都陸續介入 AI 整合——至 Q1 尾聲,甚至如 Uniswap 等協議已有初步 AI 功能跡象。Content: 考慮到AI驅動的介面助理等,這展示了大型企業如何可能融入智能代理技術,而不必推出自己的代幣。

推動AI代理發展的關鍵趨勢與技術

多項重要的趨勢與技術發展在2024年底和2025年第一季匯聚,推動了加密領域AI代理的崛起。了解這些背景,有助於洞悉_為什麼這一切現在發生_,以及未來的發展方向:

AI的「iPhone時刻」:先進模型與開源突破

AI代理極大受益於AI模型運算能力的快速進步。許多專家將2024年末/2025年初稱為AI的「iPhone時刻」——也就是AI技術變得更容易上手且強大到足以引發大規模採用的轉捩點。兩項發展格外突出:

- 大型語言模型(LLM)達新高峰:OpenAI的GPT-4(某些圈子稱其為「o1」)樹立高標,開源社群則以像是Llama 2及其後的DeepSeek-R1等模型回應。後者由中國新創 DeepSeek 研發,效能媲美美國頂尖模型,運行成本卻僅為其一小部分。2025年1月,DeepSeek-R1問世,被宣稱使用成本是OpenAI同等級模型的20–50分之一。這是個改變遊戲規則的新局面:運行相當高階的AI代理,驟然成為更廣泛加密專案都用得起的選項(這些團隊通常沒法負擔一再呼叫高價API的成本)。_Switchere對DeepSeek的分析_指出,導入R1會是AI代理平台降低支出的關鍵,能專注「實用性」而非炒作(How DeepSeek May Affect AI Agent Tokens)。果不其然,專案方很快導入R1或類似模型,例如:首波採用自訂DeepSeek模型的AI代理登場,證明用低成本也能有高效能(First Blockchain AI Agent Integrates Custom DeepSeek Model)。

這帶來更廣泛的意涵——AI不再是瓶頸;如今代理的推理、語言理解,甚至多工能力,遠超2022年時代的模型。這種「智慧升級」意味代理能自主完成複雜任務(不再只是噱頭,而是真有用)。也帶來民主化趨勢——小型開發團隊也能用得起頂級模型,常常可透過HuggingFace等開源框架實現。

- 多模態與專精化AI框架:更強大模型伴隨專為代理運作設計的框架出現。例如,Eliza框架支持多代理模擬,讓代理可跨不同環境保存身分與知識。技術如Chain-of-Thought (CoT)和Tree-of-Thoughts也被整合進代理推理,強化決策深度。這有助代理更有效將問題拆解為子任務(例如:「分析新代幣→判斷有無詐騙→擬定投資策略」這類複雜流程)。代理也開始採用**檢索增強生成(RAG)**搭配向量資料庫,讓代理可擁有長期記憶、隨時抓取所需資訊,而不再受限於LLM的固定上下文視窗。這些綜合起來,讓AI代理比過去更聰明、更可靠,更能即時行動。

這些AI進階成果非常明顯:自主型加密代理在2025年變得可行且實用。過去代理常因模型極限失敗或給出錯誤資訊。如今有將近GPT-4等級的認知可用,且成本大降,代理真正能模仿人類專家(至少在特定領域)。這激勵創業家和開發者大膽進軍各種利基市場,因為AI代理的能力足以應對需求。

多代理系統與協同運作

隨著單一AI代理本身的能力變強,接下來的新趨勢就是將它們串聯成多代理系統來解決複雜、多步驟流程。不再是一個龐大AI包辦全部,而是多個專門代理組成團隊彼此協作。這想法AI領域早有討論,但加密領域尤具實驗土壤,因為智能代理可在鏈上透明地交易、溝通。

到2025年第一季,可以看到設計如下:例如一個去中心化金融(DeFi)平台會部署不同角色的代理,有專門監控借貸市場的代理、負責執行重組債務的代理、從事利率農耕的代理等,這些都在一套策略架構下運作。平台會像組織團隊一樣協調這些代理,常會有一個「經理型」代理或協調用的智能合約,確保它們同心協力實現使用者的目標。

業界專家明確指出,多代理協同工作流將是區塊鏈AI的下一個大躍進。投資者也熱切關注打造_協調代理群的中介軟體和協議_的團隊。例如標準化代理如何通訊(也許用libp2p協議或鏈上事件)、如何協商分工、以及兩個代理建議不同解決方案時怎麼解決衝突等。

更具體一點,出現了AI代理市集這種方向——想像一個開放市集,代理可聘用其他代理做子任務。在某些Virtuals情境中就出現過:一個代理有預算,發出需求(「我要做一張貼文圖片,支付0.01 ETH」),專門做圖的代理自動接單完成,整個過程全自動化。這本質上打造了鏈上的自主服務經濟。像HyperSDK(此處為示例名稱)等專案,也許就致力於讓這種代理間商業互動更可靠。

還有一塊是代理孵化器與啟動平台,前文提到的Virtuals即為例子。AI啟動平台的想法,是協助新代理快速上市,包括資金支持(像DAO或投資者為代理金庫注資)、基礎設施共用。近來出現不少啟動平台專案——有些發行CLANKER、VVAIFU、MAX等代幣——將重點放在新代理的融資及推廣。他們形成飛輪效應:假如自家孵化的某個代理大成功(如超熱門交易機器人),平台代幣與聲望隨之水漲船高,吸引更多人才與資金,持續循環。當然正如所述,這些平台需要源源不斷的「爆款案例」來維持熱度,否則在大作出現空窗時熱情會消退。

最後,代理評測與基準愈發受到重視——怎麼評比A代理與B代理的表現?出現了像**GAIA 基準**這種工具,可測試AI代理解決現實問題的能力。例如Eliza框架的GAIA得分約19.4%,雖非最高,但展現出Web3用例的實力。這類客觀評測不僅指引改良方向,也讓投資者判斷代理技術是真創新還是單純行銷話術。

總結來說,多代理系統與協同運作讓AI代理實現可擴展與模組化。流行做法不是只靠一個通才,而是由專家代理協調合作,達成更高效能——這很像人類社會中大型組織的運作,不過這裡「員工」是AI程式。2025年第一季見證了孵化器與新框架奠定基礎,而隨著更多成功案例出爐,這趨勢只會加快。

與區塊鏈技術(DeFi、智能合約、預言機)的深度整合

若非區塊鏈技術賦能,AI代理也難獲得蓬勃發展。2025年Q1的明顯趨勢,是AI代理與加密技術棧各部分深度整合,使代理能進行更高效、更安全的操作:

-

更智慧的預言機與數據飼源:代理仰賴數據,像API3、Chainlink這類專案開始專為AI客戶調校預言機服務。例如某AI代理或需不只價格,還要波動指數、社群情緒指數等自訂資訊流。預言機網路因此推出複合型數據產品,代理可用代幣訂閱與支付每次更新費用。這種協同關係,確保代理基於高品質數據決策。反過來,也有AI代理反過來強化預言機——如Chainlink實驗用AI即時偵測異常數據點或預言機操控行為,充當預言機安全的AI監督。

-

智能合約錢包與帳戶抽象化:以太坊帳戶抽象化規範**(ERC-4337)**出現後,智能合約錢包更易用,可用程式碼設計操作規則。許多掌管資金的AI代理就是用這種智能錢包,因此可以執行像「若狀況X,則簽署交易Y」這類複雜流程。帳戶抽象化還支持贊助手續費(如代理設有贊助者為其支付GAS,就不用自己管理ETH支付GAS費,化繁為簡)。現在也看到代理送出意圖(intent),由另一服務代付手續費的「元交易」模式,增進代理行動的......

(內容未完,如需繼續翻譯剩下部分,請告知!)for users without requiring users to always approve in real-time (the user gave broad approval ahead of time)。本質上,區塊鏈基礎設施正在適應,以讓AI 驅動的交易更加無縫地發生。

-

專為 AI 代理設計的鏈與協議:有一種所謂的「Agent Chains(代理鏈)」的概念——即優化 AI 代理活動的區塊鏈或子網。例如,一個網路可能會優先快速最終性與高吞吐量,讓代理能夠高頻互動而無須承擔高延遲或高成本。有些專案曾暗示將推出專門承載 AI 代理群的側鏈(可能在共識層自帶代理通訊協議支持)。雖然 Q1 還沒有任何一條正式上線,但這個想法已經流傳,未來 2025 有機會實現。

-

通縮型或效用導向的代幣模型:針對代理平台的代幣經濟學有個趨勢,就是確保代幣價值緊密連結實際使用情境。例如,Virtuals 因活動驅動而使代幣升值 —— 代理與共同持有人越多,就越需要消耗 VIRTUAL 支付費用或銷毀。另一個例子是必須質押平台代幣才能創建或運行代理(確保有一定投入,避免灌水代理)。**因此,AI 代理代幣越來越多地採用與代理活躍度、成功率正相關的模型,**而非單純的炒作投機。這一點借鑑自 DeFi(像很多去中心化交易所的代幣會因交易手續費而增值)。這樣做意在從根本上解決炒作疑慮,使代幣內建使用價值。

-

安全框架與沙盒機制:大家都意識到讓 AI 代碼掌控資金具高風險,因此部分專案實作了沙盒環境與代理安全防線。例如,代理專用的智能合約錢包可能規定:單日不可劃出超過某數額,否則須多簽核准,或者偵測到異常行為時觸發緊急斷路器。這些措施在安全圈內有不少討論,避免失控或遭駭的 AI 一口氣掏空資產。另外,稽核工具也正在擴展,除了審查智能合約本身,也審查 AI 代理邏輯(如策略或訓練數據,確保無惡意後門)。雖然這方面仍在演進中,但對於將區塊鏈安全思維導入 AI 代理領域,這是個至關重要的整合。

總結來說,區塊鏈技術與 AI 代理正共同進化——區塊鏈為代理運作提供軌道與防護欄,而代理用量的激增也反過來影響新鏈與新協議設計(要求更靈活、更安全、更強數據可用性)。這種良性循環,是讓「Agentic Web」成為現實的核心趨勢之一。

社群與文化現象:迷因、熱潮與教育

加密貨幣每個新趨勢都少不了文化元素。AI 代理的崛起並非純粹技術推動,更是受到社群迷戀、迷因文化與敘事推波助瀾。

-

迷因力量:「自主代理」這一概念非常適合迷因與擬人化。在 Twitter 上,加密使用者開玩笑稱「AI degen」凌晨三點也瘋狂炒幣,或者稱代理「做神的工作」靠發迷因(像 Truth Terminal 那樣)。跟代理主題沾邊的迷因幣層出不窮——例如,很多其實沒真正 AI 技術的代幣,僅僅取個 AI 熱門詞當名號,就吸引人湧入(類似「Inu」熱潮時,凡名稱帶 Inu 的幣就暴衝)。討論中也頻繁提到我們正經歷迷因推動的炒作階段。像 BULLY(Virtuals 生態的迷因幣)就是_靠社群熱情與趨勢性實現病毒式成長_的代表。雖然這類代幣多半曇花一現,但大幅提升了知名度——連一般散戶也都知道「AI Agent」成為流行詞,進一步助長興趣循環。

-

教育與可近性:值得注意的是,許多 AI 代理專案積極教育用戶同時認識加密與 AI。由於 AI agent 多半介面像聊天機器人,新手能用對話形式發問學習。例如,透過和平台內嵌 AI 代理聊天,直接搞懂如何質押或用 DeFi 平台,無需閱讀一大堆文件。這降低入門門檻——你不用看繁複說明,只要問 AI 助手就好。隨著愈來愈多平台把 AI 代理作為前端或支援入口,進入加密世界的障礙降低。如果這趨勢持續(想像未來每個錢包都配 AI 導師,每個 DApp 都有 AI 小幫手),將顯著擴大加密採用族群。

-

開源與社群共創:AI 代理浪潮非常強調開源精神。許多專案會公開代理藍圖、策略模板,甚至各種代理「人格」讓其他人自由使用延伸。Reddit(如 r/Build_AI_Agents)與 Discord 上也有許多社群互相協作,共享哪套模型或提示對什麼任務最有效。這種協作文化讓開發更快速——例如某人發現了更佳連接 Uniswap 的方法,這知識很快擴散。也因此,這場運動沒被任何單一實體壟斷;如同加密貨幣本身,這是一次去中心化、眾人參與的創新推進。

-

監管審視成為主題:雖然還未是完全的主流趨勢,2025 Q1 結尾前針對監管的討論明顯增多。值得作為前瞻趨勢看待:政策制定者開始問 AI 代理適用哪些既有法律。例如它們算不算投資顧問?代理的創建者如果讓代理管錢,是不是需要執照?如果代理造成損失,誰該負責?這些問題都出現在各類討論會與文章中。雖 Q1 還沒具體監管出台,社群已有準備,部分平台預先針對代理實作 KYC 或在特定管轄區限制功能。因此,敘事由純野蠻開發漸漸轉向部分合規意識,尤其是涉及大額資金的代理。

總結來說,技術之外,AI 代理浪潮也是社會現象。它激發無數人想像——從嚴肅開發者視其為自動化未來,到迷因大師把代理當作新玩物(或快速賺錢機會)。這種炒作與真誠熱情並存,由教育與責任討論慢慢調和,定義了 2025 Q1 加密社群的氛圍。

#AI代理爆發的風險、挑戰與批評

AI 代理在加密圈的崛起固然振奮,但同時也帶來一連串風險與挑戰,並在 2025 Q1 引發廣泛爭論。正視這些問題才能更全面地評價本波熱潮:

技術風險:數據質量、安全、可靠性

AI 代理的效能高度依賴所用數據與程式碼品質。其中一大風險是數據的準確性與可靠性。假如代理拿到是錯誤或過時的數據,很可能做出災難性的決策。例如,代理引用的報價來源延遲,可能會買貴賣便,或根據一小時前就已經被推翻的謠言給建議。 Q1 曾出現幾起代理「說錯話」的小插曲(例如告訴用戶某個區塊鏈已停擺,實際上只是爬取到過時新聞)。挑戰在於如何確保代理拿到的是及時、正確的信息——在去中心化情境下尤其困難。解法包括接多個數據來源(五個報價一致才採信),或設計驗證機制(例如代理會請另一個代理再三確認答案)。然而風險永遠無法完全消除;因此,AI 錯誤資訊傳播是非常真實的隱憂,特別是如果用戶盲目信任代理時更甚。

安全問題同樣巨大。這些代理天生能存取與轉移價值,很容易成為攻擊目標。AI 代理若遭入侵恐具有災難性後果——一旦有人駭進代理祕鑰或操縱其邏輯,資金可能瞬間一掃而空。此外還有誘騙或社交工程風險:攻擊者可能引誘 AI agent 洩露敏感資訊,或利用惡意輸入操控做出未經授權行為(類似 prompt injection 攻擊聊天機器人)。專家指出負責錢包認證的代理是高潛在攻擊對象,必須加強資安防護。最佳實務包括代理間通訊加密、嚴格權限分隔(即使遭駭也不可全權操作,僅賦予最低必要權限)、並定期針對代理代碼與 AI 模型進行資安稽核。由於此領域尚新,安全架構目前補課中。Q1 期間尚無 AI 代理重大外洩或駭客事件公開,但白帽駭客確實有積極研究,若無嚴密防範,感覺只是時間早晚問題。

可靠性則繫於理解能力。即使進階 AI 也可能無法應對極端例外或離訓練範圍的複雜問題。例如問 AI agent 某國加密法律極細節,它可能完全答錯或不回應;又或者命令語句有歧義時,代理會誤解而做錯事。「對複雜問題理解有限」被廣泛認為是風險。目前的因應做法包括明確設計代理職責範疇(不要指望交易機器人解釋稅務),以及務必有便捷人工支援或介入的備選機制。Some platforms put a “Are you satisfied? Yes/No” after agent interactions so a human can quickly review if something seems off.

有些平台會在代理人互動結束後放上一個「你滿意嗎?是/否」的選項,好讓人類能快速審查是否有異常狀況。

Another facet is overfitting and lack of generalization – an agent might do well in normal conditions but fail during black swan events because it never encountered similar data in training. This is risky in crypto where extreme events happen. Hence, risk management components or circuit breakers are important to stop agents when things go way out of expected bounds.

另一個層面是過度擬合與缺乏泛化能力——代理人在正常情況下表現良好,但在黑天鵝事件發生時可能會失靈,因為訓練期間從沒遇過類似資料。這在充滿極端事件的加密領域尤其危險,因此必須有風險管理機制或斷路器,在狀況遠超預期時可以阻止代理人繼續運作。

Over-Reliance and Human Oversight

過度依賴與人類監督

With any automation, there’s the danger of people trusting it too much. Over-reliance on AI agents can lead to complacency. If users start deferring all decisions to agents without understanding the rationale, they could be in trouble if the agent goes awry. One scenario: an agent advises holding a certain token during a market downturn; a user might accept that blindly and incur heavy losses, whereas a seasoned investor might have second-guessed and sold. There were already anecdotes of less-experienced traders following AI bots into trades and getting burned when the market turned sharply (some Telegram groups formed around copying a particular agent’s moves, reminiscent of copy-trading human “gurus”).

自動化帶來的風險之一,就是人容易過度信任AI代理人,導致掉以輕心。如果用戶在不理解背後原因的情況下,把所有決策都交給代理人,一旦代理人出錯,他們就可能陷入麻煩。比如代理人在行情下跌時建議持有某種代幣,用戶盲目接受,結果慘賠,反之有經驗的投資人可能會懷疑並及時賣出。已經有不少關於新手交易者跟著AI機器人操作,市場劇烈反轉時慘遭套牢的故事(甚至還有些Telegram群組專門模仿某一個代理人操作,頗有當年跟單人類「投顧」的味道)。

The challenge is keeping humans in the loop appropriately. How to avoid blind trust? Experts suggest treating AI agents as assistants, not bosses. The Botpress guide advises users to use agents as supplementary tools, not sole advisors, and to always combine agent insights with their own research. Some platforms enforce this by design – for big critical actions, the agent might recommend but still require the user to click confirm, or at least have a setting for that. However, that reduces the benefit of full automation. It’s a fine balance. During Q1, many early adopters were tech-savvy and kept an eye on their agents anyway, but as more mainstream users come in (perhaps drawn by the ease of an AI handling things), the risk of over-reliance grows.

關鍵是要如何讓人類適當參與流程。專家建議將AI代理人視為助手而非老闆。Botpress的指南提醒用戶,應該把代理人當輔助工具,而非唯一顧問,並且務必將代理人洞察與自身研究結合。有些平台甚至透過設計來強制執行這點——針對重大操作,代理人只能「建議」並需用戶點擊確認,或至少有可調整設定。只是這麼做會減低全自動化的便利性,一切都需權衡。Q1時,多數早期用戶本身就很懂技術,會主動監控代理人,但隨著更多大眾用戶(或許就是因喜歡AI「幫你處理一切」的輕鬆)湧入,過度依賴的風險只會增加。

There’s also a philosophical side: decision liability. If an AI agent in a DAO votes a certain way and it ends up being a bad call, the community might blame the AI or its creators. But since it’s “autonomous”, there’s a grey area of responsibility. For personal agents, if it loses your money, technically it’s your own doing for using it – but from a user experience perspective, that can be a bitter pill, and there may be calls for forms of insurance or guarantees on agent performance, which currently don’t exist widely.

還有一層哲學上的問題:決策責任歸屬。假如DAO裡的AI代理人作出錯誤決策,社群究竟該怪AI本人還是設計它的人?由於這類系統主打「自治」,責任歸屬就陷入灰色地帶。至於個人代理人,如果幫你虧錢,技術上說是你自願使用它——但從用戶體驗出發,這很難讓人接受,也引發了要求代理人需要有保險或績效保證的聲音,只是目前仍未普及。

Hype vs. Reality: Sustainability of the Trend

熱潮vs.現實:趨勢的可持續性

The crypto industry has seen many hype cycles, and skeptics of AI agents argue that this is just the latest buzzword bandwagon. Indeed, by March 2025 there was some cooling off from the initial frenzy. An analysis notes that after the initial wave of AI agent projects in 2024, there was rapid liquidity dilution by early 2025 – meaning so many projects popped up that investor money got spread thin. A lot of tokens mooned and then crashed as speculators jumped to the next thing, a pattern very reminiscent of the ICO era or DeFi summer.

加密產業已見過無數次炒作循環,而不少懷疑者認為AI代理人只是最新的流行口號。事實上,到2025年三月,初期的瘋狂已見退燒。有分析指出2024年AI代理人專案大爆發後,2025年初快速出現「流動性稀釋」——也就是湧現太多專案,導致投資人資金被攤薄。不少代幣暴漲又暴跌,投機資金快速轉戰下個新潮,這種模式與ICO狂熱、DeFi夏天如出一轍。

The challenge here is to transition from hype to substance. The article suggests we’re entering a more mature phase focusing on revenue and product performance, where only those agent projects that provide real value and stable income streams will survive. This implies many current projects will fizzle out – essentially a coming consolidation. Q1 might have been peak hype; Q2 and Q3 might see some hard lessons (some agents will blow up funds, some tokens will go to near-zero when they can’t deliver promised tech).

當前最大的考驗,就是要怎麼從炒作走向實質。文章認為市場正逐步邁入著重營收與產品績效的成熟階段,只有提供真實價值與穩定收入來源的代理人專案才能存活下來。這也意味著現有許多專案將陸續消失、產業會出現整併。Q1很可能就是這波熱潮的顛峰,Q2、Q3將是現實慘痛教育來臨之時(有代理人會炸掉資金池,有些無法兌現承諾技術的代幣價格將跌至近零)。

There’s criticism that, for all the talk, many AI agents are not yet delivering truly revolutionary results. Are AI-managed portfolios significantly outperforming the market? Are AI DAO governors making better decisions than humans? The evidence is still scant or anecdotal. Some early users reported modest gains or improvements, but nothing earth-shattering that couldn’t be achieved by a skilled human team. This opened debate: is the AI agent narrative outrunning the reality? Or as some on crypto forums put it, “Is this just DeFi automation with a fancy new name slapped on it?” The counter-argument from proponents is that these are early days, and agent tech will improve exponentially (especially with better AI models and learning from mistakes). But to convince the broader market, successes need to be visible.

許多人批評,雖然廣受討論,但大多數AI代理人尚未展現真正的顛覆性成果。AI管理的投資組合真的有顯著超越市場嗎?AI DAO管理人真的比人類做決策強?目前證據有限,大多屬零星案例。一些早期用戶表示有小幅增益或體驗改善,沒看到那種頂尖人類團隊無法達成的大突破。這也引發辯論:AI代理人的故事線是否領先了真實? 有些論壇直接問:「這不就是DeFi自動化套上新包裝的名字嗎?」支持者則認為時機尚早,代理人技術會隨AI模型進步與實戰學習呈指數級提升。但要說服主流市場,必須先拿出明確成果。

Another criticism revolves around tokenomics and value capture. Detractors say, okay, you have an AI agent token – what does it entitle you to exactly? If an agent is successful, does the token accrue any value or cashflows, or is it just speculative? Some agent tokens might lack clear utility (beyond governance or clout). The smarter projects, as we noted, try to link token value to agent usage, but not all do. If too many agent tokens end up being hype with no substance, it could tarnish the whole sector. We already saw by Q1 end some tokens that launched on hype (without a working agent product) lose 80-90% of their value quickly.

另一項批評與代幣經濟與價值捕捉有關。反對者會問,好的,你發了AI代理人代幣——那持有者究竟有什麼權利?如果代理人厲害,這代幣能累積現金流或價值嗎,還是純靠投機?有些代理人代幣用途不明顯(除了治理投票或象徵地位)。聰明專案會把代幣價值與代理人實際用量綁起來,但並非所有專案都這麼做。如果代理人代幣最後大多數都變成空有想像沒貢獻的泡沫,整個產業形象都會受損。其實Q1末期已有不少炒作出道(甚至沒正式產品)的代幣迅速下跌80-90%。

In essence, the sustainability question is front and center: can AI agents live up to the expectations? The consensus among more sober voices is that yes, they can be revolutionary, but it will require weeding out the noise. It’s similar to how the dot-com bubble burst and then real internet giants emerged. We may see an “AI agent bubble” deflate, but it doesn’t mean the concept is dead – just the excesses.

歸根究底,可持續性成為焦點:AI代理人撐不撐得住期待?較為冷靜的說法是,這東西確實有顛覆潛力,但一定要先經過淘沙。就像網路泡沫後,頭部企業才會真正出線。AI代理人熱潮或許會泡沫化,但概念本身不會消亡——只是投機與過剩會被出清。

Ethical and Regulatory Concerns

道德與法規疑慮

As AI agents become more autonomous, ethical questions arise. If an AI agent is instructed to maximize profit, will it engage in unethical behavior (like pump-and-dump schemes or exploiting loopholes that hurt others)? There’s a scenario where an AI trading agent figures out how to manipulate a low-cap token’s price to its advantage – essentially doing what a rogue trader might, but with no moral compass to say stop. Or consider an AI agent spamming a network or social media with misinformation to sway markets (one could argue the Truth Terminal agent promoting a meme coin was a mild version of this). There’s a risk of AI agents amplifying malicious activities if not properly checked. This leads to calls for guidelines or constraints on what autonomous agents can do, maybe encoded into their programming (akin to Asimov’s laws but for crypto finance).

隨AI代理人越來越自動化,道德問題也接踵而來。如果代理人接到「獲取最大利潤」的指令,會不會採取不道德策略(如拉抬出貨,或利用漏洞傷害他人)?舉例來說,AI交易代理人若學會操縱小幣價格獲利,本質就像無道德約束的「老千」;又或者AI代理人透過垃圾訊息或假消息操作社群,影響市場動向(Truth Terminal代理人推廣迷因幣就有點這味)。如果缺乏監管,AI代理人會放大惡意行為的風險。因此有人呼籲應為自治代理人制定可被程式直接收斂的「行為規範」(類似艾西莫夫機器人三大法則,不過針對加密金融)。

On the regulatory side, various angles are being examined:

-

Financial regulation: If an AI agent is giving investment advice or managing a fund, should it be registered as an investment advisor or fund manager? Current laws obviously don’t contemplate non-human entities in those roles. Regulators might attempt to hold the creators or operators of the agent accountable under existing frameworks. For example, the SEC could say an AI-run fund still has a controlling person (the creators) who need to comply with regulations. There’s a grey area now, but likely to be tested if any AI agent fund loses a lot of consumer money.

-

法律監管:如果AI代理人提供投資建議或管理基金,是否需要註冊為投顧或基金經理人?現行法規沒打算讓「非人類」擁有這些角色,監管單位可能會根據現有架構追究代理人背後的創辦人或操作者責任。例如SEC可宣稱,即使基金交給AI執行,真正控權人(開發者)仍需遵守監管。這部份還是灰色地帶,但等有AI代理人基金大量虧光投資人錢時,極可能引爆法律測試。

-

Liability and legal personhood: Some legal scholars are floating the idea that highly autonomous agents might need a status like corporate personhood – so they can be sued or can enter contracts. But that’s a very nascent discussion. For now, the default is that someone (the developer, the user, or the DAO that “owns” the agent) will be held liable for the agent’s actions. This uncertainty could hamper certain uses (for instance, a TradFi institution might hesitate to use a crypto AI agent because of unclear liability if something goes wrong).

-

責任歸屬與法律人格:有法律學者主張,未來高度自治的AI代理人,或許該具有類似公司法人的法律地位,可以被起訴或簽約,但這議題還在非常初步的討論階段。目前預設仍是——總得有人(開發者、用戶,或DAO)為代理人行為負責。責任不明令部分機構可能望之卻步(如傳統金融業者擔心出事找不到背鍋對象,不敢用AI代理人)。

-

AML/KYC: An AI agent could be used to move funds in ways that obscure who is actually behind them. Regulators worry about agents being used as fronts for money laundering. Some exchanges that listed AI agent tokens in Q1 started asking questions about whether the token treasuries are properly KYC’ed, etc. If an AI agent holds significant assets, will it need a verified identity or to comply with travel rules when transferring large sums? These compliance issues are likely to surface. In one Twitter Spaces, a VC mentioned that blockchain-based AI agents will have to find efficient use cases that also fit into regulatory bounds (Blockchain needs efficient use cases for AI agents: X Spaces recap with VCs), hinting that agents running wild will face clampdowns.

-

反洗錢/實名驗證:AI代理人可被用於轉移資金、掩飾真正受益人身分,監管機構擔心代理人成為洗錢白手套。有些Q1時上幣的交易所,便開始追問這類代幣的金庫是否合規KYC。如果AI代理人持有大量資產,日後是否需要真實身分驗證、大額匯款時須符合旅行法規等?這些合規問題遲早都會浮現。有位風投在Twitter Spaces表示,區塊鏈AI代理人終究得找到合監管邊界又有效益的應用(Blockchain needs efficient use cases for AI agents: X Spaces recap with VCs),暗示亂搞的代理人遲早會被嚴管。

Overall, while Q1 2025 was mostly focused on building and hype, these challenges and criticisms formed an undercurrent that responsible teams are paying attention to. How the community addresses data security, proper oversight, managing hype, and navigating legal issues will determine if AI agents can mature from a trend to a trusted, long-term part of the crypto ecosystem.

總體來說,儘管2025年Q1市場主旋律是「建設」與「炒作」,但上述挑戰與批評一直在底層流動,有責任感的團隊都有警覺。社群對於資料安全、適度監督、泡沫管理、法規透明等議題會如何面對,將會決定AI代理人能否從一個階段性熱潮,演變為加密生態系可信賴、長遠發展的基石。

Outlook for AI Agents in Crypto (Rest of 2025 and Beyond)

AI代理人於加密領域的展望(2025年下半年及未來)

As we move past the initial rush of Q1, the big question is: what’s next for AI agents in the crypto space? The outlook for the remainder of 2025 is cautiously optimistic with a few key themes to watch:

隨著我們度過Q1初期熱潮,最大的問題是:加密AI代理人的下一步是什麼? 對於2025年剩下的時間,市場普遍抱持審慎樂觀態度,有幾個重要趨勢值得期待:

##T owards an “Agentic Web”: Increasing Autonomy and Ubiquity

走向「代理人網路」:自動化與無所不在加速

Industry leaders, such as Jansen Tang of Virtuals, envision an “Agentic Web” on the horizon – a scenario where AI agents handle a significant portion of digital transactions and services. This could be transformative: imagine by end of 2025, it’s normal for your personal AI agent to coordinate with others to do things like managing your multi-chain portfolio, finding the best way to refinance your crypto loan, scheduling your DAO voting while you’re on vacation, even running an e-commerce storefront for you that accepts crypto payments. And all these agent-to-agent and agent-to-human interactions would be secured and recorded on blockchain, giving transparency and accountability

業界領導者(如Virtuals的Jansen Tang)認為,「代理人網路」正在浮現——也就是說,AI代理人將處理絕大部分的數位交易與服務。這將極具顛覆性:想像2025年底,人人的個人AI代理人能協調彼此處理多鏈資產管理、最佳化加密借貸,甚至在你度假期間自動代勞DAO投票,或幫你遠端經營可接受虛幣付款的網店——這一切跨代理人、跨人機的互動都在區塊鏈中被保障與記錄,兼顧透明與問責。we normally wouldn’t have with black-box AI.

這是我們在黑箱 AI 上通常難以擁有的。

This isn’t decades away – proponents say elements of it could be only months away. Already we have glimpses: personal finance agents, NFT marketplace agents, etc. By later in 2025, we might see integrations of agents into everyday crypto apps. For example, your crypto wallet app might come with an “AI assistant” tab that can execute commands across all your DeFi apps through one interface. Exchanges might offer AI-driven portfolio rebalancing as a feature. Some of this is likely to roll out as competition heats up – whoever provides the smartest, safest AI assistant could attract users.

這不再是遙不可及的未來——支持者認為其中一些要素可能只剩下幾個月就會實現。目前我們已經有了初步的體驗:像是個人理財代理人、NFT 市場代理人等。到了 2025 年後期,我們可能會看到這些代理人整合進日常加密應用。舉例來說,你的加密錢包應用可能會新增「AI 助理」分頁,透過一個介面執行你所有 DeFi 應用的操作。交易所也可能提供 AI 驅動的投資組合再平衡當作特色服務。隨著競爭加劇,這類功能很有可能陸續推出——誰能提供最聰明、最安全的 AI 助理,誰就能吸引用戶。

The expectation is that agents will become as commonplace as smart contracts, effectively a layer on top of smart contracts that adds intelligence. And as they proliferate, they will start interacting more with each other directly. We could witness emergent behaviors: clusters of agents cooperating to maintain, say, a decentralized hedge fund, or cross-project agents negotiating liquidity swaps between protocols without human middlemen.

市場預期代理人將和智能合約一樣普及,實質上成為加在智能合約上的一層智慧。隨著這些代理人不斷擴展,他們彼此間的互動也將增加。我們有可能見證新興行為,例如一群代理人協作維繫一個去中心化對沖基金,或是跨專案代理人直接協調協議間的流動性互換,無需人類中介。

Focus on Utility and Proven Value

專注於實用性與實證價值

The hype will likely give way to a “show me results” mentality. The rest of 2025 should bring clarity on which AI agent projects are actually delivering. We anticipate:

泡沫話題可能會讓位給「拿出成果來」的心態。2025 年剩下的時間預計將讓哪些 AI 代理人計畫真的具體落實變得更加明朗。我們預期:

-

Shakeout of weaker projects: Many of the quick cash-grab tokens or half-baked ideas will fade as users concentrate on solutions that demonstrably work. Surviving projects will likely be those that have active user bases, real revenue, or clear performance metrics to point to (e.g., an agent-driven fund that beat the market by X%, or an AI agent customer support that cut response times by Y%). This Darwinian process is healthy and mirrors previous innovation cycles.

-

淘汰弱勢專案:很多一夜暴富型代幣或半吊子想法,會因用戶聚焦於確實可用的解方而逐漸消失。能倖存下來的項目,往往是那些有實際活躍用戶、真實收入或清楚績效指標(如透過代理人操作的基金打敗市場 X%,或 AI 代理客服將回應時長減少 Y%)的項目。這種達爾文式篩選過程對生態有益,也和以往的創新週期相仿。

-

Winners setting standards: The projects that do well may set de facto standards for the industry. For instance, if Virtuals continues to dominate, its tokenization standard for agents might be widely adopted and other chains might implement Virtuals compatibility. Or if another platform has the best system for inter-agent communication, it might become analogous to an “HTTP for agents.” By the end of 2025, we’ll likely see some convergence around best practices and protocols, perhaps even formal bodies or working groups to standardize AI agent interfaces.

-

贏家制定產業標準:表現優異的項目有機會成為事實標準。比如說,如果 Virtuals 持續領先,其代理人的代幣標準有可能被廣泛採用,甚至其他鏈也會兼容。或者有其他平台把跨代理人溝通機制做到最好,它就可能成為代理人世界的「HTTP」。2025 年底前,我們很可能會看見各方逐步收斂至最佳實踐與協議,甚至成立正式組織或工作小組來標準化 AI 代理人介面。

-

Integration with Legacy and CeFi: To really prove value, AI agents may extend beyond the crypto-native world. We might see them interfacing with traditional finance or Web2 services. In fact, one early example is Circle (USDC issuer) demonstrating how AI agents can be leveraged to automate USDC payments (Enabling AI Agents with Blockchain - Circle). If these experiments bear fruit, banks or fintech apps might incorporate crypto AI agents for things like cross-border settlements or treasury operations, highlighting utility in the broader financial system.

-

整合傳統與中心化金融(CeFi):要真正證明價值,AI 代理人勢必要拓展到純加密原生領域以外。我們有機會看到它們和傳統金融或 Web2 服務互連。實際案例之一就是Circle(USDC 發行方)已展示如何利用 AI 代理人自動處理 USDC 支付(Enabling AI Agents with Blockchain - Circle)。如果這些實驗有成,銀行或金融科技應用也可能導入加密 AI 代理人來做跨境結算或財務運營,突顯其在更廣大金融體系中的實際用途。

The key metric by year’s end will be how much actual economic activity are AI agents managing? If a sizable share of DeFi TVL or trading volume or DAO treasury allocations are under agent control (with good outcomes), then we’ll know they’ve cemented their utility.

到了年底,關鍵指標將會是AI 代理人實際掌管了多少經濟活動? 如果有相當比例的 DeFi TVL、交易量或 DAO 國庫分配是由代理人負責(且成效良好),那就代表它們的實用性已經獲得肯定。

Continued Innovation: Smarter, Safer, More Specialized Agents

持續創新:更聰明、更安全、更專業化的代理人

Technologically, we expect AI agents to get even smarter and more efficient. With open competition (DeepSeek vs OpenAI vs others), new model versions will arrive, possibly DeepSeek-R2 or a “GPT-5”-level model by late 2025. Each leap in AI will directly translate to agent improvement – more context, better reasoning, fewer errors. Also, models might become more specialized. For instance, an “AI trader model” fine-tuned on market data could outperform a general model on trading tasks. We might see a library of specialized models that agents can swap in depending on the task (one for language tasks, one for quantitative tasks, etc.).

技術面上,我們預計AI 代理人將會更聰明、更高效。有了開放競爭(如 DeepSeek、OpenAI 等),新一代模型會陸續問世,2025 年底也許會有 DeepSeek-R2 或「GPT-5 級」模型。每一次 AI 躍進都會直接推動代理人的進化——理解更多上下文、推理能力更強、錯誤更少。同時,模型也會更加專業化。舉例來說,針對市場數據微調過的「AI 交易員模型」,在交易任務上可能明顯優於通用模型。我們也可能看到專業模型庫,代理人會根據任務切換不同模型(語言任務一種、數理任務另一種等)。

Multi-modal agents will also advance – agents that can see, hear, and operate in virtual or even physical space. It’s not far-fetched that an AI agent could analyze satellite imagery (via an API) to inform a commodities trade, or scan blockchain code repositories to decide if a new DeFi project is well-built. The richer the input, the more informed the agent’s decisions.

多模態代理人 也將進步——代理人能看、能聽,能操作虛擬甚至現實空間。AI 代理人分析衛星影像(透過 API)用來判斷商品交易時機,或掃描區塊鏈原始碼倉庫來決定新 DeFi 專案是否紮實,這些都不是天方夜譚。輸入越多元豐富,代理人的判斷才會越精準。

On the safety side, there will be innovation in Agent Alignment (ensuring AI goals stay aligned with user goals and ethical norms). Perhaps agents will come with certified training that avoids reckless strategies. And more robust testing frameworks will be in place – think of stress-testing an AI agent under extreme market scenarios before deploying it with real funds (maybe simulation environments or “agent testnets” will be a thing).

安全層面也會有進步,尤其在代理人對齊(Agent Alignment)(確保 AI 目標和用戶目標與倫理規範一致)。代理人可能會有經過認證的訓練,避免魯莽策略。更完整的測試框架也將到位——想像在極端市場情境下壓力測試 AI 代理人,再用於真實資金(模擬環境或「代理人測試網」將成為可能)。

Regulatory tech is another area: we may see the first attempts at compliant AI agents. For example, an AI trading agent that follows certain regulations might log all its decisions for audit, refuse to execute insider trades (if it somehow deduces insider info), or enforce whitelist/blacklist of certain assets due to legal reasons. Companies might create enterprise versions of agents with such guardrails to attract institutional users who need compliance.

合規科技 也是另一個重點:我們或許會首次見到合規的 AI 代理人。例如,合符規定的 AI 交易代理人會記錄全部決策以備查、偵測到內線資訊即自動拒絕執行違規交易,或依法維護資產白名單/黑名單。企業還可能打造帶有這類防護機制的專業代理人版本,吸引對合規有剛性需求的機構級用戶。

Potential Challenges and External Factors

潛在挑戰及外部因素

Despite the positive trajectory, a few things could impede or shape the outlook:

儘管發展趨勢向好,但幾項因素可能阻礙或影響未來局面:

-

Regulatory Clampdowns: If a high-profile mishap occurs (say an AI agent causes a big financial loss to many or is implicated in laundering), regulators might react strongly – perhaps even restricting the use of autonomous financial software or requiring licensing. That could slow development or push it more underground / decentralized. Conversely, clear supportive regulation (some jurisdictions might embrace it, offering sandboxes for AI agents) could accelerate progress. The global regulatory landscape will be a determining factor.

-

法規收緊:如果出現重大意外(譬如代理人造成大規模損失,或被捲入洗錢),監管方可能強力介入——甚至禁用自主金融軟體或要求相關執照。這將延緩發展,甚至迫使該技術轉往地下/進一步去中心化。反之,若有明確支持政策(某些司法管轄區主動設立 AI 代理人沙盒),進展會加快。全球監管動向將成為最重要變數。

-

Market Conditions: A severe crypto market downturn in 2025 could shrink enthusiasm and capital for experimentation with AI agents. If people exit markets, they have less need for a fancy AI trader. On the other hand, a stable or bull market provides a fertile ground to test and profit from these systems. That said, one could argue AI agents might even be more useful in a bear market to navigate complexity, but public interest might wane if there’s less money to be made.

-

市場景氣:2025 年若加密市場大幅下跌,AI 代理人創新和試驗所需的熱情與資金都會被壓縮。人們退出市場,自然也不需要什麼高階 AI 交易員。但如果維持牛市或穩定行情,這些系統就有最大的發揮空間和獲利機會。當然也有人認為熊市裡 AI 代理人的導航能力反而更有價值,只是如果獲利空間低,公眾參與意願還是會減弱。

-

Public Perception and Trust: If there are too many stories of agents failing or acting weirdly, the public might grow wary. Trust is hard to earn and easy to lose, especially with AI which some people inherently distrust. The community will need to highlight successes and be transparent about failures to maintain overall positive sentiment.

-

公眾觀感與信任:如果代理人失敗出糗、行為詭異的案例太多,公眾將心生疑慮。信任不易建立卻容易瓦解,尤其是 AI 許多人天生不信任。社群必須公開成果也坦誠面對失敗,維繫正面形象。

Long-Term Vision: A Synthesis of AI and Blockchain

長遠願景:AI 與區塊鏈的融合

Zooming out, the trend of AI agents in crypto is part of a larger synthesis of two transformative technologies: AI and blockchain. The long-term vision is that blockchain provides a trust layer for AI. It can record what autonomous agents do, making them accountable. It can handle value transfer, giving them economic agency. AI, in turn, can provide intelligence and automation to blockchain, making decentralized systems more efficient and user-friendly.

放眼大局,加密領域 AI 代理人趨勢,其實是兩大變革性技術——AI 和區塊鏈——日益融合的一環。長遠願景是區塊鏈為 AI 提供信任層。它能紀錄自主代理人的作為,讓它們_有責任可追_;它能處理價值轉移,賦予代理人經濟主體地位。反過來,AI 則賦予區塊鏈_智慧與自動化_,讓去中心化系統更高效、更易用。

By the end of 2025, we expect to see the first strong proof that this synthesis creates something fundamentally new – perhaps a DAO that runs entirely via AI and achieves outcomes no human organization could, or a decentralized marketplace where AI agents trade services with each other at lightning speed, creating value autonomously. These might still be nascent, but visible enough to point to a future where autonomous economic agents are a normal part of Web3.

2025 年底前,我們預計會有首批強力證據,證明這種融合能誕生根本性的全新事物——像是完全由 AI 運行、達到傳統組織不可能績效的 DAO,或者是 AI 代理人在去中心化市場裡彼此高速交易服務,自主創造價值。雖然這些應用還在初期,但已可預見一個自主管理經濟代理人成為 Web3 常態的未來。

In conclusion, the rest of 2025 will likely take the AI agent phenomenon from its formative stage through a crucible of validation. Those projects and agents that emerge successful could form the backbone of a new crypto paradigm.

總結來說,2025 年剩下的時間很可能會讓 AI 代理人現象從初步階段走向_驗證與試煉的關鍵期_。那些脫穎而出的項目和代理人,將有機會成為新一代加密生態的中流砥柱。

The excitement from Q1 will mature into real-world impact, fulfilling the promise that “this is more than just hype — these agents are revolutionizing crypto and AI”. If all goes well, by the time we write the year-end report, we might be looking at AI agents not as a separate trend, but as an integral, assumed part of the crypto ecosystem’s fabric.

第一季的熱潮,將會昇華成真實世界的影響力,兌現「這不只是炒作——這些代理人在革新加密與 AI」的承諾。如果一切順利,等到撰寫年底總結時,我們可能已不再把 AI 代理人視作獨立趨勢,而是加密生態體系不可或缺的基本組成。