在傳統金融及數位資產的重大演進中,專注於加密貨幣的ETF正迅速進入主流市場。

最新的進展是美國證券交易委員會(SEC)批准ProShares的XRP期貨ETF,將於2025年4月30日上市。

這一舉措正值監管趨於寬鬆之際,此前於2024年1月批准第一檔美國現貨比特幣ETF,4月則預計在香港推出現貨比特幣ETF。這些里程碑象徵著市場重大轉變,加密貨幣已不再只是邊緣的投機資產,而是逐漸成為受監管投資組合中的要角。

ETF(交易型基金)因其透明、高效成本及可提供市場多元化曝險的能力,長久以來受到青睞。加密ETF的興起,象徵著機構投資風險控制機制與數位資產高波動的融合。從比特幣、以太幣到較新的Solana及最新的XRP,無論期貨或現貨型ETF,都讓投資人能更輕鬆地透過傳統券商平台涉獵加密市場。

截至2025年,加密貨幣ETF不只是金融商品,更代表了投資人情緒、監管政策及市場成熟度的指標。隨著XRP ETF獲批後機構資金大量湧入,以及比特幣ETF一週高達50億美元流入額,一個嶄新的投資典範已清晰可見。

然而,機遇伴隨複雜性。理解這些發展中工具的基本原理和差異,對評估未來動向至關重要。

了解ETF:傳統VS加密

ETF(交易型基金)是追蹤某一基礎資產或資產組合表現的投資工具。和個股一樣在交易所交易,ETF可讓投資者接觸各類標的,從股票指數、債券、商品到新興市場皆涵蓋。ETF受歡迎的原因是能提供多樣化、即時流動性及比共同基金更低的費用。

傳統ETF主要有下列幾類:

- 股票型ETF追蹤像S&P 500或Nasdaq-100等股票指數。

- 債券型ETF涵蓋政府、地方及公司債券。

- 商品型ETF追蹤像黃金或石油等實體資產價格。

- 主題型ETF則聚焦於AI、ESG、潔淨能源等投資主題。

相較下,加密ETF設計在於讓投資人無須直接持有數位資產,就能參與加密幣的價格波動。其類型主要分為:

- 期貨型ETF:追蹤在受監管交易所(如CME)交易的加密貨幣期貨合約。例如ProShares比特幣ETF(BITO)及新推出的XRP期貨ETF。

- 現貨型ETF:直接持有比特幣或以太幣等加密貨幣。美國於2024年1月才批准現貨ETF,這類產品更能反映市場現價,但因託管、操控及流動性等問題而受到更嚴格監管。

全球則各自有不同步調。美國在多年監管疑慮後才謹慎准許現貨ETF,而巴西與加拿大則更開放,早就推出現貨加密ETF。香港亦積極爭取成為亞洲首個批准現貨比特幣ETF的金融中心。

但監管挑戰仍然存在。期貨ETF經常受到跟蹤誤差與展期成本批評,現貨ETF則面臨稅務和監管機制定存疑。儘管如此,傳統金融架構與數位資產藉由ETF的融合,已經標誌著加密貨幣機構化的重要時刻。

主要加密ETF的財務成果

加密ETF的財務表現已成為衡量投資人情緒及市場趨勢的關鍵指標。隨資金流入與機構參與度提升,如貝萊德(IBIT)、灰度(GBTC)、富達(FBTC和FETH)、21Shares(ARKA)等業者正改變整個市場格局。本節將探討它們於2025年的資產淨值、價格、費用比及策略布局。

iShares比特幣信託ETF (IBIT) – 流動性領航者

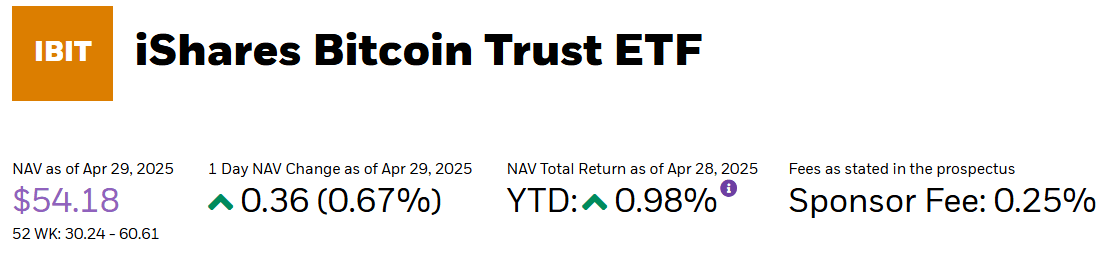

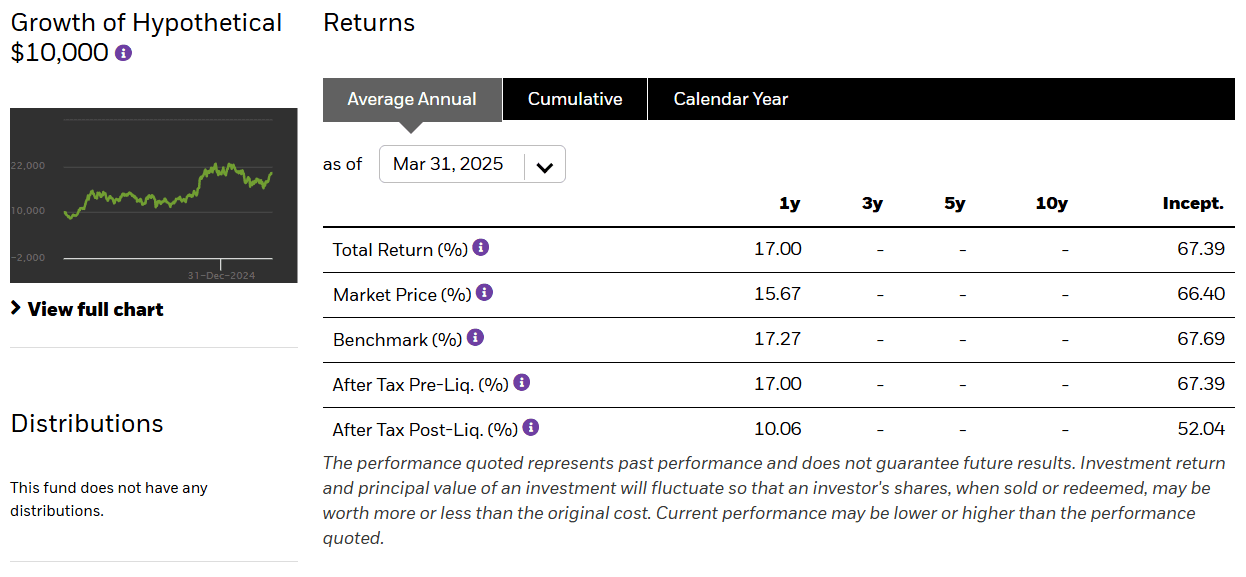

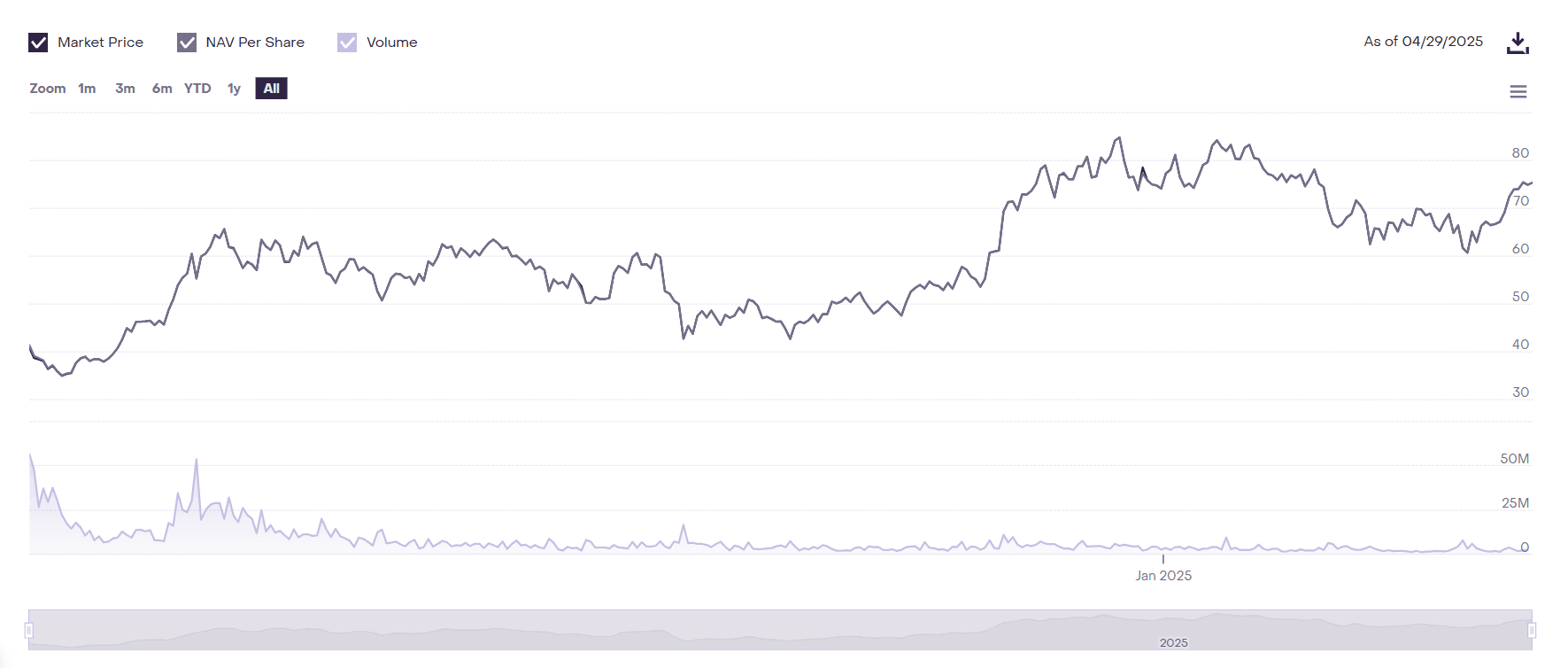

貝萊德的iShares比特幣信託ETF(IBIT)迅速成為現貨比特幣ETF領域的霸主。截至2025年4月29日,資產淨值每股54.18美元,今年來報酬率0.98%,贊助商費用僅0.25%,為同類產品最低之一。其近一日資產淨值漲幅0.67%,依憑買賣價差窄、流動性強,持續吸引成交量。

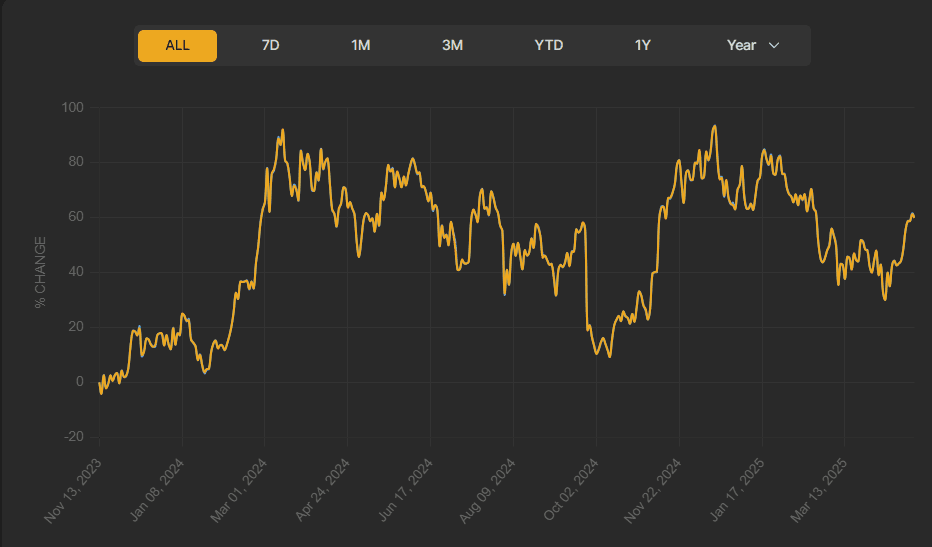

IBIT自成立以來的平均年化報酬率高達67.39%,緊貼基準指數。一年報酬率達17%,略高於富達同類ETF,幾乎與比特幣現貨表現一致。人為一萬美金假設投資成長圖,自2024年1月以來即使過程有波動也趨於穩健。

IBIT最大的優勢在於其機構級基礎架構——背靠貝萊德10.5兆美元資產管理規模,以及與Coinbase Prime技術整合。該基金的穩定表現、持倉透明及大量交易量,使其成為機構投資人尋求受監管比特幣曝險的首選工具。

灰度比特幣信託ETF (GBTC) – 資深轉型受監管

灰度GBTC是美國第一檔上市交易的比特幣信託,並於2024年1月11日正式轉換為現貨ETF。截至2025年4月29日,每股75.25美元,日交易量超過210萬股。儘管GBTC採用舊制結構,但已因應ETF競爭,維持零溢價/折價並與資產淨值同步。

GBTC資產規模超過181.7億美元,為全球最大加密ETF。但1.50%總費用率對成本敏感投資人是劣勢。其也數度下調費用(2024年前高達2.00%),以因應ETF生態快速擴張帶來的競爭。

持有超過19萬比特幣,使GBTC仍舊是機構信心的指標。早期先行優勢,加上Coinbase託管背書,即使競爭者湧現,長線投資組合內仍具參考價值。

富達Wise Origin比特幣基金(FBTC)與以太坊基金(FETH)– 平民化巨人

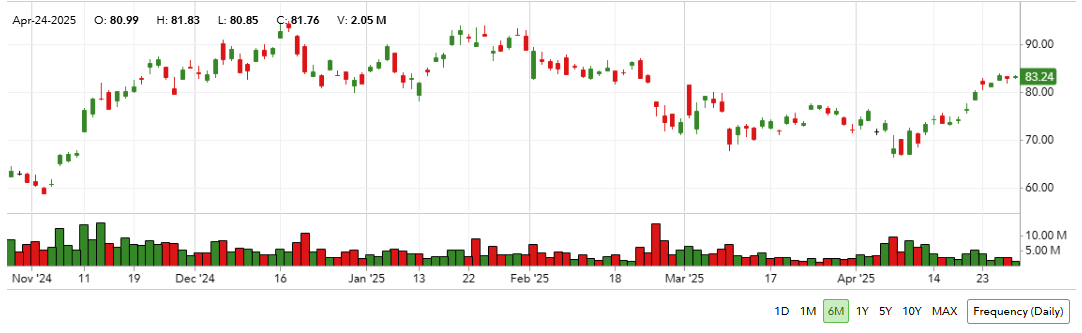

富達FBTC截至2025年4月29日交易價為83.24美元,資產規模163.2億美元,費用比0.25%。過去一年總報酬為+15.97%,略低於比特幣參考指數+16.77%,跟蹤誤差小。FBTC以其稅務效益高的信託結構及估值透明受到零售投資人歡迎,在Robinhood和富達自身平台皆可交易。

同時,富達以太坊基金(FETH)波動更大。現價18.23美元,存續報酬為-47.67%,反映近期以太幣表現不佳及與質押功能相關的監管阻力。儘管如此,FETH因入場門檻低、費用比0.25%及吸引7.275億美元資產規模,使以太幣持續具有存在感。

ARK 21Shares主動式比特幣期貨ETF(ARKA)– 以主動操作換取報酬但成本高

ARKA ETF於2023年11月上市,是由Ark Invest及21Shares主動管理的比特幣期貨ETF。資產淨值59.77美元,但截至2025年4月28日,今年來報酬為-5.99%,相比被動型如IBIT及FBTC表現較差。

ARKA訴求於主動調整比特幣期貨倉位,在趨勢明顯時有機會提高報酬,但現階段表現反映主動策略的成本與效率不如預期,加上0.70%費用率高於大多數現貨ETF。

其資產規模不足900萬美元,顯示即使獲得Cathie Wood的Ark品牌加持,市場接受度仍然有限。

investors seem wary of high fees and tracking slippage.

投資人似乎對於高昂的費用與追蹤誤差心存疑慮。

VanEck Crypto & Blockchain Innovators ETF (DAPP) – The Thematic Underdog

VanEck’s DAPP ETF doesn’t directly hold crypto, but invests in blockchain-related equities, including MicroStrategy, Coinbase, and Riot Platforms. As of April 29, 2025, its NAV sits at $7.45, with a YTD return of -27.12%, underlining its exposure to crypto-adjacent equities rather than crypto itself.

VanEck 的 DAPP ETF 並未直接持有加密貨幣,而是投資於區塊鏈相關股票,包括 MicroStrategy、Coinbase 與 Riot Platforms。截至 2025 年 4 月 29 日,其淨資產價值(NAV)為 7.45 美元,今年以來報酬為 -27.12%,突顯其主要風險來源為加密貨幣概念股而非加密貨幣本身。

Since inception in 2021, a hypothetical $100 investment has fallen below $40, reflecting extreme sectoral volatility. Despite this, DAPP remains a UCITS-compliant product with global accessibility and is used by investors seeking diversified exposure to the crypto ecosystem without holding tokens or futures.

自 2021 年成立以來,假設投資 100 美元,如今已跌至 40 美元以下,反映出此產業的高度波動性。儘管如此,DAPP 仍是一款符合 UCITS 標準、全球均可交易的產品,適合想分散接觸加密生態但不希望持有代幣或期貨的投資人。

Inflows, Outflows, and Investor Sentiment

資金流向與投資人情緒

Bitcoin ETFs have entered a new phase of capital engagement marked by heavy institutional dominance, selective inflows, and volatility-induced repositioning. The past 6–12 months have seen ETF flows acting as a key barometer of sentiment, replacing traditional exchange activity as the preferred method of market exposure for large investors.

比特幣 ETF 已邁入資本運作的新階段,特徵為機構主導、資金流入趨向精選,並因價格波動頻繁調整部位。在過去 6 至 12 個月,ETF 資金流已成為情緒主要指標,逐步取代傳統交易所成為大戶參與市場首選管道。

From January 2024 to April 2025, cumulative Bitcoin ETF inflows crossed $42 billion, peaking in momentum during Q1 2025. However, sentiment cooled in February amid macro uncertainty, with Bitcoin ETF flows turning negative. A strong rebound was seen in April 2025 as ETFs registered their second-highest weekly inflow on record—$3.06 billion in the week ending April 25, largely driven by BlackRock’s IBIT, which single-handedly pulled in $1.45 billion.

2024 年 1 月至 2025 年 4 月,比特幣 ETF 累計流入突破 420 億美元,資金動能在 2025 年第一季達到巔峰。不過,因總體經濟不確定性,2 月市場情緒明顯降溫,ETF 累積淨流反轉為負。直到 4 月 ETF 強勢反彈,當週(截至 4 月 25 日)史上第二高週流入 30.6 億美元,主要由 BlackRock 的 IBIT 所帶動,單周吸金 14.5 億美元。

This resurgence in April is noteworthy. Between April 21–25, not a single day saw outflows, suggesting a short-term institutional consensus. However, the sentiment flipped quickly again by April 29, with net outflows of $36.76 million in Bitcoin ETFs and $43.86 million across all crypto ETFs, revealing how fragile and reactive the flow dynamics remain.

4 月的市場回升相當值得關注。4 月 21–25 日期間每日皆為淨流入,顯示機構短線達成共識。但至 4 月 29 日情緒再度反轉,比特幣 ETF 出現 3,676 萬美元淨流出,整體加密 ETF 淨流出達 4,386 萬美元,顯示資金流動仍十分脆弱且容易受情緒影響。

The dominant investors behind these moves are clearly institutional. Retail interest, as measured by Google Trends, has dropped to its lowest point since October 2024, despite Bitcoin nearing all-time highs (~$95,000). In contrast, institutional sentiment is rising, with sovereign entities, financial advisors, and hedge funds increasingly treating Bitcoin as a macro-hedge rather than a speculative asset.

這些主要資金流動明顯來自機構投資人。根據 Google 趨勢的資料,即使比特幣價格接近歷史新高(約 95,000 美元),散戶關注度卻已降至 2024 年 10 月以來新低。相較之下,機構情緒逐步增強,主權機構、理財顧問及避險基金等均日益將比特幣當作宏觀避險工具,而非單純的投機資產。

This shift is evident in behavior. Institutions favor ETFs for regulated, passive exposure—resulting in capital concentration. Funds like IBIT, FBTC, and GBTC are now absorbing liquidity that might have previously fueled altcoin rallies. This is altering the risk appetite and market rhythm. Instead of typical altseason rotations, the market is witnessing ETF-driven repositioning around basis trades and macroeconomic signals.

這種態度轉變已反映在行為上。機構偏好透過 ETF 法規監管下的被動投資方式,導致資金愈發集中。過去本應流向山寨幣的流動性,如今更多被 IBIT、FBTC 與 GBTC 等基金吸收。此現象正在改變市場的風險偏好與運作節奏,市場不再循傳統「山寨季」輪動,而是出現圍繞基差交易與總體訊號的 ETF 布局。

A critical example is CME Bitcoin Futures, where open interest (OI) dropped consistently over four days before stabilizing in late April due to rising basis yield (~9%), indicating traders’ renewed appetite for arbitrage opportunities.

一個關鍵案例是芝商所 CME 比特幣期貨,其未平倉合約數連續四日下滑,至 4 月下旬因基差年化報酬升至約 9% 而止穩,顯示套利需求重燃。

Moreover, April’s ETF surge was not uniform. Outflows from ARKB and FBTC occurred even as IBIT gained, suggesting reallocations rather than net inflows. This was confirmed by Farside data on April 29, where IBIT saw $6.2 million outflows, FBTC lost $24.4 million, and ARKB shed $13.3 million, leading to a net negative day.

此外,4 月 ETF 資金湧入並非全面性。即使 IBIT 資金流入,ARKB 與 FBTC 則出現流出,反映資金僅為重新分配而非總體淨流入。根據 Farside 於 4 月 29 日的數據,IBIT 當日淨流出 620 萬美元,FBTC 出現 2,440 萬美元流出,ARKB 減少 1,330 萬美元,單日合計為負值。

In summary, while capital continues to flow into Bitcoin ETFs at a historic pace, the pattern is marked by institutional caution and strategic rotations. ETFs have institutionalized sentiment, replacing retail-driven volatility with tactical accumulation and reallocation strategies.

總結而言,儘管資金流入比特幣 ETF 的速度仍具歷史意義,但整體以機構審慎與策略輪動為主。ETF 將市場情緒制度化,以策略性吸納與調整配置,取代以往散戶為主的波動特徵。

Emerging ETFs and Global Trends

新興 ETF 與全球趨勢

Altcoin ETFs Gain Momentum Beyond Bitcoin and Ethereum

比特幣與以太坊之外,山寨幣 ETF 加速崛起

The success of spot Bitcoin and Ethereum ETFs has opened the door to the next wave of crypto ETF innovation, focused on altcoins like Solana, XRP, Cardano, and Avalanche. The U.S. Securities and Exchange Commission (SEC) is currently reviewing 72 crypto ETF applications, signaling an industry-wide race to bring diversified offerings to market. Major issuers including VanEck, Bitwise, Grayscale, 21Shares, and ProShares are expanding their ETF filings beyond BTC and ETH, targeting popular Layer 1 networks and payment-focused tokens.

比特幣及以太坊現貨 ETF 的成功推動下一波創新,主軸轉向 Solana、XRP、Cardano、Avalanche 等山寨幣。美國證交會(SEC)目前正審查多達 72 檔加密 ETF 申請,顯示業界爭相推出多元產品。主要發行商如 VanEck、Bitwise、Grayscale、21Shares 與 ProShares 已陸續將 ETF 申請從 BTC、ETH 擴展至主流公鏈與支付類代幣。

ProShares recently filed for a suite of XRP-related ETFs, including long and inverse versions, while 21Shares submitted a Dogecoin ETF proposal. Meanwhile, Canada became the first North American market to list spot Solana ETFs in April 2025. 3iQ’s Solana Staking ETF (SOLQ) attracted C$90 million in assets within 48 hours, while CI Global’s SOLX offered dual-currency exposure and waived fees for initial investors. These developments point to surging institutional interest in altcoin access through regulated investment vehicles.

ProShares 近來申請一系列涉及 XRP 的 ETF,包括做多與反向產品,21Shares 則提案推出狗狗幣 ETF。同時,加拿大於 2025 年 4 月率先成為北美現貨 Solana ETF 挂牌市場。3iQ 的 Solana Staking ETF(SOLQ)短短 48 小時吸引 9,000 萬加幣資產,CI Global 推出的 SOLX 則提供雙幣報價並對首批投資人免收費用。種種跡象顯示,機構正積極透過合規投資工具布局山寨幣市場。

Regional Trends: U.S. Leads in Volume, Canada and Europe in Innovation

區域趨勢:美國領先交易量,加拿大與歐洲率先創新

While the U.S. dominates in ETF trading volumes, Canada has taken the lead on innovation and speed of approvals. Canadian regulators approved both Bitcoin and Ethereum spot ETFs as early as 2021 and are now leading the altcoin ETF frontier. Europe, particularly Switzerland, has long supported ETPs tied to various crypto assets through progressive frameworks. Asia is also catching up. Hong Kong regulators have expressed openness to spot crypto ETFs, and South Korea continues to explore pathways for regulated crypto investment products with speculation of BTC ETF to be traded this year. However, regulatory conservatism and political caution still hinder widespread ETF rollout in the region.

雖然美國在 ETF 交易量稱霸全球,加拿大卻以創新速度和審批效率居首,加監管機構早於 2021 年核准比特幣與以太坊現貨 ETF,現亦領軍山寨幣 ETF 潮流。歐洲、特別是瑞士,早已透過進步監理架構,支持多種加密資產 ETP。亞洲也急起直追,香港監管表達對現貨加密 ETF 開放態度,南韓也積極探索合規加密投資產品,市場預期今年有望上市 BTC ETF。但基於監管趨於保守、政治審慎,ETF 在該區域推展仍面臨障礙。

Tech-Forward Innovation: Tokenized and Onchain ETFs

科技進化:資產代幣化與鏈上 ETF

Beyond asset diversity, innovation in structure is reshaping the ETF landscape. Tokenized ETFs, which issue shares directly on blockchain networks, are under exploration for their potential to reduce settlement latency and improve transparency. Additionally, ETFs like VanEck’s upcoming Onchain Economy ETF aim to track companies building blockchain infrastructure—blending traditional finance with crypto-native exposure. This shift signals a future where ETFs are not only gateways to crypto assets but also built using the very technology they invest in. As the ETF ecosystem expands, the next frontier lies in fully integrating blockchain into how these products are constructed, traded, and settled.

除了標的多元化,產品結構創新也正重新定義 ETF 格局。所謂資產代幣化 ETF,直接在區塊鏈上發行份額,有助縮短交割時間並提升透明度。而 VanEck 即將推出的 Onchain Economy ETF,旨在追蹤區塊鏈基礎建設公司,把傳統金融與加密原生資產結合。這預示未來 ETF 不僅是加密資產的投資入口,更將直接採用本身投資的技術來打造。隨 ETF 生態圈擴張,下一個戰場即是不斷將區塊鏈深度整合進產品結構、交易與結算流程。

Risks, Opportunities, and the Future of Crypto ETFs

風險、機會與加密 ETF 未來展望

Key Risks Shaping the Crypto ETF Landscape

關鍵風險:影響加密 ETF 前景

Despite growing institutional interest, crypto ETFs face persistent risks that could hinder their long-term adoption. Regulatory uncertainty remains the most pressing challenge. While the approval of Bitcoin and Ethereum ETFs marked major milestones, the SEC continues to scrutinize altcoin ETFs, particularly those tied to assets like XRP and Solana. Filings can face delays of up to 240 days or be denied outright, depending on perceived risks around manipulation, liquidity, and investor protection.

即便機構需求升溫,加密 ETF 仍面臨多項長期障礙。首要風險即是監管不確定性。比特幣與以太坊 ETF 核准固然是重大里程碑,SEC 目前對山寨幣 ETF(尤其 XRP、Solana 等資產)則更加嚴格。相關申請可能遭延遲長達 240 天,甚至直接駁回,視虛擬資產操控、流動性、投資人保護等風險評估而定。

Market volatility also poses a challenge. Cryptocurrencies are inherently more volatile than traditional assets, and ETF structures may magnify short-term price swings—especially in leveraged or inverse products. Custody remains another hurdle. Institutional-grade storage solutions must meet high security and compliance standards, and any breach could shake investor confidence. Lastly, the thin liquidity of some altcoins may hinder efficient ETF pricing, especially during market stress.

市場波動也是一大挑戰。加密貨幣本質上遠較傳統資產劇烈,ETF 結構可能放大短線價格波動,尤其槓桿或反向產品風險更高。保管機制也是問題,機構級託管必須滿足嚴格安全與合規標準,任何漏洞都可能動搖信心。最後,部分山寨幣流動性不足,於市場壓力時恐使 ETF 報價失真,造成額外風險。

Unlocking Opportunities: Access, Diversification, and Institutional Growth

機會啟動:門檻降低、多角化與機構成長動能

On the other side of the ledger, crypto ETFs unlock powerful opportunities. They offer a regulated, simplified entry point for both retail and institutional investors, allowing exposure without the complexities of wallets or private keys. ETFs enable portfolio diversification across digital assets, from Bitcoin to emerging altcoins, and provide passive exposure through traditional brokerages.

反觀機會面,加密 ETF 則帶來巨大紅利。它們為散戶與機構提供合規、簡化的入場機會,無須處理自主管理錢包與私鑰等複雜程序。ETF 便於分散數位資產風險,從比特幣到新興山寨幣都能涵蓋,投資人還可直接透過傳統券商進行被動配置。

Experts like Eric Balchunas and Nate Geraci point out that ETFs are becoming the dominant structure for crypto adoption. With projections from Standard Chartered setting a $200,000 year-end price target for Bitcoin, ETFs are increasingly viewed not just as speculative vehicles, but as tools for long-term financial planning and hedging against macro risk. As tokenized ETFs and blockchain-native infrastructure develop further, crypto ETFs are poised to blur the line between legacy finance and decentralized technology reshaping capital markets in the process.

專家如 Eric Balchunas、Nate Geraci 皆指出,ETF 正成為推動加密資產主流化的關鍵工具。渣打銀行預估比特幣年底目標價高達 20 萬美元,ETF 不再只被視為投機工具,更是財務規劃與宏觀風險避險的長線配置選擇。隨著資產代幣化 ETF 與原生區塊鏈基礎設施愈趨完整,加密 ETF 勢將持續模糊傳統金融與去中心化科技的界線,重塑資本市場格局。

Closing Thoughts

總結反思

Crypto ETFs are rapidly evolving from niche offerings into cornerstone instruments of mainstream digital asset investing. As regulatory clarity improves and

加密 ETF 正加速從小眾選項轉型為主流數位資產投資基石。隨著監管明朗化及 ...Sure! Here’s the translation in the requested format:

altcoin applications grow,ETF在彌合傳統金融與加密貨幣之間的鴻溝方面將扮演更重要的角色。

在當今的金融格局中,它們代表了一個入口——為機構級投資者提供接觸這個在壓力下逐漸成熟的資產類別的方式。加密貨幣ETF的未來不僅僅在於追蹤數位代幣,更在於重新定義投資者如何參與創新、風險與機遇。